Good Energy has branded Ecotricity’s potential acquisition as a “highly opportunistic approach” following the latter making three indicative offers for the company.

The final of these offers, which came in at 340 pence per share, was made on 15 June and subsequently rejected by Good Energy’s board.

In a new statement released today (14 July), Will Whitehorn, chair of Good Energy, said: “This is a highly opportunistic approach by a direct competitor to the company which the board believes is not in the best interests of our shareholders, employees or customers. We have a clear strategy, a strong leadership team and a proven track record in delivering on our objectives.”

It echoes comments made in 2017 when Ecotricity’s founder Dale Vince launched a bid to appoint himself to the board of Good Energy as a non-executive director. This presented a “significant conflict of interest”, Good Energy said, making reference to Ecotricity being a competitor.

Vince later cited concerns over corporate governance before dropping the proposals.

Good Energy today said that the indicative offer “materially undervalues” the company and that the premium offered – 10.6% over the price of the company’s shares on 9 July 2021 and 26.6% over the volume weighted average price of the shares over the last 3 months – doesn’t give shareholders “anything approaching an adequate premium for giving up control of the company”.

Good Energy also made reference to what it described as excellent progress in positioning the business to benefit from increased demand for services, with successful implementation of new customer technology platforms for domestic and business customers.

Its domestic customers have been integrated onto Octopus’ Kraken platform as part of a deal announced in October 2019, while its B2B customers have been integrated onto energy software supplier ENSEK’s Ignition platform.

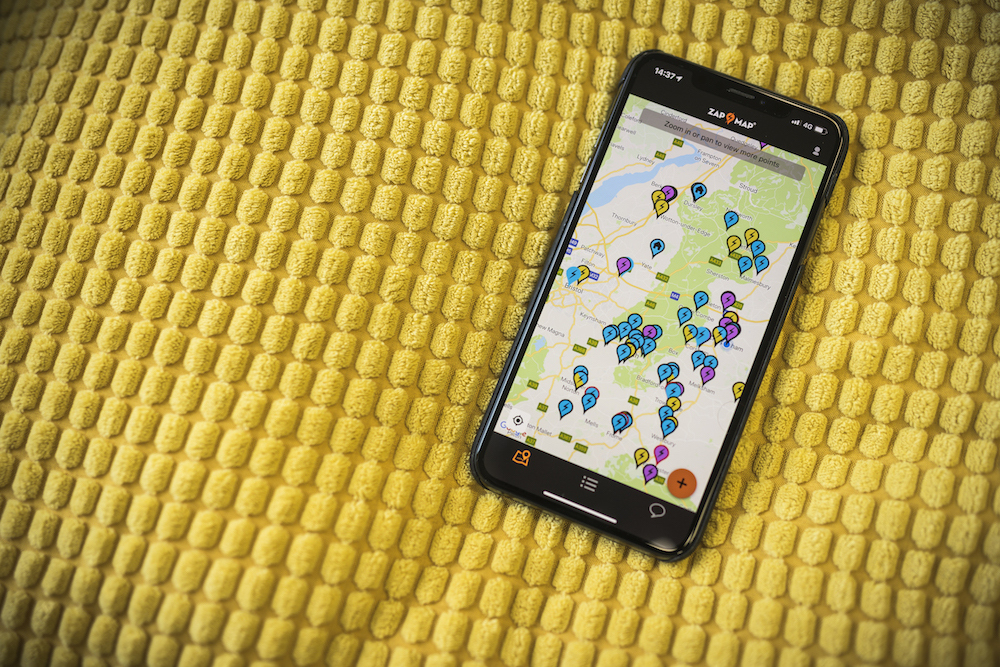

The supplier also lauded its continued investment in the development of energy services propositions and a range of innovation projects, alongside having key partnerships signed and a further investment in Zap-Map committed.

It took a 12.9% stake in the parent company of Zap-Map in March 2019, bumping this stake up to 50.1% in June 2020.

Current± reached out to Ecotricity, however the company declined to comment.