Cornwall Insight anticipates that power prices will not shift below 2022 levels until the late 2030s.

This revelation has come as part of the company’s GB Power Market Outlook to 2030 which released today (6 July). The report cited that the surging demand for power putting stress on the grid will be the main driver of this trend.

Surging demand is expected to occur due to the UK’s need to decarbonise rapidly in a bid to attain net zero goals. In particular, the uptake of electrified heating, via heat pumps, and electrified transportation will see demand surge for energy.

One of the biggest drivers for this demand will be the increased adoption of electric vehicles (EVs), a topic that has been well documented on Current±. The impending ban on the sale of fossil fuelled internal combustion engine (ICE) vehicles by 2030 is set to be a defining factor.

Writing for Current±, Ken McMeikan, CEO at Moto Hospitality, emphasised the dramatic increase in electricity demand that EV charging is expected to instigate.

“Of those barriers, perhaps the most under-appreciated is the need for significantly improved energy capacity and infrastructure improvements across the National Grid,” he said. “To put it into perspective, to service the growing demand for EVs, by 2030 alone, EV charging capacity will require an incredible twelve times as much energy as we currently use today.”

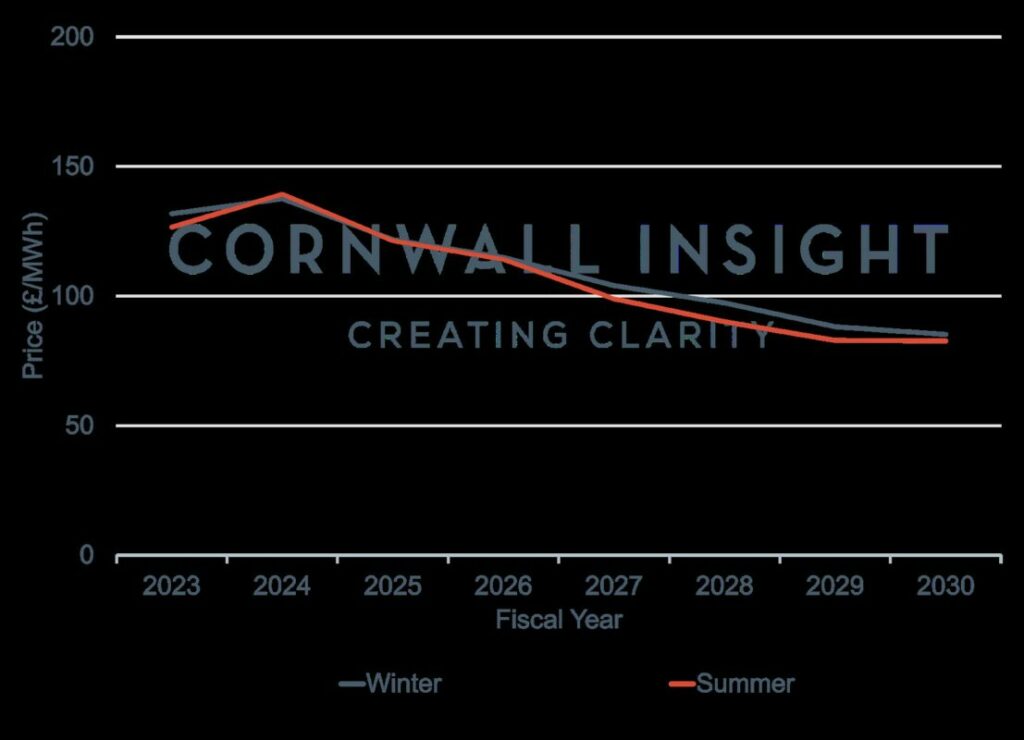

However, there is to be some relief from high power prices in the short-term, Cornwall Insight said. The company’s report states that the introduction of low-carbon, cost-effective energy sources is predicted to drive prices downward, with prices expected to fall below £100/MWh by 2028, two years earlier than previously projected.

The report outlines that as we approach 2030, the transition to more affordable renewable energy sources will be accompanied by the increasing electrification of the economy. In order to ensure a consistent power supply during periods of low wind, gas will need to play a role in filling the gaps and maintaining system stability.

There is however an unexpected factor that will impact prices in the near future. Across the channel, the deteriorating state of French nuclear capacity means GB will be exporting more power to the continent over the next decade, Cornwall Insight said. This will also contribute to the levelling out of prices above pre-pandemic levels.

“Our latest long-term power forecast reveals a changing and complex landscape for the energy market in Great Britain. The challenges of rising power demand, increasing exports and reliance on gas continue to keep our power price forecasts above historical levels for many years to come,” said Tom Edwards, senior modeller at Cornwall Insight.

“Despite these concerns, we continue to be optimistic about the positive impact of low-carbon, cost-effective energy sources and favourable gas price trends. We are pleased to see prices are expected to fall below £100/MWh sooner than previously anticipated, which offers consumers a glimpse of the benefits of the ongoing energy transition.

“It is of utmost importance that the government and other decision-makers fully comprehend the urgent and pressing need for continued investment in renewable energy sources and innovative solutions. The time to act is now.

“We must invest in long-duration storage technologies, nuclear power and carbon capture usage and storage that can effectively bridge the gap between intermittent renewable generation and maintaining a consistent energy capacity. This will bolster the chance of success in our transition to a sustainable future.”