Chancellor George Osborne has confirmed that the Carbon Reduction Commitment (CRC) energy efficiency scheme is to be abolished, with increases in the Climate Change Levy (CCL) to rise in 2019 to compensate.

The decision follows a consultation launched last year on business energy efficiency rates which proposed plans to reform the complex system currently in place.

CRC will be scrapped following the 2018-19 compliance year, with rising CCL taxation intended to recover the revenue lost from this decision. Businesses will not be required to purchase allowances to cover emissions for energy supplied from April 2019.

This is intended to streamline the business energy tax landscape by moving to a system where businesses are only charged one energy tax administered by suppliers rather than CRC participants being required to forecast energy use, buy and surrender allowances.

To counteract the CCL rate increase for energy intensive industries, larger discounts for businesses that participate in climate change agreements will be offered from April 2019 so that these firms do not pay more than a RPI increase. The existing CCA scheme eligibility criteria will stay in place until at least 2023.

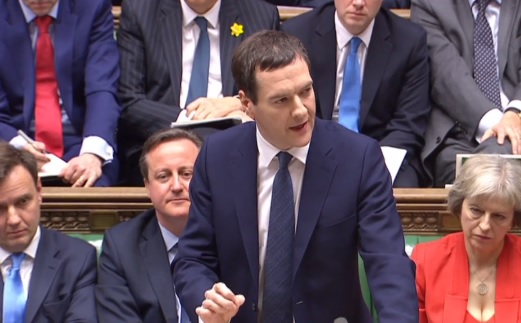

During his Budget speech earlier today, the chancellor said: “Many retailers have complained bitterly to me about the complexity of the CRC. It’s not a commitment; it’s a tax.

“So I can tell the House: we’re not going to reform it. Instead I have decided to abolish it altogether. And to make good the lost revenue – the Climate Change Levy will rise from 2019.”

CCL rates will also be rebalanced for different fuel types with the eventual aim of reaching an equal ratio between gas and electricity by 2025. This is intended to reduce gas use in line with the UK’s climate change targets, although seems to contradict the Department of Energy and Climate Change’s recent ‘dash for gas’ policy.

The Budget documents also claim the government will incentivise energy efficiency among CCL-paying businesses.

A second consultation will be launched in the summer to pin down the detail of a simplified energy and carbon reporting framework for introduction by April 2019.

According to the Treasury’s consultation response, there was a clear consensus among respondents in favour of moving to a system where a single business or organisation faces one energy tax and one reporting scheme.

This sentiment was echoed yesterday by Richard Griffiths of the UK Green Building Council, who said: “This review of policy that’s happening at the moment is an absolutely unprecedented opportunity to come up with a policy landscape that really delivers change.

“As a general pattern, energy efficiency has stagnated a lot over the last few years and there’s a real marker in the sand now where we can really introduce a new policy regime which is simpler but hopefully more effective.”

The potential of such a scheme has been stated by Jayne Harrold of BIF Four accountancy PwC, who said today: “Energy tax reforms, through scrapping the CRC and replacing it with an increased rate of CCL from April 2019, as well as rebalancing the CCL rates away from electricity and towards gas, will greatly reduce the administration and compliance burden placed on many businesses that fall within the CRC scheme.

“Now they will receive all of the cost of their energy taxes directly through their energy bills.”

Harrold added that the Budget had also addressed a criticism of the CCA scheme, namely a mismatch between the CCL and CRC savings received from business that can’t meet the energy efficiency targets.

A target review will now be undertaken by DECC that will also review the level of the buy-out penalty that is involved, to address the problem.