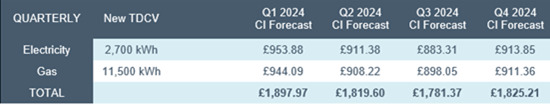

Cornwall Insight has set its first Q1 Default tariff Cap prediction at £1,897.97 – 3.5% higher than the current cap.

This figure relates to costs paid by a typical, dual-fuel, direct debit, household.

The next price cap will last from 1 January to 31 March, replacing the current cap – set at £1,897 following Ofgem revising the Typical Domestic Consumption Values – which was implemented yesterday (1 October) and will last until 31 December.

The January rise is primarily attributed to rising wholesale prices caused by Australian liquified natural gas (LNG) production strikes over the past few weeks.

It’s also worth noting that the first three months of the calendar year typically see higher wholesale prices.

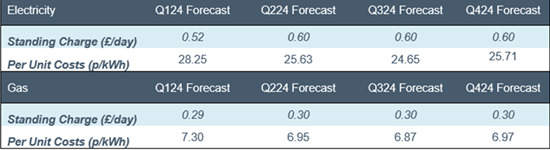

According to the market research company’s prediction, both electricity and gas will experience a slight increase in their Per Unit Costs from 27p/kWh to 28.25p/kWh and 7p/kWh to 7.30/kWh respectively.

Cornwall Insight’s Q1 2024 prediction represents a huge decrease of roughly £2,300 from the Q1 2023 price cap which was set at £4,279.

This shows a positive trend in energy prices as the UK continues to recover from the energy crisis that has crippled households throughout the nation.

Despite the continued steady decrease of energy prices however, costs will still remain high for UK homes as the Q1 2024 price cap prediction remains over £600 than the 2022 winter price cap.

“The energy price cap has steadily declined over the past year, and while it is disappointing to see this trend stall, given the movements in the wholesale market of late it is not wholly unexpected. While the rise is small, it shows we cannot just assume prices will continue their fall and eventually reach pre-pandemic levels. Policies need to be put in place to deal with the possible situation that high energy prices have become the new normal,” said Dr Craig Lowrey, principal consultant at Cornwall Insight.

“Dealing with persistently high prices in this new energy landscape will not be achieved by a one-size-fits-all solution. The government possesses a toolbox of short- and medium-term options, including targeted support such as social tariffs or investment in energy efficiency, which could ease the burden on vulnerable households.

“However, it is important we understand such assistance cannot overcome the effects of a volatile international energy market on bills. It is only by continuing our transition away from fossil fuels, towards secure and sustainable domestic energy sources that we can reduce our exposure to such international drivers and, in turn, stabilise our energy prices.”

Concern is currently circling the current price cap as the strain on UK households to pay their energy bills will begin to show in the coming months. Government support that existed last year – such as the Energy Bills Support Scheme and Energy Price Guarantee – will no longer be available, leading to similar bills than last winter despite the decreasing price cap.

Using Cornwall Insight’s latest Q1 2024 prediction, the Energy and Climate Intelligence Unit (ECIU) revealed that the average energy bills will be as high as last year at £1,200.

“The gas crisis certainly isn’t over with many millions of people set to feel the pinch this winter just as much as last. The high price of gas combined with Government household insulation programmes underperforming means many people will find themselves colder and poorer this winter,” said Jess Ralston, energy analyst at ECIU.

“The recent Government U-turn on standards for private sector rentals bakes in higher bills for renters for years to come.

“Whatever the Government does on oil and gas licences, the North Sea will inevitably decline. The stuff is simply running out. Unless we start to get serious about making the switch to electric heat pumps and more renewables, we’ll end up importing colossal quantities of foreign gas.”