A new report from the International Energy Agency (IEA) has revealed that the battery market continues to go from strength to strength, especially for EV batteries.

The report notes that electric care sales rose by 25% in 2024 to hit 17 million, causing annual battery demand worldwide to surpass 1TWh – something the IEA calls “a historic milestone”. Meanwhile, the average price of a battery pack for an electric car has now fallen below US$100 per kWh, which now puts many EVs at an equal cost with, or cheaper than, conventional car models.

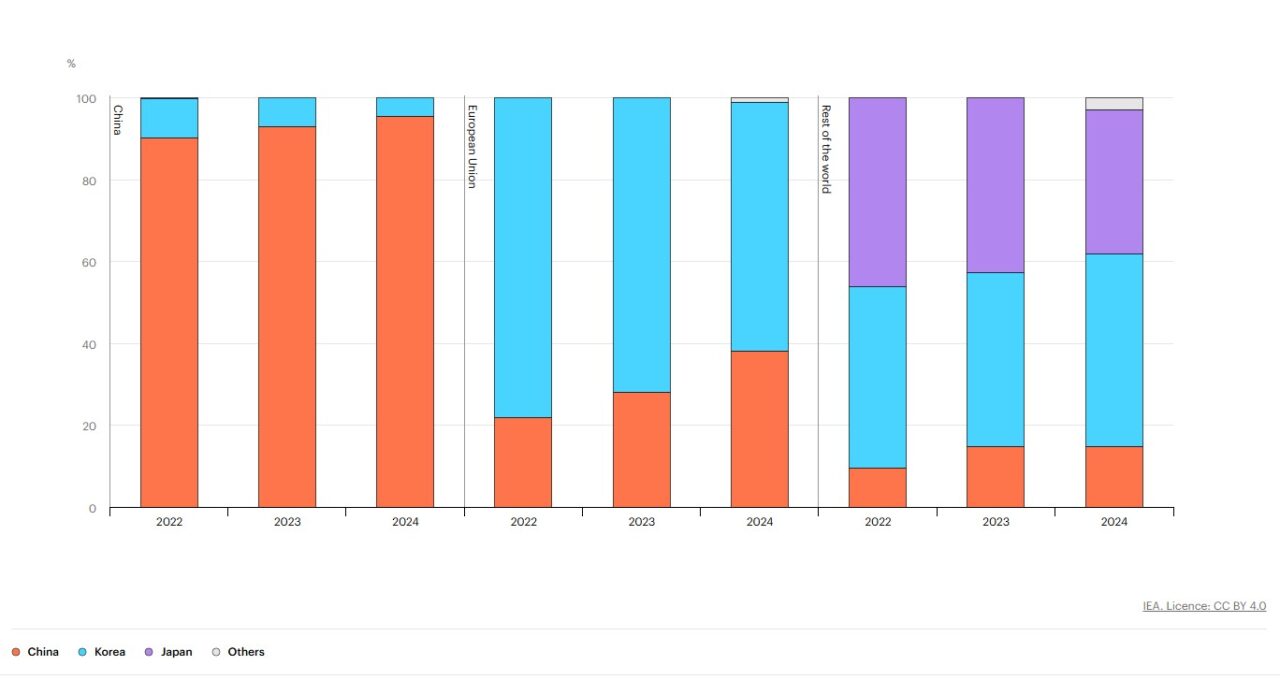

According to the report, over three-quarters of batteries sold globally are produced in China, and average battery prices in China dropped by 30% in 2024 and feel faster than anywhere in the world. As such, many EVs in China are now cheaper than conventional car models. The price advantage of Chinese battery producers can be attributed to several factors, including strong domestic competition and extensive manufacturing experience in China. This is especially true for EV batteries, over 70% of which were manufactured in China last year.

The IEA also notes that efforts to catch up to the dominance of China’s battery market will require “sufficient and sustained demand”, adding that EV sales, which currently account for 85% of the battery market, are the only driver that could create sufficient volume to help challenge Chinese market dominance.

In the European Union, 38.1% of electric car batteries sold last year were manufactured in China, up from 28.2% in 2023. Meanwhile, Korea’s market share in the EU has dropped: in 2023, 71.8% of electric car batteries sold in the EU came from Korea, compared to 60.7% in 2024.

While China still dominates the EV market, other nations are making efforts to catch up. In 2024, Korean producers supplied over one-fifth of global electric car battery demand, while Japanese manufacturers supplied a little under 7%. Meanwhile, in the US, battery manufacturing capacity has doubled since the introduction of the Inflation Reduction Act and associated tax credits for battery manufacturers in 2022. The US currently has over 200GWh of battery manufacturing capacity in operation, with almost 700GWh of further manufacturing capacity currently under construction. Around 40% of this capacity is owned or operated by previously established battery makers working in close collaboration with automakers.