Cornwall Insight’s power generation forecast shows that solar and wind will account for just 44% of generation capacity by 2030, lower than what is needed for net zero.

According to modellers, a 67% contribution from the two technologies is necessary for a decarbonised electricity system. In view of Labour’s plan to deliver a zero-carbon power system by 2030, huge increases in onshore and offshore wind and solar generation capacity are needed.

The amount of onshore wind capacity that needs to be added (35GW) is 17GW above Cornwall Insight projections of what will actually happen; the necessary 50GW increase to offshore wind is 27GW above projections; solar needs a 55GW increase, 10GW more than is projected.

In just a few weeks in office, Labour has been praised for the speed at which they have moved on the renewables rollout – but more still needs to happen, Cornwall said.

Tom Edwards, principal modeler at Cornwall Insight, said: “The swift actions of the new government, such as lifting the de facto ban on onshore wind, are encouraging. However, much more needs to be done to turn decarbonisation promises into a reality.”

Projected infrastructure build-out is expected to cost £18 billion; Cornwall Insight predicts a further £48 billion will be needed. Encouraging investment should be a key priority. Cornwall Insight says the Contracts for Difference (CfD) scheme might attract business but there are significant global bottlenecks.

The CfD scheme has hugely contributed to the UK’s renewable energy aspirations and has supported various technologies, such as offshore wind and solar, in increasing installed capacity and project pipelines.

After allocation round 5 (AR5) of the scheme was widely criticised for its low budget of £227 million, the Conservative government revealed that the sixth round would have a budget of over £1 billion.

Edwards said: “Increasing the attractiveness of the CfD scheme for renewables schemes by increasing budgets or Administrative Strike Price caps is likely to draw in more developers, as the potential for better returns makes investing in GB a more attractive prospect. However, this is only one piece of a large and complicated puzzle.”

For him, issues that “often lie beyond a government’s control”, like international competition and material shortages are a factor, too.

He added: “Updates to grid connections, increased storage and a whole plethora of other policy changes will be needed to make a 2030 zero-carbon power system a realistic target.”

Although the government has pledged to increase storage capacity, it has made no firm commitments.

In the run-up to the general election, Solar Energy UK published a manifesto for the incoming government stating 50GW of solar is needed by 2030, with 30GW of zero-carbon energy storage.

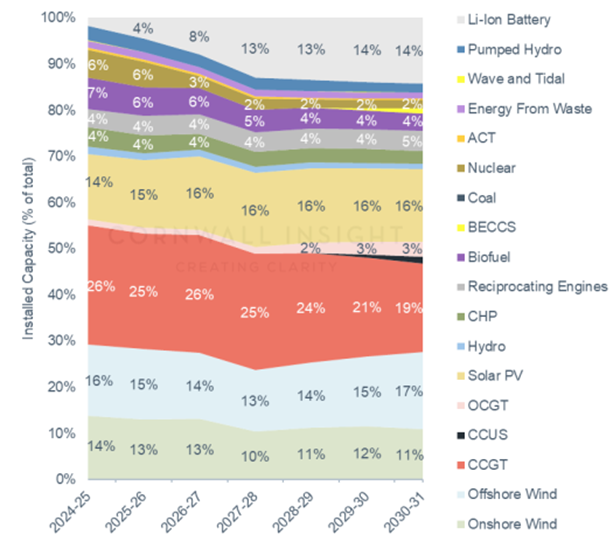

The future electricity generation capacity breakdown shows that onshore wind actually decreases, with offshore picking up by 2% from 2029 to 2031.

Projections show a significant increase in lithium-ion battery contribution, and carbon capture, utilisation and storage (CCUS) contributing only marginally to the electricity generation capacity mix.

Notably, carbon capture and storage (CCS) is a key element in all of National Grid ESO’s pathways to net zero, offsetting carbon intensive industries like aviation and steel.

Edwards added: “Our findings highlight the urgent need for a step change in Great Britain’s approach to renewable energy capacity delivery. While the underlying goal to decarbonise the power system is one that many would agree is crucial for the country’s future, the gap between our current trajectory and the new government’s 2030 target is substantial. Without significant intervention, we risk falling far short of the decarbonisation goals.”