Longer term market signals are the key focus of this week’s edition of Current± Price Watch – powered by Enact – taking a look at the T-4 Capacity Market results, the new default tariff price cap and incoming weather fronts.

Day Ahead: High T-4 prices speak of changing market dynamics

The Day Ahead price in Britain hit a high of £182/MWh for the last week on Sunday 26 February and a low of £70/MWh on Monday 20 February.

Last week saw the T-4 Capacity Market auction clear in the third round at a record high of £63/MWh, speaking to the continued concern around capacity and its impact on power prices in coming years.

“A key driver of the high clearing price is that there was less competition in this years’ auction with 93% of capacity that entered the auction receiving a contract compared to 87% last year,” explained LCP Delta consultant George Martin.

“This is driven by a number of factors:

- Higher assumed peak demand (1.2GW higher than in the 2025/26 auction) led to a higher capacity requirement. This combined with a similar amount of existing available capacity to last year to cover this requirement increased the need for new build capacity thus decreasing competition.

- High levels of battery storage capacity (around 5GW nameplate) cleared in this auction, but their derating factors have been significantly reduced (halved in most cases) compared to the last T-4 auction meaning they contributed less derated capacity to the auction requirement and therefore less capacity competing in the auction. The lower derating factors also would have meant that the battery storage units would have required higher prices (on a £ per derated kW basis) to achieve the same level of income, further pushing the price up.

- Declining investor confidence and revenue uncertainty for future projects may have led to less capacity bidding into the auction. Macro-economic factors such as inflation and interest rates, as well as global supply chain difficulties and high commodity market prices, are increasing financing costs and capex for new plants. In addition, uncertainty in future gas prices and uncertainty around changes to market arrangements such as the government’s Review of Electricity Markets (REMA) could be causing further uncertainty.”

One of the big winners in this year’s T-4 Capacity Market auction was battery energy storage with 1.29GW securing contracts.

1.29 GW of #batterystorage capacity secured contracts in the #UK's latest T-4 Capacity Market auction. Most importantly, more than 60% of this #storage is providing a #duration of over two hours. Yet more opportunities for #batteries on the #grid. https://t.co/36LYQ41SZM

— Invinity Energy Systems (@InvinityEnergy) February 27, 2023

“We are pleased to have secured contracts for our portfolio in the 2023 T-1 and T-4 Capacity Market auctions, reflecting the importance of energy storage in supporting the stability of the grid and the growth of renewable energy sources,” said Alex O’Cinneide, CEO of Gore Street Capital.

“The contracts – worth a combined total of £1.8 million and £45.4 million, respectively – will serve as a reliable source of revenue and support the Company in realising its plan, articulated to investors during our most recent funding round, of using operational revenue to cover dividend payments from future quarters onward.”

Intraday: Despite wholesale power price drops, tariff cap remains high

The APX Mid price for the last week hit a high of £180.08/MWh on Tuesday 21 February, and a low of £46.33/MWh.

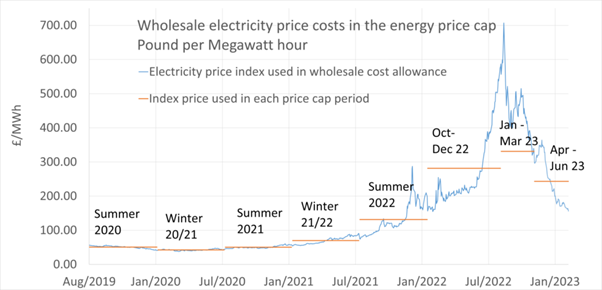

Wholesale power prices have dropped considerably in recent months, and this was represented to an extent in Ofgem’s default tariff price cap for the coming period, which the regulator announced today would be set at £3,280 for typical dual fuel households

Despite a £1,000 reduction from the current cap however, households will see no benefit as bills continue to rise with the Energy Price Guarantee from April, which superseded the tariff cap and will move from £2,500 to £3,000.

“Today’s announcement reflects the fundamental shift in the cost of wholesale energy for the first time since the gas crisis began, and while it won’t make an immediate difference to consumers, it’s a sign that some of the immense pressure we’ve seen in the energy markets over the last 18 months may be starting to ease. If the reduction in wholesale prices we’re currently seeing continues, the signs are positive that the price cap will fall again in the summer, potentially bringing bills significantly lower,” said Ofgem’s CEO, Jonathan Brearley.

“However, prices are unlikely to fall back to the level we saw before the energy crisis. Even with the extensive package of government support that is currently in place, this is a very tough time for many households across Britain.”

Imbalance: Extreme weather and extreme prices on the way?

Imbalance prices were similarly stable, hitting a high of £220/MWh on Monday 20 February and a low of £0/MWh on the same day, with prices remaining fairly stable throughout the day.

More extreme weather could potentially be on the horizon however, which could stretch power prices again.

“There is some concern that we could be about to experience a significant cold snap, due to the sudden stratospheric warming (SSW) event which occurred earlier in February,” said Tim Sparks, consultant at LCP Delta.

“SSW is a meteorological phenomenon which is often associated with the arrival of colder temperatures and winter storms to the British Isles, such as the ‘Beast from the East’ in 2018. However, an SSW event is not a guarantee of extreme cold weather and – as there’s typically a lag of around two weeks between the occurrence of an SSW and any potential impact on the weather in the UK – it’s currently a little too early to say with confidence what will happen. We should get more certainty in the next few days, given that the timing of the SSW event would point to a cold snap potentially arriving as soon as this weekend, the 4-5th March. Traders will therefore want to be keeping an extra close eye on the weather forecast this week to monitor how this situation develops.”

To find out more about LCP Delta’s Enact platform, click here or follow them on Twitter or LinkedIn for the latest market updates.