Ofgem has today confirmed (27 February) that the energy price cap will be set at £3,280 for typical dual fuel households. Despite a £1,000 reduction from the current cap however, households will see no benefit as bills continue to rise.

The £3,280 price cap refers to the maximum energy unit price for a household with typical dual fuel household (receiving gas and electricity from the same supplier via direct debit) that a supplier can charge.

For households who pay via standard credit the default cap stands at £3,482 – a £1,051 decrease from last quarter. The price cap has also decreased for prepayment meter customers from £4,358 to £3,325.

These values include VAT and represent the current Typical Domestic Consumption Values (TDCV) of 2,900kWh of electricity and 12,000kWh of gas.

In spite of these reductions the energy regulator warned that the corresponding £500 rise in the Energy Price Guarantee (EPG), limiting household bills to £3,000 in April, means that bills will rise again in April.

According to Cornwall Insight’s final price cap forecast (which was only £14 lower than the figure confirmed today), as the cap is still higher than the EPG, annual consumer bills will jump by at least 20% (£500).

Ofgem did report a brighter outlook for Q3 2023, however, stating that that significant reduction from the current cap (£4,279), means that the prices paid by customers will drop for the first time in more than 18 months.

“Although wholesale prices have fallen, the price cap has not yet fallen below the planned level of the Energy Price Guarantee. This means, that on current policy, bills will rise again in April. I know that, for many households this news will be deeply concerning,” said Ofgem’s CEO, Jonathan Brearley.

“However, today’s announcement reflects the fundamental shift in the cost of wholesale energy for the first time since the gas crisis began, and while it won’t make an immediate difference to consumers, it’s a sign that some of the immense pressure we’ve seen in the energy markets over the last 18 months may be starting to ease. If the reduction in wholesale prices we’re currently seeing continues, the signs are positive that the price cap will fall again in the summer, potentially bringing bills significantly lower.”

“However, prices are unlikely to fall back to the level we saw before the energy crisis. Even with the extensive package of government support that is currently in place, this is a very tough time for many households across Britain.”

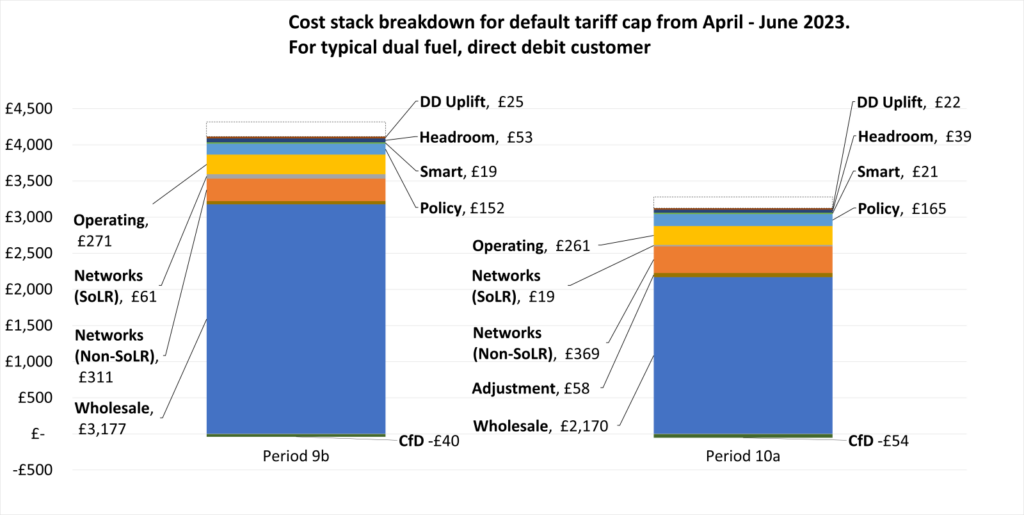

In the above cost stack from period 9b (Jan – Mar 23) and 10a (Apr – Jun 23), Ofgem showed that wholesale costs still constitute the majority of a typical dual fuel household’s bills at roughly 66%.

Whilst other costs remain relatively similar, a positive decrease can be seen in Supplier of Last Resort (SoLR) prices reducing from £61 in Q1 2023 to £19 Q2, meaning that fewer customers were displaced as a result of supplier depletion.

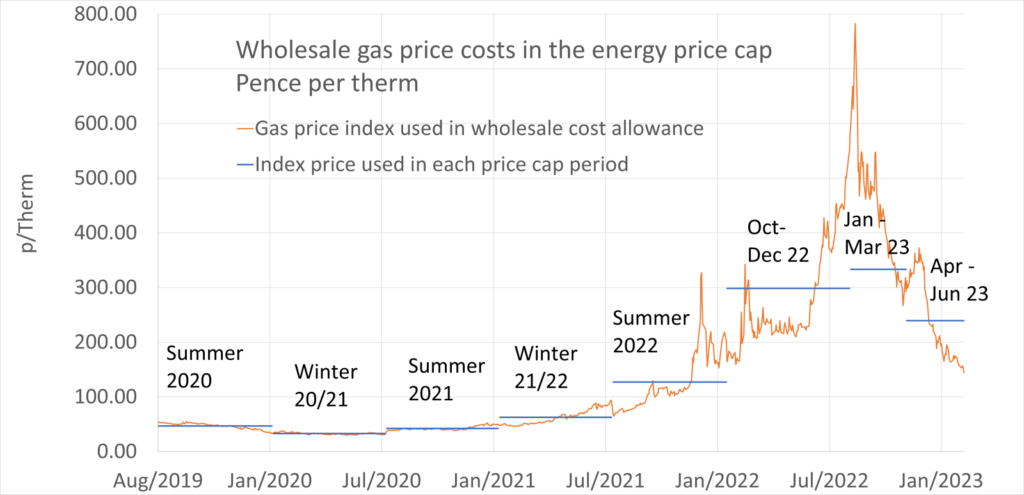

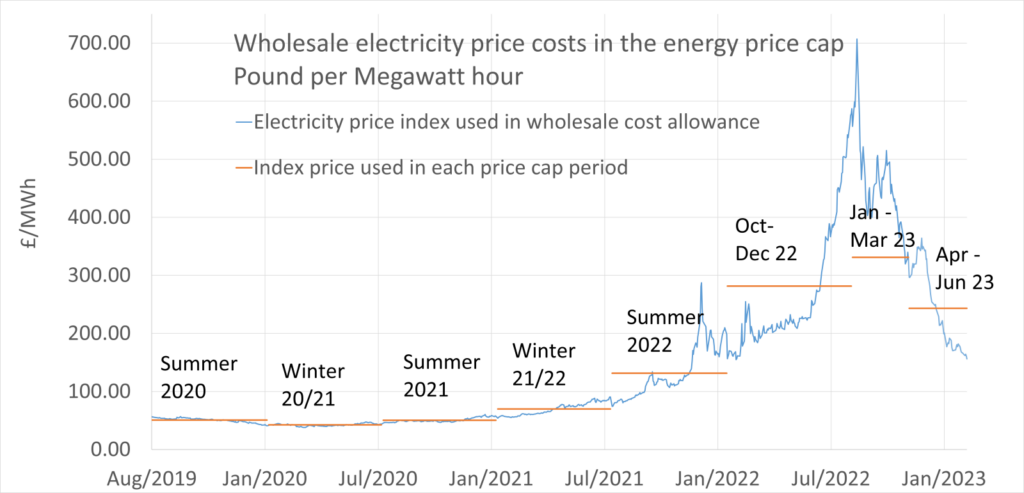

The energy regulator also released the two below charts, showing the indexed wholesale prices from cap period 9b to 10a for gas and electricity.

Wholesale gas price costs in the energy price cap

Wholesale electricity price costs in the energy price cap

The fixed horizontal lines represent the average wholesale cost allowance for each six month price cap period prior to October 2022 when the EPG was launched. These are based on the price of recent forward-looking energy contracts – represented by the jagged line.

The wholesale allowance calculated within the price cap between October 2022 and March 2023, is “not directly comparable” noted Ofgem, as they were made during the transitional period following the energy regulator’s announcement to set the price cap quarterly in August 2022 – this was done from April 2022.

Following today’s announcement the industry has warned of the devastating effects of increasingly expensive bills and called for increased Government support for struggling households.

“With consumers currently shielded from price cap rates by the government’s EPG, it is not the falling cap that households should be concerned with, but the rising rates of the government scheme. If the government goes ahead with its proposed plans to raise the EPG limit from an average £2,500 to £3,000 a year from April, far from falling, typical consumers could see their bills skyrocket by £500,” said Dr Craig Lowrey, principal consultant at Cornwall Insight.

“The government will be saving £2.5bn by raising the EPG, but this will come at a cost to households.

“While the EPG will provide a small saving from today’s announced price cap, the proposed increase in costs will still be difficult for many consumers who were relying on the scheme to safeguard their finances from unpredictable market trends. Instead, they will now be faced with the daunting prospect of having to pay significantly more for their utilities from April.”

“In addition, households will also be losing the £400 Energy Bills Support Scheme (EBSS) payment which has also helped shield them from the immediate impact of rising energy costs on their household budgets.”

“There is some cause for optimism, while the price cap fall may not offer immediate relief for consumers, if wholesale prices continue their downward trajectory, we currently predict that the price cap will fall below the EPG in July. This will provide much-needed relief to struggling households currently waiting to see falling wholesale prices trickle down to their bills.”

In response to pressures caused by rising household bills, a Department for Energy Security and Net Zero spokesperson said: “Government support will continue to help households with their energy bills.

“We know this is a difficult time for families, which is why the Government has covered around half of the typical household’s energy bill this winter, and by the end of June the Energy Price Guarantee will have saved a typical household in Great Britain around £1,000 since it began in October. In the meantime, we’re committed to helping people with rising costs by reducing inflation and growing the economy.”

“The cost of energy has already been falling and we expect this to drop further over the coming months, which we fully expect suppliers to pass onto their customers.”