Analyst firm BloombergNEF has indicated that the globe is on course for record electric vehicle (EV) sales, but forecasted growth slowdown could jeopardise climate targets.

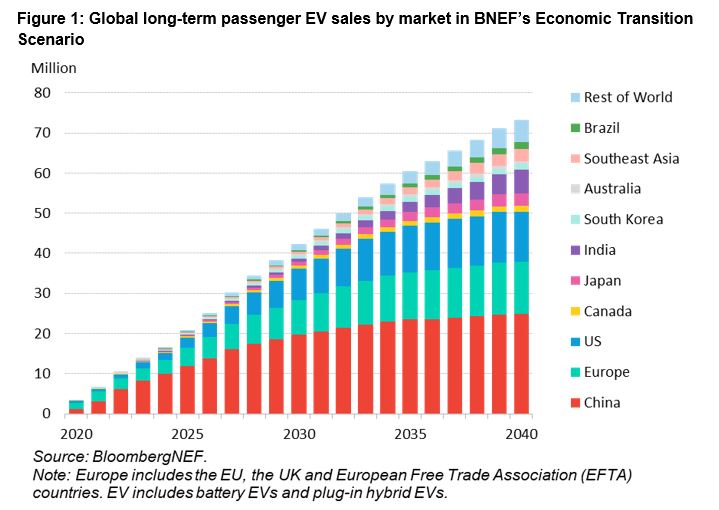

Detailed within the organisation’s Long-Term Electric Vehicle Outlook, passenger EV sales are expected to exceed 30 million in 2027 in BNEF’s base case scenario and grow to 73 million per year in 2040. This growth has been supported by several factors, including improved electrification technologies and a downward trajectory in battery prices.

According to BloombergNEF, these factors will shift adoption away from being policy-driven to being driven by consumer demand across all markets.

The report outlines two updated road transport scenarios. The first is the base case Economic Transition Scenario (ETS), in which EV adoption is influenced by current techno-economic trends and no new policy intervention. The second is the Net Zero Scenario (NZS), which aligns with achieving a global zero-emission fleet by 2050.

In the ETS base case, EV sales continue to rise globally, with growth slowing in the US and Europe due to regulatory and political changes. Some automakers are also pushing back their EV targets.

In the US, EV adoption has started to stall. This is attributed to the lack of lower-cost models and concerns around the general EV market, which have been influenced by the upcoming presidential elections.

In Europe, the block-wide fuel-economy targets will not become more stringent until 2025, which means automakers operating in the region are not under immediate pressure to increase EV sales significantly.

BNEF reports that electrification is rapidly expanding in all road transportation sectors, from rickshaws to heavy trucks. Sales of two- and three-wheeled vehicles are steadily rising in emerging economies, and global EV sales are projected to exceed 90% by 2040. The efforts to reduce carbon emissions in the commercial vehicle industry, including vans, trucks, and buses, have already commenced and are anticipated to accelerate.

BNEF’s report reports that the potential market for EVs could reach a total value of $9 trillion by 2030 and $63 trillion (£49 billion) by 2050. To meet this demand, an estimated $35 billion investment in battery cells and component plants is necessary by the end of the decade. However, the report states that companies have already planned to invest $155 billion, surpassing this requirement.

“Governments trying to champion domestic manufacturing at the cost of faster decarbonisation should consider very carefully what they are prioritising, as reaching net-zero road transport emissions by 2050 is still possible, but much faster progress is needed,” said Aleksandra O’Donovan, head of electric vehicles at BNEF.