The International Energy Agency (IEA) has released a new paper signalling that the UK ranks amongst the highest for average household electricity prices.

The Electricity 2024 report identifies common trends from across the global energy markets and it comes as no surprise that household electricity prices were highlighted as one of the biggest topics from across the year.

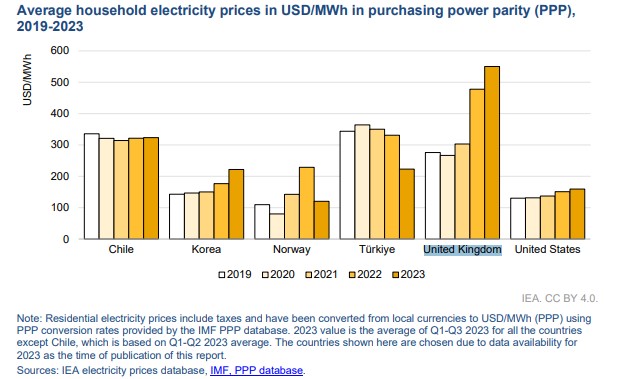

As shown in the graph released by the IEA below, readers can see the severity of the electricity prices for households in comparison to other countries such as the United States, Turkey, Norway, Korea and Chile.

The report also notes that prices in the UK have increased by 19% year-on-year (YoY) and have doubled since 2019. Though it is worth mentioning that Norway, which is often recognised as one of the leaders in renewable technologies and net zero, also saw record-high electricity prices in 2022.

One of the reasons both nations saw skyrocketing energy prices and a topic regular readers of Current± will be aware of, is the energy crisis.

The wholesale gas market became even more volatile in early 2022, with many households and businesses at the mercy of the market with the cost of energy in the UK skyrocketing. This was primarily a result of the Russian invasion of Ukraine, which then saw a reduction in Russian imported fossil fuels.

The extent of this damage across both 2022 and 2023 on household bills is now being realised and, with significantly higher electricity costs than other countries, question marks should be raised on whether enough was done to protect households and businesses.

But this also raises the question as to whether enough has been done by the UK government to bolster renewable generation capacity. Due to the country’s reliance on imported oil and gas for energy, the country was very much at the mercy of geopolitical issues. Indeed, when embargoes were enforced on Russian imports, this crippled the nation.

If the government had instead bolstered its renewable capacity and heavily scaled investment in the sector, much of these costs could have been mitigated.

The UK’s energy mix forecast to see decline in coal and gas output

It is not all doom and gloom for the UK energy market. Instead, the IEA signalled that, as coal-fired generation is phased out by 2024, gas-fired output will decline as the ramp-up in renewable generation continues to expand.

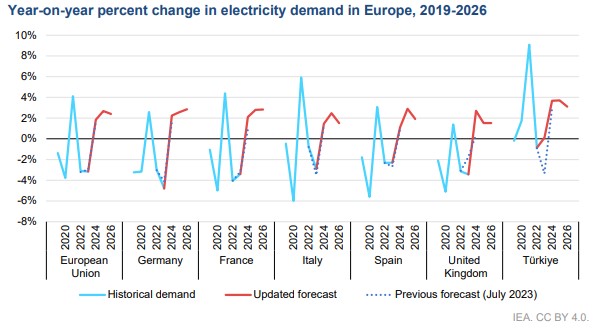

In 2023, interestingly, electricity demand declined by 3.4% in 2023 as a result of “high energy prices and sluggish economic growth”. There was also a dramatic shift away from fossil fuel consumption with a 36% decline in coal, a 20% decline in gas, whilst nuclear generation also saw reduced output at a 15% decline. You can find a breakdown of the energy mix across the GB market here.

For the 2024 and 2026 period, the IEA forecast electricity consumption to increase by just under 2% per year on average. Coal will also be phased out to zero in 2024 whereas nuclear generation will remain “relatively constant” until 2026 when a 15% cut will occur due to decommissioning.

Ireland has the ‘highest growth rate in Europe’ for electricity demand

Across the Celtic Sea, Ireland has seen its electricity demand rise by 2% making it one of the few countries in Europe to record an increase in 2023. Across the year, a 17% fall YoY was recorded for coal generation alongside a modest decline in gas-fired output of 1.2%.

Renewable generation remained stable as increases in solar, hydro and biomass generation were outweighed by a decline in wind. Despite this, it is worth mentioning that wind generation made up about 33% of total power generation in 2023.

According to the IEA, Ireland is forecast to have the highest demand growth rate in Europe for electricity demand and consumption, where it is expected to rise by, on average, almost 7% per year.

Interestingly, data centres are expected to contribute hugely to this with the nation braced to see a rapid expansion in this sector. Irish data centres are estimated to have consumed around 5.3TWh of electricity in 2022, up by 31% in 2021. This is around 17% of the country’s electricity demand and almost equal to the consumption in all urban dwellings, the IEA said.

Renewables are also set to see growth of around 13% between 2024 and 2026 largely driven by the growth of the wind sector both onshore and offshore.