BP has made its first stride into the offshore wind market in a deal to develop the renewable generation technology in the US with Equinor.

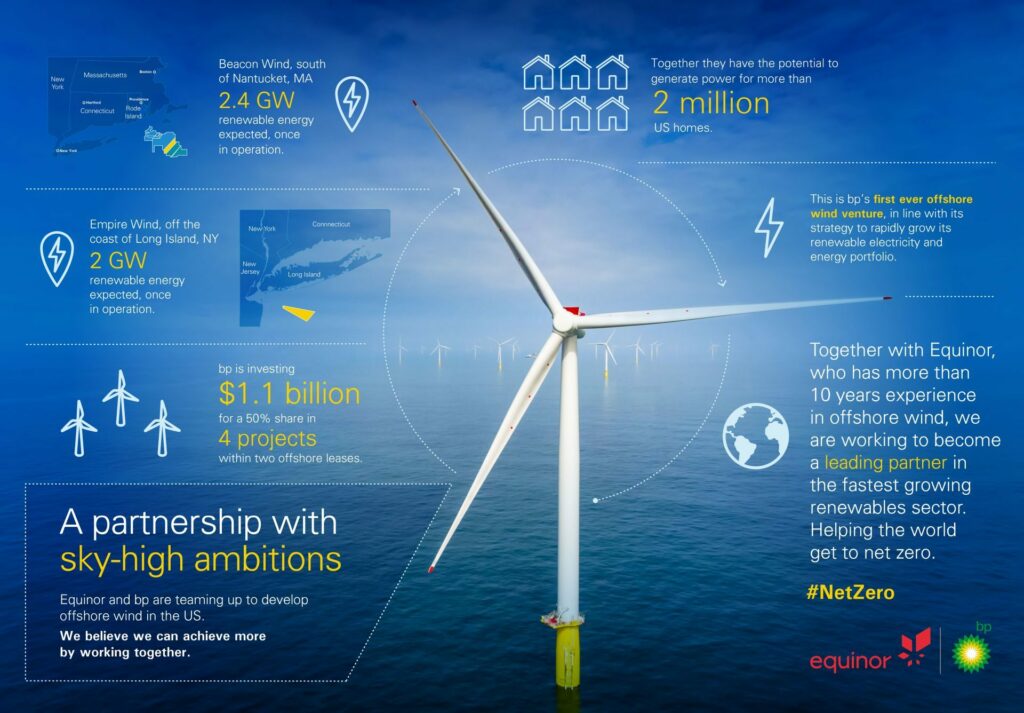

A US$1.1 billion (£844 million) investment has been made by the oil and gas giant into four projects within two of Equinor’s existing leases, transferring 50% of non-operated interests in the sites from Equinor to BP.

The two sites – the Empire Wind site which is set to have the capacity to of over 2GW and the Beacon Wind site which is set to have a capacity of over 2.4GW – are located on the US’ east coast.

The strategic partnership – and acquisition of interests – comes following BP’s announcement last month that it would be increasing its renewable capacity to 50GW by 2030, a significant jump from the 2.5GW it had in 2019. This was in support of its target of becoming a net zero company by 2050 or sooner.

Analysis: Alice Grundy, Current± reporter

Despite being a huge player in O&G, BP is no stranger to investing in – and as we’ve seen in the case of BP Chargemaster, acquiring – renewable projects and companies. A 50GW by 2030 goal is therefore not necessarily unachievable, but it was clear from its first announcement detailing its net zero ambitions, and even more apparent at its 50GW by 2030 announcement, that it could not do this solely with the solar developed under its solar arm Lightsource BP.

Offshore wind was the next logical step, in part due to factors BP itself pointed out – the sector is forecast to grow significantly over the next ten years or so, particularly by BloombergNEF which predicted an increase from ~30GW today to ~190GW, and is supported by favourable regulation, both in the US and here in the UK.

A deal with Equinor – which has a proven track record of developing wind and previous partnerships with BP – makes strategic sense, allowing BP to dip a toe into the technology with minimal levels of risk. It’s safe, it’s known and it’s in partnership with a company that should, by all accounts, know exactly what it’s doing.

Writing on LinkedIn, BP CEO Bernard Looney said that whilst the leases are “massive in scale”, the partnership is about more than a simple transaction as “we can learn a lot from them”.

“By leveraging their skills with our own expertise in areas like trading we expect to be a great team. Especially as we look to develop more opportunities in the US over time,” he said.

Equinor is to remain the operator of the projects through the development, construction and operations phases and it is anticipated that the wind farms will be equally staffed after a period of time.

The two companies are to consider future joint opportunities in the US for both bottom-fixed and floating offshore wind, with intentions to leverage relevant expertise to jointly grow scale.

“Our partnership underlines both companies’ strong commitment to accelerate the energy transition and combining our strengths will enable us to grow a profitable offshore wind business together in the US,” Equinor CEO, Eldar Sætre, said.