The distribution system operator (DSO) arm of National Grid has seen half of all EV chargepoints connected to its network registered as flexibility assets.

The National Grid DSO Flexibility Market Update Insights Report, covering April 2024 to March 2025, shows 9.8GWh of flexibility procured across its license areas, with 90% of registered flexibility assets coming from domestic households.

More than double the amount of assets were registered on National Grid DSO’s flexibility markets compared to the year previously and 2.9GWh of electricity was dispatched through flexibility.

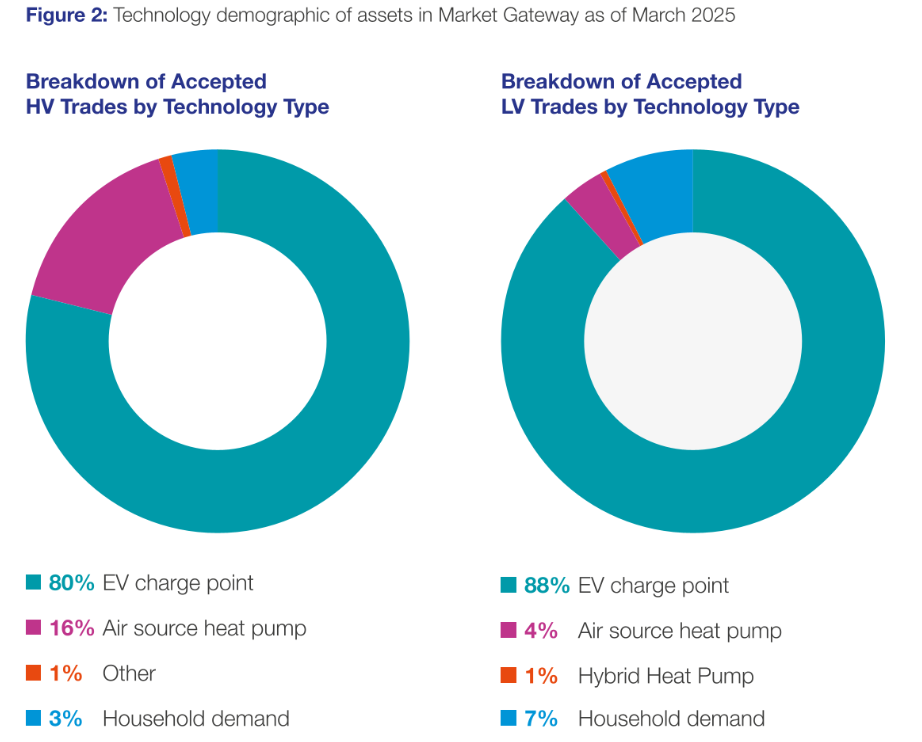

National Grid Energy Distribution (NGED) sources electricity flexibility from a range of technologies, but the largest number of assets came in the form of EV chargers. Other key technologies for the period covered were heat pumps, batteries and household demand.

Domestic participation in flexibility markets is primarily low carbon, with 96% of high voltage (HV) and 93% of low voltage (LV) accepted trades employing low carbon assets.

The reliability of flexibility assets was also high, with on average over 90% of the volume instructed being delivered. This is one area where EVs lagged: household demand delivered 100% of instructed flexibility, but EV chargers provided at 89.6%.

National Grid DSO said 6% of agreed delivery failed to respond at all in the period reported on.

More assets, more competition, lower prices

During its last round of long-term procurement, launched in autumn 2024, the DSO awarded flexibility in HV zones at prices 34% lower than its ceiling prices, and 18% lower in LV zones, which it says meant savings of approximately £75,000, which National Grid DSO said goes directly to its customers.

Doerte Schneemann, National Grid DSO’s head of flexibility markets, said: “We are making participation in flexibility markets easier and more rewarding than ever. This report shows we are committed to growing the range and value of our flexibility offerings and making them available to as many consumers as possible.”

Of the regions within the DSO’s license areas, the East Midlands had the highest volume sought for availability in long-term markets, while the South West sees the highest response to the volume of flexibility demand—this is the metric that indicated the extent to which the market supply meets the demand for flexibility.

Still, in terms of the average number of assets responding to each flexibility opportunity, the East Midlands had the most.

Response rates in rural and urban areas were relatively close, with a 23% response rate in rural areas compared to 20% in urban areas.

Contrary to other reports rating price sensitivity low for its impact on flexibility engagement, reports, National Grid DSO said that areas with higher ceiling prices respond to a greater percentage of flexibility demand, with a 41% response in areas of above average price compared to 16% in areas below average price.