This week’s issue of Current± Price Watch – powered by Enact – explores the impact on market prices from the increasing presence of renewables in the energy mix, NGET and SSEN’s plans for a new 525kV, 2GW HVDC transmission cable and the successes of the demand flexibility service (DFS) amongst the public.

Day Ahead: Increasing renewable presence in energy mix sees average prices fall

Last week saw a slight decrease in average day ahead prices compared to the past few weeks with a high of £91.18/MWh on Tuesday 4 July and a low of £63.48/MWh on Monday 3 July.

The low average day ahead price on Monday can be attributed to a renewable majority in Britain’s energy mix as wind produced 47.2% of British electricity and solar 7%.

Following wind, low-carbon nuclear produced 19% of the electricity mix followed by gas at 13.7%.

On Monday #wind generated 47.2% of British electricity followed by nuclear 19.0%, gas 13.7%, imports 8.3%, solar 7.0%, biomass 4.0%, hydro 0.5%, coal 0.2%, other 0.0% *excl. non-renewable distributed generation pic.twitter.com/ni1NxkphmH

— National Grid ESO (@NationalGridESO) July 4, 2023

Cheap energy produced by renewables making up the majority of Britain’s electricity mix translated into lower day ahead prices, reaching a trough of £25.9/MWh.

Solar also enjoyed high production levels last week generating almost 10% (9.9%) of our electricity mix on Friday 7 July.

On Friday #wind generated 35.4% of GB electricity, more than gas 24.4%, nuclear 18.8%, solar 9.9%, imports 6.0%, biomass 4.6%, hydro 0.9%, coal 0.0%, coal 0.0% *excl. non-renewable distributed generation pic.twitter.com/HtLyzTjUiX

— National Grid ESO (@NationalGridESO) July 8, 2023

These figures suggest that July could follow June in experiencing high generation levels of renewable energy.

National Grid ESO’s (ESOs) June 2023 generation stats revealed that 46% of Britain’s generation came from zero carbon sources in that month – with a peak of 80% on 7 June 10am.

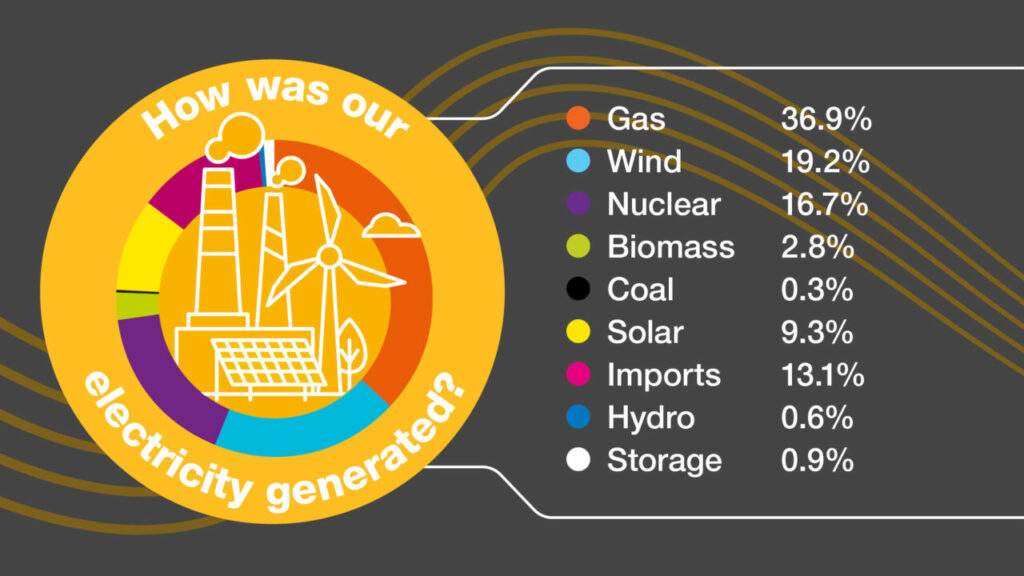

Gas was the largest single source of fuel for Britain producing 36.9% of electricity followed by wind at 19.2%.

June also saw the UK importing 2,642GWh of energy, which was much more than it exported (742GWh) as a total of 20TWh ran through the network during that month.

Overall renewables are becoming an increasingly significant contributor to the production of Britain’s electricity, allowing consumers to enjoy lower energy prices. Recent data from the Department for Energy Security and Net Zero (DESNZ) show that renewables made up almost half of the nation’s total generation at a record 47.8%.

“Nearly HALF of our electricity came from renewable energy sources in the first 3 months of the year,” tweeted Ofgem.

“Not only that, we saw a 10% decrease in fossil fuel generation. Great news as part of our journey to Net Zero.”

Intraday: NGET and SSEN unveil plans for new 525kV, 2GW HVDC transmission cable

Intraday market prices saw a high of £148.88/MWh on 4 July with prices experiencing a low of £-15.51/MWh just the day before. The average price started the week at £44.88/MWh before finishing the week on £100.23/MWh.

The week’s highest intraday market price came the day before National Grid Electricity Transmission (NGET) and Scottish & Southern Electricity Networks (SSEN) Transmission formally established a joint venture to build a 525kW Scotland-England subsea transmission cable.

The ‘Eastern Green Link 2’ (EGL2) project will install a 525kV, 2GW high-voltage direct current (HVDC) subsea transmission cable, which is anticipated to flow between Peterhead in Scotland to Drax in England and would be the “single largest electricity transmission project ever” in the UK.

It could also play a role in the intraday markets with further renewables being able to be transmitted between wind-rich Scotland and England.

Once final approval is granted from Ofgem, work on the EGL2 is expected to commence in 2024, with a targeted operational date of 2029.

“The government ambition of 50GW of offshore wind by 2030 demands unprecedented scale and complexity of action. It’s essential that we find new ways to work and unite as a sector to rise to this challenge and this joint venture with SSEN is a prime example,” said Carl Trowell, president of UK strategic infrastructure at National Grid.

“Eastern Green Link 2 is part of our Great Grid Upgrade, the largest overhaul of the grid in generations. This new infrastructure will connect more clean, renewable energy from where it’s generated to where it’s needed, helping contribute to lower energy bills over the long-term and make the UK’s energy more self-sufficient.”

As alluded to by Trowell, the Eastern Green Link 2 will help contribute to the reduction in energy bills via the transmission of renewable energy generated via Scotland’s vast onshore and offshore wind generation capacity which can then be transmitted south to England.

For instance, the Scottish Government is targeting having 20GW of onshore wind capacity available by 2030 – just a year after the targeted operational date of the subsea transmission cable.

Imbalance Price: 83% of DFS participants would take part again, says ESO

Imbalance prices started from a low with minimum prices negative at £-75.08 and max prices at £127.85, a wide spread which consolidated towards the end of the week with average prices ending higher on £99.55 compared to a low start of £21.9.

A number of companies (like Octopus Energy) have been trialling DFS recently, a mechanism which – if used more widely – would modify energy consumer behaviour to fit changing price signals.

National Grid ESO’s DFS trial concluded recently, with 83% of participants saying they would take part in the initiative again, with 76% saying they were primarily motivated by reducing their energy bills.

In total 1.6 million households and businesses participated and shifted over 3,300MWh of electricity during peak times.

With imbalance prices being lower at the start of the week due to increased renewables generation, greater use of demand flexibility could have shifted more of the demand to days when there was an abundance of renewable electricity supply.

The DFS scheme has been seen as a success with many, including Octopus Energy’s founder and chief executive Greg Jackson, wanting the scheme to stay in place for the coming winter and become a regular part of the electricity system. Such a scheme – used at scale – could replace the use of coal contingency units.

To find out more about LCP Delta’s Enact platform, click here or follow them on Twitter or LinkedIn for the latest market updates.