Cornwall Insight’s latest price cap prediction has shifted only £38 since March 2023, reflecting the UK’s wholesale energy market’s decreased volatility.

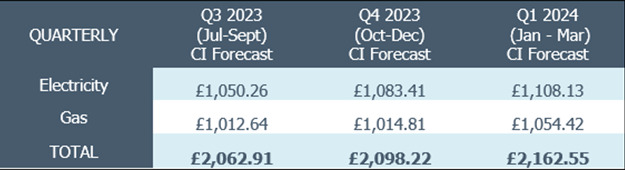

A typical house is now predicted to pay roughly £2,062.91 a year from July (Q3 2023) – up from the organisation’s April prediction of £2,024.58 for the same quarter.

Figure 1: Cornwall Insight’s Default tariff cap forecasts including VAT (dual fuel, direct debit customer, national average figures)

To forecast the price cap Cornwall Insight adopts Ofgem methodology, using current wholesale gas and electricity market prices in conjunction with its assessment of non-wholesale bill components.

As the wholesale market makes up a significant portion of the price cap prediction, Cornwall Insights has said the lesser fluctuations (roughly £100 over the last two months) reflects the decreased volatility of the electricity market.

This is especially apparent when compared to predictions from January to mid-February this year which fluctuated by more than £600.

Cornwall Insight also attributed the stabilisation of the price cap to: higher-than-predicted European storage levels; reduces consumer demand; and a mild winter, all which lowered concerns over supply.

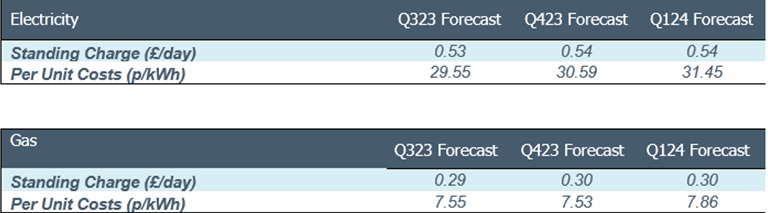

Figure 2: Default Tariff Price cap forecasts, Per Unit Cost and Standing Charge including VAT (dual fuel, direct debit customer, national average figures)

According to the organisation, the cap is expected to remain relatively stable into early 2024 and beyond.

The decreased volatility could prompt energy suppliers to introduced fixed-rate tariffs at a similar rate to the price cap; however Cornwall Insight warned that fixing energy tariffs also carries the risk of leaving customers locked in higher-than-market rates for a fixed duration of time.

Cornwall Insight also noted that despite lowering price caps, the current prediction is still £1,000 more than pre-pandemic rates.

“As the wholesale energy market has levelled out in recent weeks, our predictions for the price cap have followed suit. Some energy suppliers will potentially look to leverage this opportunity to bring back fixed tariffs on or around the price cap, with stable projections lowering concerns they will lose out over the fixed term. This potential re-emergence of competitive tariff propositions presents an opportunity for households to finally get a grip on their energy bills, having been hit hard by the energy crisis. While this seems positive, fixing energy tariffs is a gamble, the market may go down as well as up, and households run the risk of getting locked into bills higher than the price cap,” said Dr Craig Lowrey, principle consultant at Cornwall Insight.

“We are faced with several uncertainties as we look beyond the July price cap, with ongoing consultations on the cap modelling and other legislative changes that could potentially bring significant changes. This leaves our predictions for the end of this year and beyond potentially vulnerable to change.

“What we do know is while energy bills may begin to stabilise, they are still far from returning to pre-2020 levels. While consumers may feel more secure, we must not underestimate the fact that these bills remain unaffordable for many households. The global energy market and our heavy dependence on energy imports still impact bills. Moreover, unforeseen geopolitical events can easily disrupt the wholesale market again. It is crucial that the UK accelerates its journey towards energy self-sufficiency. Only by reducing our reliance on imported energy can we gain the confidence that bills will remain stable in the long term.”