“The current policy framework is not fit for delivering Review of Electricity Market Arrangements [REMA] objectives,” said Sarah Keay-Bright, market strategy co-manager at National Grid ESO, speaking during last week’s webinar in which the ESO presented its conclusions on investment policy for net zero as part of its Net Zero Market Reform project.

Commencing in 2021, the Net Zero Market Reform project set out to ‘holistically’ examine the changes that need to be made to the current GB electricity market design to achieve next zero.

As part of the project ESO commissioned the consultancy Baringa to support its assessment of current investment policies, in particular the Contracts for Difference (CfD) scheme.

Acknowledging the scheme’s undeniable success so far, especially in light of the energy crisis, Keay-Bright said that it will be necessary to drive forward the required investment for net zero, however the ESO, Keay-Bright continued, has some concerns.

What are the CfD concerns?

Keay-Bright outlined two key reasons that the current CfD market is no longer fit-for-purpose: it disincentivises assets from adding additional system value and it causes wholesale market distortions.

“The current CfD design disincentivised assets from delivering added system value, and has distorting impacts on wider markets. We [ESO] think that can be unsustainable with scaled up investment under the scheme” noted Keay-Bright.

A CfD allows renewable generators to bid for a guaranteed revenue scheme for the duration of the contract. Once the contract is agreed, the counterparty will pay the difference between the agreed fixed strike price decided through auction and a reference price (determined by day ahead prices).

As generators are rewarded based on their metered output, the CfD scheme introduced a negative pricing rule which stops generators producing energy when day ahead prices become negative. This can cause distorted bidding of other Balancing Mechanism (BM) participants as it could incentivise generators to adjust its price to a level which just undercut the subsidised generator.

The cost of this distorted bidding is ultimately paid for by the consumer.

Another difficulty which arises from the negative price rule is the high balancing costs caused by a second order “herding” effect.

This is because all CfD units do exactly the same thing at the same time, which means that if all CfD units drop off the system entirely due to the negative pricing rules, it incurs both operability issues and considerably raises balancing costs.

As an example of this high pricing, Keay-Bright references 28 and 29 December 2022 when the aggregate output of wind generating units was de-synced due to negative prices. In response, ESO had to complete three actions: hold additional response to mitigate expected drop-off; some wind curtailed with significant BM prices; and large volumes of CCGT, coal and biomass turned on through BM to provide ancillary services.

This resulted in the 11th highest costing balancing day in 2022 at £11.9 million.

The second key issue highlighted by Keay-Bright is that despite renewable assets having the capability to provide ancillary services, the CfD design distorts incentives to do so.

For example, both wind and solar technologies are able to provide response, stability and local constraint market/MW Dispatch services. However, the value of the ancillary service must exceed the generator’s strike price.

The ESO believes that the most effective use of these technologies is to allow them to respond to prices in any way that is most valuable to the system at any moment in time.

Suggested reforms

Keay-Bright concluded by outlining a number of ESO-suggested reform options to address distortions caused by the CfD system whilst retaining current benefits.

Retail market reform is inevitable if a net zero market is to be created, however, ESO emphasises that these reforms need to align generator incentives with market signals within operational timescales.

ESO also calls for policy to stimulate demand-side contracting.

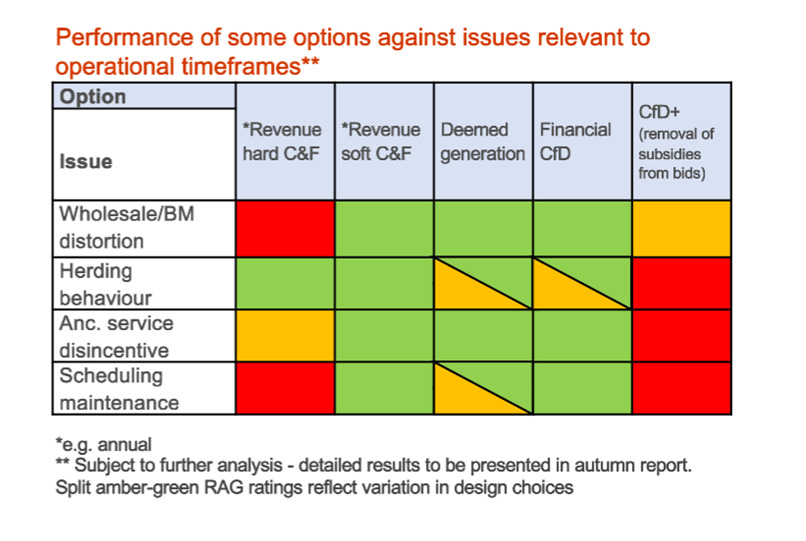

In the table below ESO provided some CfD reform options, noting their verdict on each reform option’s suitability in achieving the desired alterations.

The revenue soft cap and floor option scored highest in ESO’s assessment to address the aforementioned system and, with the right design, the ESO does not believe it would have significant negative impact on investor confidence.

“In summary we believe reform options exist which align generator incentives with market signals within operational timeframes, whilst retaining the benefits of the current CfD scheme to some degree,” said Keay-Bright concluding her presentation.

“We acknowledge that there will be some trade off between cost of capital increase and total system cost reduction.

“With any reform it is import to ensure that no new distortions are introduced and that the new design is aligned with the future wholesale market design.”

ESO’s final Net Zero Market Reform report will be published this autumn.