Battery storage software provider Arenko has officially launched the beta version of its Nimbus Portfolio Performance Tool offering data on the UK’s battery energy storage projects.

The portfolio performance tool enables battery developers and asset owners to both accurately monitor and track the performance of a battery within a project. In doing so, owners can effectively check the status of the technology and optimise projects accordingly.

According to Arenko, the tool “extensively maps the financial performance across the full revenue stack (all wholesale trading and ancillary services), including the estimated cost to serve of all UK batteries for every settlement period with model assumptions validated against the real performance of assets”.

The technology also grants public access to “every operational UK battery” allowing for prospecting developers to review opportunities in the market and to weigh up potential innovation within the market.

In providing the new technology and performance analysis tool the company is helping to increase the entrepreneurialism in the battery market – something energy data platform Origami recently called on the sector to increase.

The firm called on the UK’s energy storage owners and operators to be “ruthlessly entrepreneurial” to navigate current Energy Market Reform conversations and prepare for the rapid growth expected in the near future.

By providing this new tool, it will help battery owners to navigate better solutions and optimisation features for the UK’s battery energy storage sites and ultimately support the acceleration of the sector.

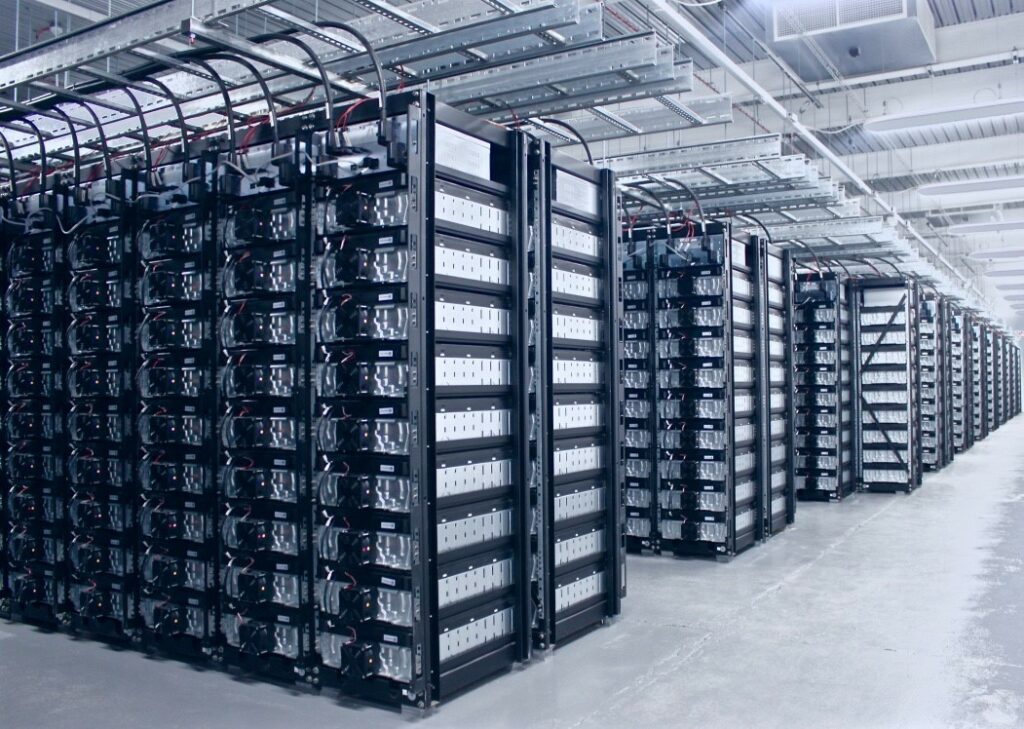

Arenko has optimised a number of battery projects, most notably those that belong to Foresight, Gresham House and Vattenfall. These had been optimised via Arenko’s cloud-based software, Nimbus.

In June, Arenko also expanded its services to allow intraday European Power Exchange (EPEX) trading. The platform was previously capable of trading in the Balancing Mechanism (BM), frequency response and other ancillary service markets.

Arenko CEO Rupert Newland said was the first of “several additional services modules” the company planned to deploy over the next year. The platform – which is fully autonomous – is to “seamlessly” stack EPEX and BM revenue sources, with Arenko lauding this as a feature that will incrementally improve an asset’s trading performance.