This week’s issue of Current± Price Watch – powered by Enact – looks at over six hours of negative day ahead prices over the weekend and explores this year’s Future Energy Scenarios published last week by National Grid ESO.

Day Ahead: Weekend prices drop as wind overtakes gas in GBs energy mix

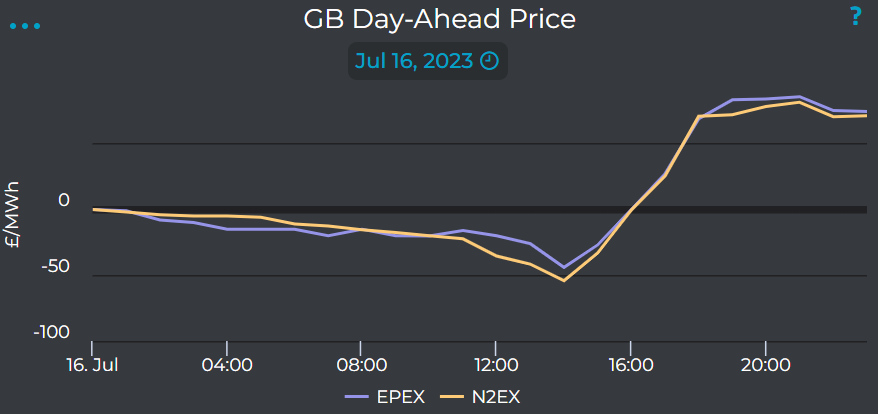

Day ahead prices dropped from an average of between £91/MWh and £72/MWh at the beginning of the week to a low of £-54.17/MWh on Saturday 16 July.

The drop in prices directly correlates to an increase in wind power; following gas having dominated Britain’s energy mix from Monday to Friday, wind produced 54.9% of Britain’s energy on Saturday which saw average day ahead prices drop from £31.74/MWh on Friday 15 July to £9.44/MWh on Saturday.

On Saturday #wind produced 54.9% of GB electricity followed by nuclear 16.8%, gas 12.6%, solar 7.2%, biomass 4.4%, imports 3.2%, hydro 0.9%, coal 0.0%, coal 0.0% *excl. non-renewable distributed generation pic.twitter.com/YNf4JxyDYH

— National Grid ESO (@NationalGridESO) July 16, 2023

Wind also dominated Britain’s energy mix on Sunday 16 July producing 50.6% followed by gas at 17.3%.

Rajiv Gogna, partner at LCP Delta, highlighted on LinkedIn that the weekend would see more negative pricing throughout Europe with wind playing a significant role in bringing these prices down.

Although, as Gogna pointed out, there was no six-hour period of negative prices in Britain on 15 July meaning that wind self-curtailment was avoided, Sunday 16 July saw negative prices surpassing the six-hour mark.

This meant that like the preceding weekend (8-9 July), the six-hour negative price rule had to be implemented which causes difference payments to be temporarily set to zero.

The economic benefits of the increasing presence of cheap renewable energy in Britain’s energy mix was recognised in this year’s Future Energy Scenarios (FES) published last week, as the ESO called for greater support to bolster renewables generation in Britain.

Under each of the three scenarios presented by the FES in which Britain achieves net zero by 2050, ESO revealed that at least 89GW of wind and solar must be connected to the grid by 2030.

This figure jumps to at least 119GW in ESO’s best-case scenario (‘Leading the Way’) which sees Britain reach its net zero target four years early in 2046.

To achieve the minimum of 89GW of connected renewable energy required to meet net zero by 2050, ESO called for strategic coordination to: increase strategic network investment; facilitate a quicker connection reform; and develop a coherent strategy to ensure large electricity demands are located where they can provide the biggest benefit.

“Two years ago, the Government announced its intention for the electricity system to be fully decarbonised by 2035. This ambitious target reinforced Great Britain’s existing global leadership in enabling low carbon electricity generation,” wrote an ESO spokesperson in the FES Executive Introduction.

“The 2035 target gives us just over a decade to deliver a world-first, requiring a major transition across industry, regulation and government policy – a challenge that we need to meet head on.”

Intraday: National Grid ESO outlines the importance of demand flexibility in FES

Average prices fell from a high at the beginning of the week of £95.5/MWh to £58.22 today (17 July), with a low of £24.09 on 16 July, showing the general reduced electricity demand on the weekend. Minimum prices again went negative, to £-32.18 on 16 July. Once again, over 50% of electricity supplied to the grid came from wind power over the weekend, with gas at only 12.6% on Saturday 15 July.

On Saturday #wind produced 54.9% of GB electricity followed by nuclear 16.8%, gas 12.6%, solar 7.2%, biomass 4.4%, imports 3.2%, hydro 0.9%, coal 0.0%, coal 0.0% *excl. non-renewable distributed generation pic.twitter.com/YNf4JxyDYH

— National Grid ESO (@NationalGridESO) July 16, 2023

Intraday prices are heavily affected by consumer demand. The Future Energy Scenarios report published by National Grid ESO outlined how demand flexibility will play a “crucial role” in achieving net zero goals.

This consumer transformation requires people to make changes including extensive alterations to improve domestic energy efficiency, and the majority of demand smartly controlled – such as through a Demand Flexibility Service (DFS) – to provide system flexibility.

The ESO revealed that the households and businesses participating in the Demand Flexibility Service shifted over 3,300MWh of electricity during peak times.

Further changes in consumer behaviour are needed to reach net zero by 2050, for example, domestic demand for lighting and appliances must be reduced to 47TWH in 2050, while smart digital solutions will help with consumer habit change, and a market-wide Half Hourly Settlement would allow consumers to participate more readily in demand flexibility.

LCP Delta says that: “Consumers are keen to participate in Demand Side Response (DSR) programmes such as DFS. National Grid ESO highlighted that Wales delivered nearly 350MWh of demand reduction, while Southern England delivered the highest levels of demand reduction with over 410 MWh across 22 DFS events held this winter. The challenge going forward will be to help connect consumers and open revenue earning potential from wholesale market, network charging, ESO & DSO services.”

LCP Delta’s Faisal Wahid noted on LinkedIn that the ESO had hosted a webinar which concentrated on DSR options as part of its Future Energy Scenarios report. Further progress on rolling out smart technologies and incentivising consumer behaviour change with market reforms will help to bring down intraday prices in the long run, but just as with every aspect of the drive for net zero, progress needs to be accelerated.

Imbalance: Imbalance prices hit two-day high as energy storage is emphasised in FES

Imbalance market prices saw a two-day high of £160/MWh on 11-12 July before dropping to -£46/MWh minimum on 16 July. The average price started the week at £90.06/MWh and finished the week at £62.95/MWh.

The FES documentation highlighted several considerations that would affect imbalance prices – namely on the topic of energy storage.

Current±’s coverage of FES found that it emphasised the importance of investment for Long Duration Energy Storage (LDES) and a clear funding and development plan for hydrogen and Carbon, Capture, Use and Storage (CCUS) projects beyond the delivery of financial clusters.

George Martin, energy consultant at LCP Delta, stated on LinkedIn that one of the key messages from FES “emphasises the system need for LDES, CCS and Hydrogen and how government need to reduce investment uncertainty for these technologies. This is something we very much agree with at LCP Delta and has been highlighted in our own work both with industry and government, particularly for LDES”.

Energy storage will be a crucial mechanism for the UK’s decarbonisation prospects. With the scaling of renewable, intermittent energy generation sources the need to capture this green energy for later use could be paramount in achieving net zero. FES highlighted that “under the Consumer Transformation pathway, 47GW of electricity storage must be operational and 18GW connected at distribution level”.

“The REA particularly welcomes the importance placed by the FES key recommendations on delivering the infrastructure and systems required to integrate the full range of renewables and clean technologies needed to decarbonise our power, heat and transport systems,” said Mark Sommerfeld, deputy director of policy at the REA.

“This includes delivering strategic network reinforcement, grid connection reforms, infrastructure for delivering negative emissions and delivering both power distribution and transport flexibility.

“The REA emphasises that the upcoming Autumn budget should now be used to detail policies designed to deliver the most ambitious of these Future Energy Scenarios and ensure the UK remains an attractive market for low carbon investment, or risk falling further behind in the UK’s decarbonisation targets.”

To find out more about LCP Delta’s Enact platform, click here or follow them on Twitter or LinkedIn for the latest market updates.