In this guest blog, Tom Smout, senior associate, GB research team, at Aurora Energy Research, discusses the opening of the second Renewable Energy Markets Arrangements (REMA) consultation and weighs the impact of Locational Marginal Pricing.

On Tuesday 12 March, the Department for Energy Security and Net Zero (DESNZ) released the latest instalment in its ongoing consultation into Renewable Energy Markets Arrangements (REMA). The REMA consultation is, or was, one of the most ambitious on record, contemplating radical overhauls to electricity markets, from doing away with the Capacity Market (CM), reinventing the Contracts for Difference (CfD) scheme and splitting the wholesale market for different technologies.

In the end though, DESNZ has chosen caution. The most radical reforms contemplated in REMA have been struck from the list. We are going to maintain the CM, the CfD scheme and a wholesale market based on marginal cost pricing. Notably, one radical change is still on the table: a potential move to Locational Marginal Pricing (LMP).

The proposal of LMP is essentially to split the GB wholesale market into a smaller subset of markets rather than settling a single national price. The government has ruled out the most extreme option, Nodal Pricing (sometimes called “hyper-locational pricing”), but “Zonal Pricing,” where the country will essentially be split into smaller subregions, remains on the table.

Why bother? The benefits of Locational Marginal Pricing

The debate around LMP predates REMA, though it has been galvanised by it. Energy UK has said it doesn’t think the bar has been met to prove the benefits of LMP, while National Grid ESO (ESO) and Ofgem have both produced analyses highlighting those benefits. Our own analysis finds LMP has some benefits, particularly if government ambitions around renewable energy are met, but these could easily be wiped out by a minor loss of investor confidence, and an increased cost of capital.

Counterintuitively, the biggest change being floated to wholesale markets won’t much impact the most important assets for wholesale markets. The assets that will dominate in wholesale in the future will mostly be subsidy-backed renewables. Zones with strong renewable resources will likely see lower prices than the rest of the country, but subsidies will blunt the impact of locational price signals on investment decisions.

If you’ve tried to build a renewable power plant in Britain in the last 10 years, you probably know that price is only one barrier to success. Equally important constraints on renewable deployment today are grid connections and planning. Developers cannot simply look at a map and freely choose an area with attractive capture prices. Rather, they must identify locations that are likely to produce good economics, timely grid connections and minimal planning complaints all at once.

Given our heavy regulatory focus on offshore wind, you do not have the free option to put a turbine anywhere you like off the British coast. Rather, you need to have already leased an area of the sea floor from the Crown Estate, which is not cheap. People who have done this already don’t want to give up on what they’ve paid for, and they’ve overwhelmingly secured seabed off the coast of Scotland.

In the long term, of course, these constraints will relax. The grid will open up, and more of the seabed will be leased to generators, but that doesn’t do much good for a state laser-focused on energy policy for 2035.

At least in the short term, the impact of locational pricing is more likely to be on the dispatch of generation than on its location. The costs of managing our transmission network are estimated to exceed £1bn/year this decade, according to ESO’s 2020/2021 Modelled Constraint Costs.

As an example of how this happens, interconnectors can be dispatched in response to a national price signal, even though the GB network doesn’t have the ability to transmit those imports once they enter the GB system. In response, interconnectors get redispatched in the BM and the lost generation has to be replaced at short notice. Under an LMP system, those assets would never import to begin with because the wholesale price in the zonal market would reflect the saturated nature of the network.

Indeed, there is a set of perverse incentives at play here. Assets aren’t penalised (in wholesale) for contributing to network constraints but can profit from them. We’ve seen SSE fined by Ofgem for exploiting transmission constraints to extract high payments via pumped storage capacity in July 2023, and a recent Bloomberg investigation suggests significant gaming from large wind producers in Scotland.

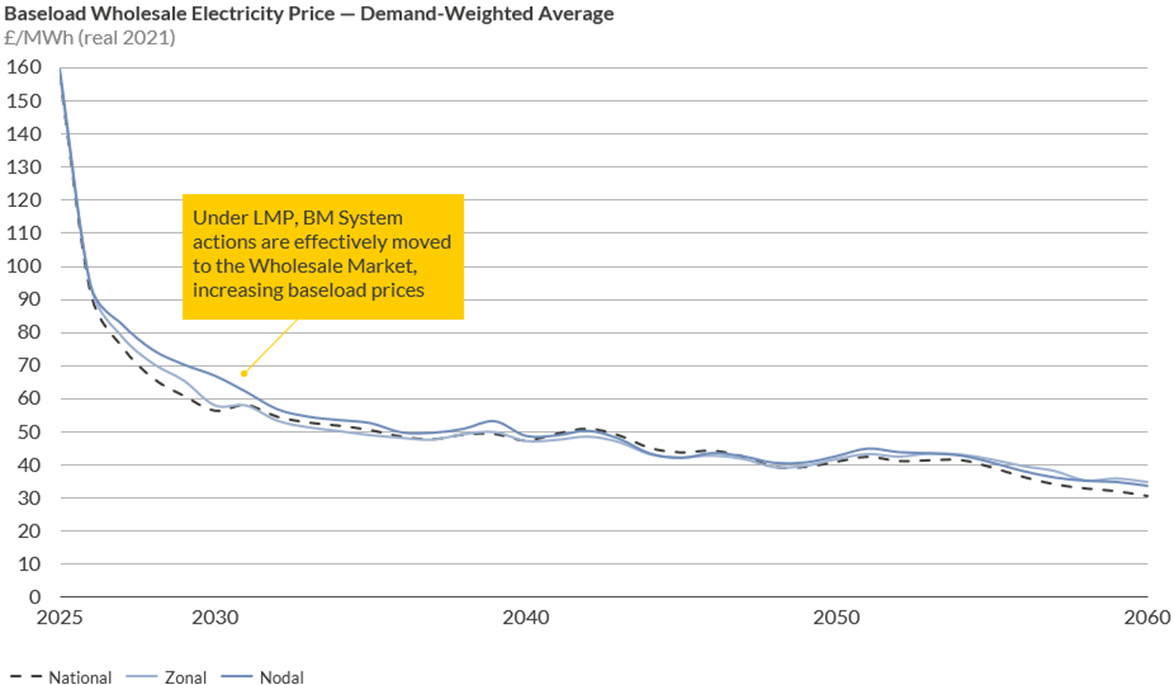

LMP can address these market failures by pushing network-driven redispatch into the wholesale market, creating a single market settlement that accounts for constraints and doesn’t need to be adjusted.

Winners and losers

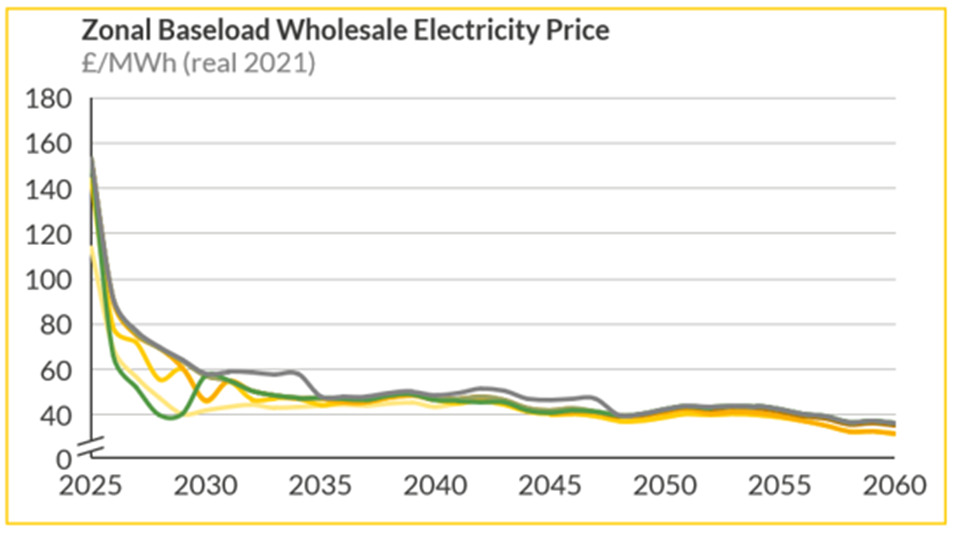

Assuming that zonal pricing does happen, assets in different parts of GB will be exposed to different prices; some will be happier about this than others. Generally, areas with high generation and low demand will have low prices due to oversupply, while places with high demand will face higher costs. In GB, this means that the South of England, where the population is concentrated, will face higher costs, while the North of Scotland will be heavily oversupplied and see extremely low bills. This is not a totally smooth gradient, as there will be variations around the specific zones that are used.

It’s important to note that there is no universally agreed model for zonal pricing. On the simplest level, you could split Scotland off from England, but this is unlikely to be effective as Scotland has two transmission grids, and the connections between them can be heavily constrained.

There is always a trade-off in fragmenting the market. Smaller markets are less liquid and run off enabling local monopolies, but they are also better at reflecting the grid constraints that LMP is supposed to solve. Fewer larger markets will be liquid but fail to capture important network characteristics and leave the heavy lifting to our existing, inefficient mechanisms.

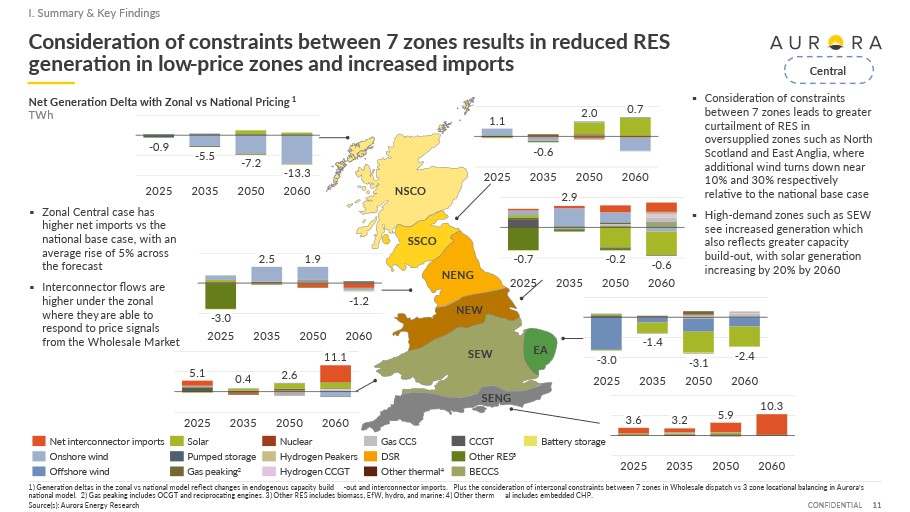

In our analysis, we assume that GB is split into seven zones, each roughly the size of the Integrated Single Electricity Market (ISEM). This promises reasonably liquid wholesale markets while also capturing the key network constraints. It is unlikely that DESNZ will propose this exact design or that the design will remain completely constant over time (zones will have to be redrawn as boundaries shift). Nevertheless, we believe that this is as good a place as any to start.

In terms of generation, LMP leads to reduced renewable generation, as renewables are built in areas that have plentiful renewable resources and a low population. Although Scotland is often discussed as the beneficiary of LMP, East Anglia sees lower wholesale prices than anywhere in Scotland, at least in the 2020s. This is thanks to plentiful offshore wind, some nuclear and limited grid reinforcement. The highest-price zone is actually not the zone that contains London (SEW) but the South Coast (SENG). This is because SENG contains most of the interconnector capacity, a good chunk of the population and limited wind capacity.

It is also worth noting that while Scotland generally does exhibit low prices, the different zones within Scotland are not the same. North Scotland contains more generation than South Scotland, despite the south of the country containing most of the population.

Overall, wholesale prices can be expected to increase under LMP, as the costs of balancing are met in the wholesale market, but the avoided costs of balancing actions under the old system more than offset this overall.

Conclusions

The impact of LMP is hard to evaluate. It is a small but meaningful improvement to market efficiency and an attempt to address a status quo that isn’t working. Efforts to date haven’t, and probably can’t, resolve the issues around our increasingly overloaded transmission network, so I find the alternative measures around reforming the Transmission Network Use of System (TNUoS) and the BM considered in REMA to be unconvincing.

Ultimately, there is no magic fix to network constraints, which are ultimately caused by the physical state of the transmission network and the distance between population centres and high-wind regions. With the right implementation, LMP can be a step in the right direction, but only as part of a wider, more complex transition.