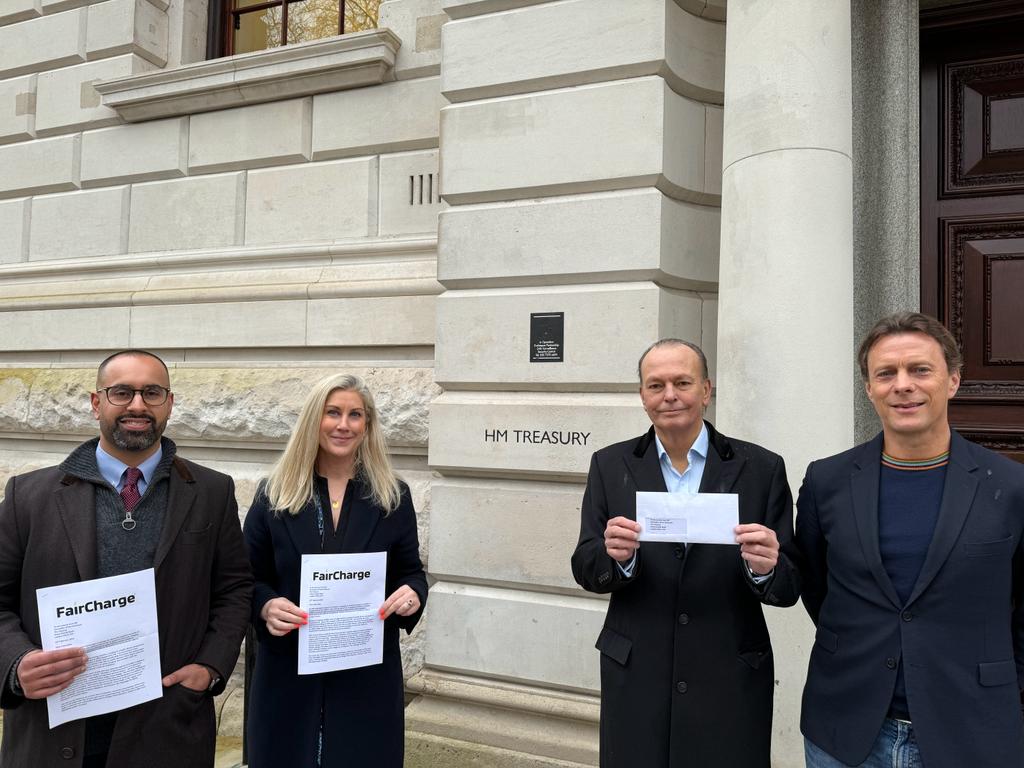

An open letter from FairCharge alongside E.ON and Auto Trader has been sent to chancellor of the exchequer Jeremy Hunt ahead of the Spring Budget to advocate for a public charging VAT reduction.

The Value Added Tax (VAT) applied to electric vehicle (EV) charging in public stands at 20%, heavily contrasting with the 5% applied to private charging.

The reduced rate of VAT is known as the ‘de minimis’ provision, as detailed by HM Revenue and Customs (HMRC) in 2021, and applies if the supply of electricity is ongoing, is to a person’s house or building and is less than 1,000kW hours per month.

Campaign group FairCharge is challenging the quadrupled VAT with this letter, which has been co-signed by the likes of Jaguar Land Rover (JLR), Stellantis, Polestar, Autocar Magazine, Greenpeace, Transport & Environment, Zapmap and the AA.

Auto Trader has calculated that drivers charging off-peak at home could save £865 annually compared to internal combustion engine vehicles but that a driver using public rapid chargers would pay £264 more over a year.

32% of consumers surveyed by Auto Trader last year cited the expense of public charging as a key barrier to owning an electric vehicle, proving that the VAT charge is an obstacle to growing UK EV adoption.

It is also worth noting that this is not FairCharge’s first attempt with this problem, having already sent a similar open letter in March 2023 ahead of last year’s Spring Budget.

At the time, FairCharge was backed by 44 MPs and some fellow EV charging businesses, but this year’s signatures include significantly more influential members of the automotive industry, like Stellantis and JLR.

Quentin Willson, FairCharge founder and motoring journalist, said: “If the Government is serious about wider EV adoption, they must revisit this out-of-date VAT legislation – written in the early 1990s before the arrival of electric cars – and make it fit for purpose.

Dev Chana, managing director for E.ON Drive Infrastructure, added: “Taxing EV drivers four times as much for using public chargers is effectively a tax on people who don’t have a driveway.

“A fairer system which charges the same rate of VAT wherever and whenever you charge your electric car would be a real consumer win during this cost-of-living crisis and would also help speed up EV adoption by taking away an unnecessary and unfair cost.”

Backing the cause

In addition to the fact that this letter is not FairCharge’s first attempt at reducing the 20% VAT on public EV charging, other members of the EV industry have also independently ventured into the discourse.

Chargepoint operator (CPO) EZ-Charge called on the UK government to reduce the charging VAT in January 2024, arguing that it was a significant hindrance to persuading more drivers to go electric.

In February 2024, Zapmap reported that, as a result of rising energy prices across the board, the overall cost of high-powered charging on the public network increased by 11% in 2023.

According to the Zapmap Price Index, the average price of charging an EV in the UK using a rapid or ultra-rapid increased from 73p/kWh in December 2022 to 81p/kWh in December 2023. Slow-charging prices also rose, increasing by 13% from 49p/kWh in December 2022 to 55p/kWh in December 2023.