New research from the International Energy Agency (IEA) has found that more than one in five cars sold worldwide in 2024 is expected to be an electric vehicle (EV).

As the planet hurtles towards the end of the decade, increasing electrification and decarbonisation efforts across the transportation sector are expected to boost EV sales. By 2030, China will see EVs making up almost one in three cars on its roads, whereas the US and EU will see nearly one in five.

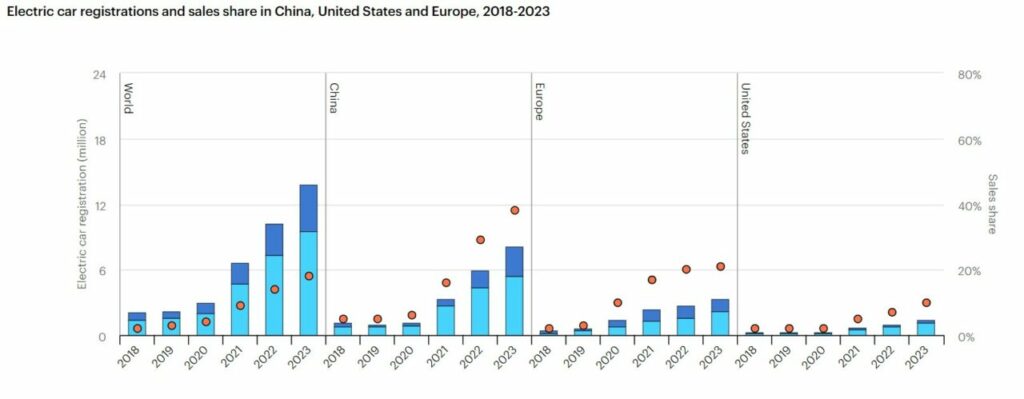

The IEA’s latest Global EV Outlook details that global EV sales are set to reach around 17 million by the end of the year. Growth has already been significant, with sales growing by about 25% in the first quarter compared to the same quarter in 2023.

To illustrate that, the number of EVs sold globally in the first three months of this year was roughly equal to the number sold in all of 2020. And 95% of these sales were in China, Europe and the US.

This research is supported by the Society of Motor Manufacturers and Traders (SMMT), which disclosed in February 2024 that the UK market had surpassed its one-millionth EV. The graph below breaks down the UK’s monthly car sales over the past two years.

EV sales are ‘significantly concentrated’ in a few major markets

Although the sale of EVs continues to increase around the globe, these are still restricted to a few major markets, most noticeably the US, EU and China. In 2023, just under 60% of new EV registrations were in China, just under 25% were registered in Europe, whereas 10% were in the US.

Despite this strong performance across the three major markets, sales of EVs remain limited elsewhere, even in developed automotive markets such as Japan and India. Because of this, the IEA has argued that the global car stock is becoming increasingly concentrated.

In the US, new EV registrations totalled 1.4 million in 2023, representing growth of around 40% year-on-year (YoY). While this represents slower growth than in the preceding two years, the “demand for EVs and absolute growth remain strong”, the IEA argued.

Across the pond in Europe, new EV registrations reached nearly 3.2 million in 2023, increasing by almost 20% YoY. In the EU, sales amounted to 2.4 million, with similar growth rates.

The IEA outlined that, much like China, the high rates of EV sales in Europe suggest that growth “remains robust” as markets mature. Germany, for instance, had a very strong year in EV registrations, becoming the third country, behind the US and China, to record half a million new EV registrations in a single year.

The IEA said EV sales and their sales share increased in the rest of Europe. Around 25% of all cars sold in France and the United Kingdom were electric. The figure is 30% in the Netherlands and 60% in Sweden. In Norway, sales shares increased slightly despite the overall market contracting, but its sales share remains the highest in Europe, at almost 95%.

More affordable EVs are needed to reach mass-market tipping point

Although EV registrations and sales continue to climb globally, the IEA believes that having more affordable EVs could enable the technology to reach a “mass-market tipping point”.

The IEA stated that enabling mass adoption of EVs, both within countries and globally, hinges on the successful launch of affordable EVs – something that continues to plague the industry and adoption rates.

The first major barrier to adoption rates is the total cost of ownership (TCO). According to the IEA’s research, the upfront retail prices for EVs were generally higher than their internal combustion engine (ICE) counterparts, which increased the overall TCO. However, it is worth noting that higher fuel efficiency and lower maintenance costs enabled cost savings for EVs in comparison.

Positives also came from the development of a second-hand market for EVs. The IEA said EV depreciation tends to be much faster than ICEs. This means that modern EVs can be bought cheaper than fossil fuel-powered vehicles, which could support the development of a vast second-hand market for EVs globally.

Although the price of EVs remains high, prices are beginning to decrease due to lower battery prices and intensifying competition. However, they remain, on average, more expensive than ICE equivalents. In some cases, after adjusting for inflation, their price stagnated or even moderately increased between 2018 and 2022, the IEA said.

What next for EVs?

The IEA believes the depreciation valuation of batteries and EVs could be reversed for multiple reasons. Firstly, the IEA believes that consumers are gaining more confidence in electric battery lifetimes, thereby increasing the resale value of EVs.

Alongside this, the strong demand and the positive brand image around many battery electric vehicle (BEV) models could mean that they actually hold their value longer, such as the Tesla models. Alongside this, the rollout of ultra-low emission zones (ULEZ) around cities, such as London, coupled with increasing fuel prices, could mean that ICE vehicles experience faster depreciation rates than EVs.

Global public charging could increase sixfold by 2035

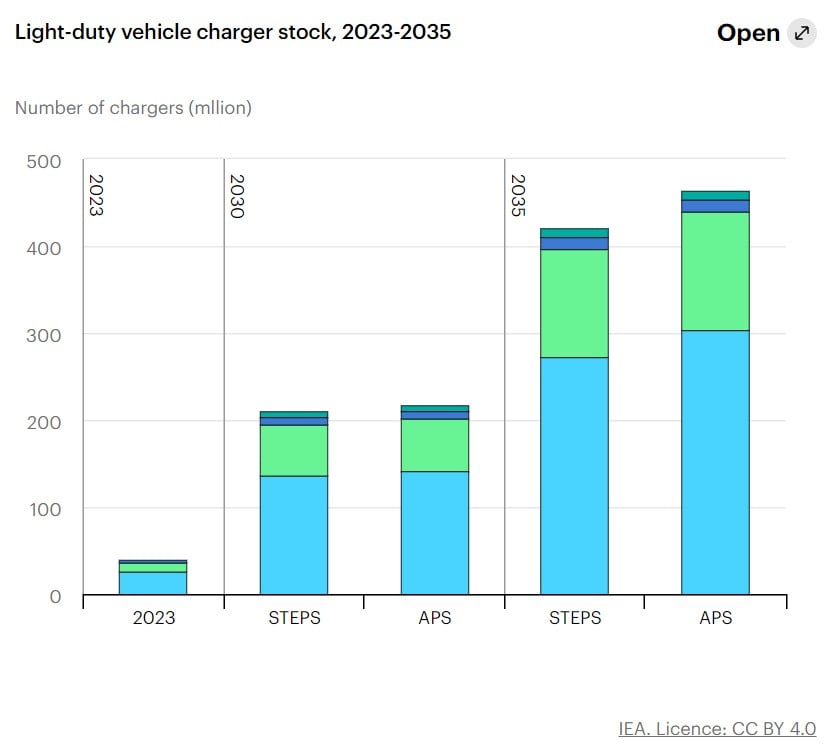

The IEA report also explored trends in public charging infrastructure. According to the organisation’s research, the global number of public chargepoints will exceed 15 million by 2030, a four-fold increase compared to the almost four million operating in 2023. This is according to the Stated Policies Scenario (STEPS) and the Announced Pledges Scenario (APS).

By 2035, this number is expected to reach almost 25 million – six times 2023’s figures.

It is worth noting that the APS scenario assumes all announced ambitions and targets made by governments around the world are met in full and on time. The STEPS scenario reflects existing policies and measures, as well as firm policy ambitions and objectives that governments around the world have legislated.

The Net Zero Emissions by 2050 (NZE) scenario is a normative scenario that sets out a narrow but achievable pathway for the global energy sector to achieve net zero by 2050. It is consistent with limiting the global temperature rise to 1.5°C with no or limited temperature overshoot.

Many early adopters of EVs, particularly in the UK, have done so knowing they have access to home charging. But to ensure the transition and decarbonisation of road transportation maintain its trajectory, the public must have access to suitable chargers to ensure a just transition is pursued.

Interestingly, the IEA’s research has found that most public chargepoints have been installed in urban areas, where utilisation rates are likely to be higher. Although this increases profitability for companies, rural communities are being neglected, which will require a shift to open the EV market to a wider audience.

Policy continues to be a major driver for charging infrastructure and its development. In the UK market, various drivers have been supporting the rollout, which has led to the nation implementing a target of 300,000 public chargers by 2030, higher than the EU’s Alternative Fuels Infrastructure Regulation (AFIR), which has a target of 220,000 by 2030, however, has a wider spread across the EU.

On the other hand, the US market plans to install a network of 500,000 public EV chargepoints by 2030, thanks to a newly announced US$50 million (£40.36 million) project set to subsidise and expand access to convenient charging.

Battery demand to jump tenfold in ten years

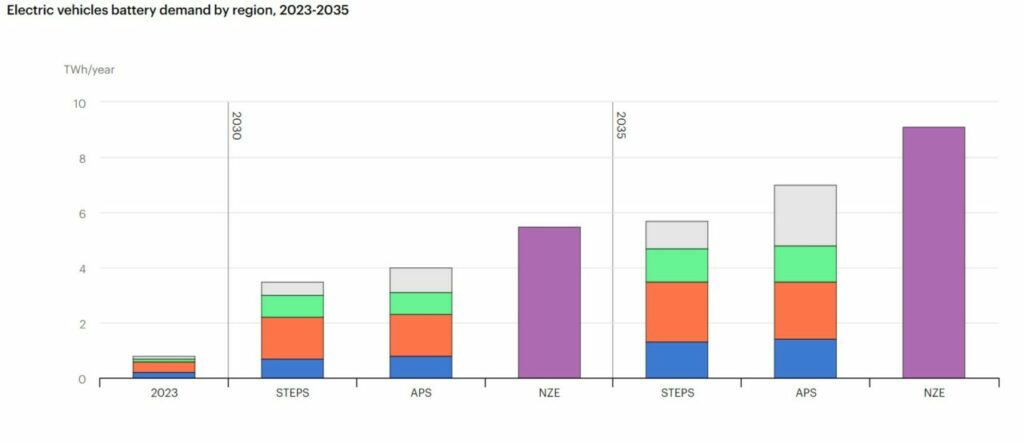

Another crucial aspect of the report centres around battery demand, especially with growing EV adoption and electrification around the globe. Because of this growth, battery demand for EVs is anticipated to grow four-and-a-half times by 2030 and almost seven times by 2035 compared to 2023.

According to the APS and the Net Zero Emissions by 2050 (NZE) scenarios, the demand for EV batteries is expected to grow significantly. For APS, the demand is predicted to increase by five times in 2030 and by seven times in 2035. For NZE, the demand is estimated to multiply by nine times in 2035 and by twelve times in 2035. To put this into perspective, in APS, the demand for EV batteries could be as high in a week in 2035 as the entire year of 2019.

Cars are set to be the main driver of EV battery demand, accounting for around 75% in the APS in 2035, a decrease from the 90% registered in 2023.

As EVs become more popular in new markets, there will be an increased demand for batteries. According to STEPS, China, Europe, and the United States will account for almost 85% of the market in 2030 and just over 80% in 2035, a decrease from the current 90% market share.

In the APS, almost 25% of battery demand will come from markets outside the major ones by 2030. This increase is mainly due to growing demand in India, Southeast Asia, South America, Mexico, and Japan. By 2035, the share of battery demand outside the major markets will increase to 30%.