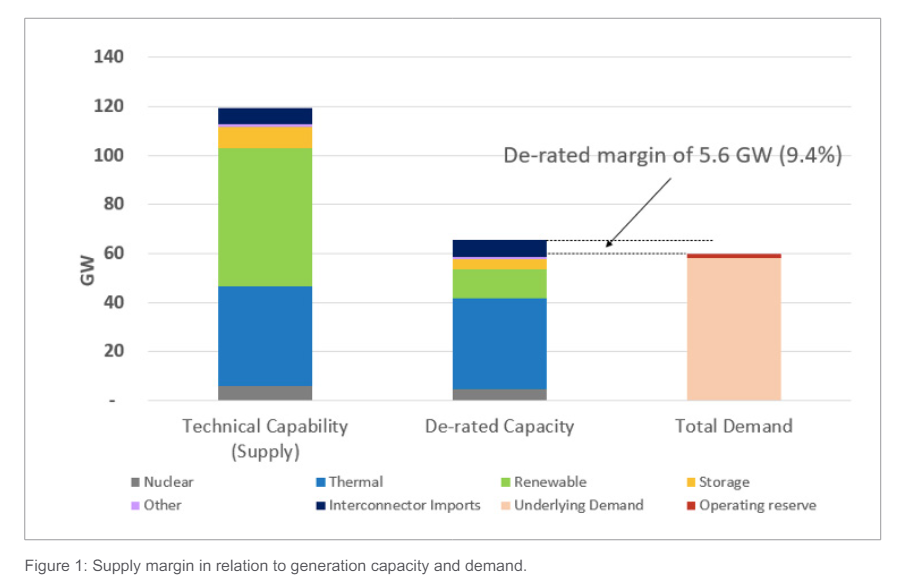

National Grid ESO says Great Britain’s electricity grid is expected to have sufficient operational surplus throughout winter. This year has a de-rated margin of 5.6GW (9.4%) which is higher than last year.

The ESO has published its annual Early Review of Winter Outlook report to give organisations across GB’s energy industry time to prepare for the winter months. It uses a base case scenario to assess the ability of de-rated capacity to meet peak average cold spell demand.

The base case margin has an associated loss of load expectation (LOLE) below 0.1 hours; margins are expected to be within the Reliability Standard of three hours.

The year-on-year (YoY) improvement is due to increased interconnector capacity, new gas generation, growth in battery storage capacity, and the effects of increased generation being connected to the distribution networks.

Although it is acknowledged that there “may be some tight days”, the base case operational view shows sufficient operational surplus for every week of winter. This takes into consideration the expected variations of demand, wind and outages.

Still, standard operating tools such as issuing electricity margin notices (ENMs) and capacity market notices (CMNs) are not ruled out. Should it be required, the ESO can trade on interconnectors to secure the flows required to meet peak demands.

National Grid ESO assumed a peak average cold spell demand of 59.8GW and its assessment further assumes all providers with CM agreements deliver in line with their obligations.

Last year’s forecast broadly aligned with reality

Alongside the Early View Outlook, the ESO published a Review of the 2023/24 Winter Outlook. Forecast margins were largely in line with the actual range, and customer demand was not interrupted due to unavailable supply. Balancing costs fell by 40% year on year.

During winter 2023/24, no ENMs or CMNs were issued. In late winter, National Grid reports, unplanned nuclear outages led to reduced generation and resulting prolonged period where the operational surplus was below the Winter Outlook Report’s forecast.

The ESO hailed the successful introduction of Demand Flexibility Services (DFS), launched in the winter of 2022/23 and expected to be enacted for the third time this year. DFS showed that demand flexibility can be provided on a national scale, and the ESO said it is engaging with industry stakeholders to consider how the service could evolve. More information is expected in the coming days.

National Grid ESO’s chief operating officer Kayte O’Neill said: “Our initial assessment of the winter ahead indicates that we will have sufficient margins throughout the period. Factors such as increased interconnector capacity, new gas generation, growth in battery storage capacity and increased generation connected to the distribution networks are contributing to higher margins than last winter.

“Global energy markets are showing signs of stability, but uncertainties remain and therefore as a prudent system operator we remain vigilant, continuing to monitor potential risks and working closely with our partners to establish any actions necessary to build resilience.

“We are continuing to meet the challenge of reliably operating a changing electricity system as new technologies, and diverse forms of capacity, contribute to security of supply.”

Global energy market implications

The report also highlighted that global energy markets are finding a new equilibrium, but uncertainty remains. Rebalancing in European markets has reduced the risk of fuel shortages for gas generation in GB and made interconnector imports more resilient to supply-side shocks.

The T-1 Capacity Market auction for delivery in winter 2024/25 secured 7.6 GW of capacity across various technologies and market developments, improving the outlook regarding supply security.

A more in-depth Winter Outlook report will be published later in the year to provide more up-to-date information about the coming winter.