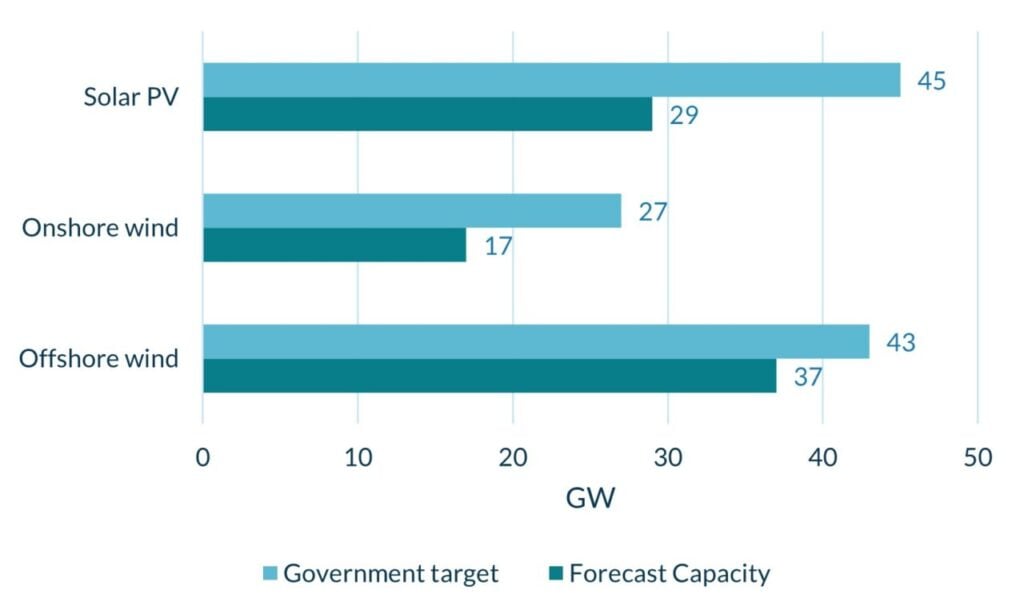

Projections from Cornwall Insight show the government could miss its Clean Power 2030 targets by a combined 32GW.

Data from the energy consultancy’s GB Benchmark Power Curve shows a shortfall in capacity across offshore and onshore wind and solar PV. Missing targets by 16GW, solar PV is set for the biggest underperformance, despite forecasts suggesting solar capacity will increase by 70% by 2030 from 17GW installed today.

This would see it reach 29GW out of the targeted 45-47GW. Onshore wind would miss the 27-29GW target by 10GW, Cornwall Insight says, despite policy changes boosting the technology. Offshore wind, meanwhile, comes the closest to hitting targets but still falls 6GW short of the 43-50GW target.

According to Cornwall Insight, CP30 included “much-needed detail” on grid connections and potential investment in storage and flexible generation technologies to balance intermittent generation.

However, the impact of promised reforms may not be felt before 2030. This is despite the National Energy System Operator (NESO) and government suggesting the targets, while a “huge challenge”, can be met.

Cornwall Insight’s projections account for uncertainty caused by a lack of clarity around the Review of Electricity Market Arrangements (REMA), particularly the potential move away from national wholesale pricing.

As explored in a Current± blog recently, a separate process to get more transmission and distribution capacity built where it needs to be could mitigate the need for a zonal market. Any reform to the electricity market, though, drastic or not, will necessitate major regulatory overhaul with significant commercial implications for developers. Cornwall Insight says without clear guidance, this leaves developers “hesitant” to invest.

The projections by Cornwall Insight also factor in growing energy demand from data centres, which has been spurred by the government’s push to expand AI capabilities. It says this underscores the urgency of renewable energy investment, without which the UK grid may fall back on fossil fuels.

“Grid connection delays, supply chain constraints and uncertainty surrounding electricity market reforms are all creating a challenging environment for developers”, said Tom Musker, modelling manager at Cornwall Insight.

Musker added: “The government’s push towards a fully decarbonised grid represents an opportunity to cement the UK’s position as a global leader in renewable energy. However, while setting ambitious goals for renewables is crucial, some argue that pushing too quickly could have unintended consequences, diverting resources to short-term solutions at the expense of longer-term energy security and sustainability.”

On track for net zero

Although 2030 targets are not forecasted to be met, the Cornwall Insight data puts the UK on track to achieve net zero emissions in the next decade, ahead of the net zero economy-wide target of 2050.

Other technologies could outpace CP30 targets. Market analytics platform Modo Energy points out that NESO’s final impact assessment of its connections reform methodologies show high amounts of oversupply from battery energy storage projects, providing up to six times the capacity targeted for 2030.

When the government first published CP30, trade body Solar Energy UK said it expected solar generation to “considerably exceed” the set target, publishing its own analysis showing that targeting 60GW solar generation by 2030 could significantly lower the cost of electricity.

Solar Media Market Research figures also show huge solar growth potential, as seen in an article published on our sister site, Solar Power Portal, available here.