A cost benefit assessment of locational pricing systems in Britain has found that implementing a nodal pricing system could deliver up to £51 billion in consumer savings, but benefits face regional disparities.

In the framework of the Review of Electricity Market Arrangements (REMA) – which published its consultation summary in March this year – Ofgem commissioned management consultancy, FTI Consulting and Energy Systems Catapult to assess the cost benefits of a more locational energy market in Britain.

The assessment compared the national system (currently implemented) with a zonal and nodal system.

Nodal pricing determines market energy prices by locations on the transmission grid (called nodes), whereas a zonal market forms its pricing system at a much more macro level within a defined zone or region.

For the assessment the zonal pricing structure split Britain’s market into seven zones with individual prices whilst the nodal system split the market into roughly 850 “nodes” with individual prices.

Three different scenarios were examined within the study: leading the way (NOA7) where the majority of fossil fuels are phased out by 2035; leading the way (Holistic Network Design) where greater transmission capacity allows more demand to be met through wind generation; and system transformation (SysTr) a slower net zero transition with lower wind and solar generation.

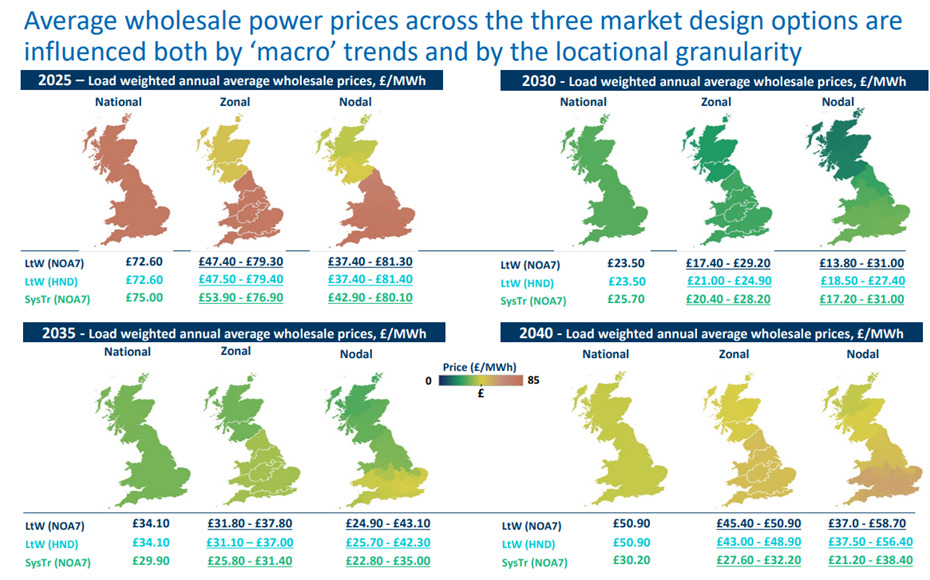

Lower average wholesale prices

The study found that consumer benefits modelled in a nodal market modelled between 2025 and 2040 would range from £28 billion and £51 billion. A zonal market over the same period would deliver benefits between £15 billion and £31 billion.

A locational pricing system widens the range of energy as the wholesale price reflects the Tx congestions and losses (for a nodal structure) continued the report as shown below.

The report found that a system with more integrated renewables (LtW NOA4 and HND) usually present a greater price spread due to the broader technology mix, higher demand and two-way assets (interconnectors and batteries).

By 2025, the assessment estimated that under a nodal market design Scottish wholesale prices would drop below Norwegian and Spanish prices due to it’s high wind capacity, while prices in the rest of Britain remain similar to its Western Europe counterparts.

These benefits increase in the long-term outlook to 2040 as more efficiency and dispatch under a nodal market means that Scottish, Northern English and Northern Welsh wholesale prices would be amongst the cheapest in Europe, whilst South England and Wales would enjoy prices lower than in France or Germany.

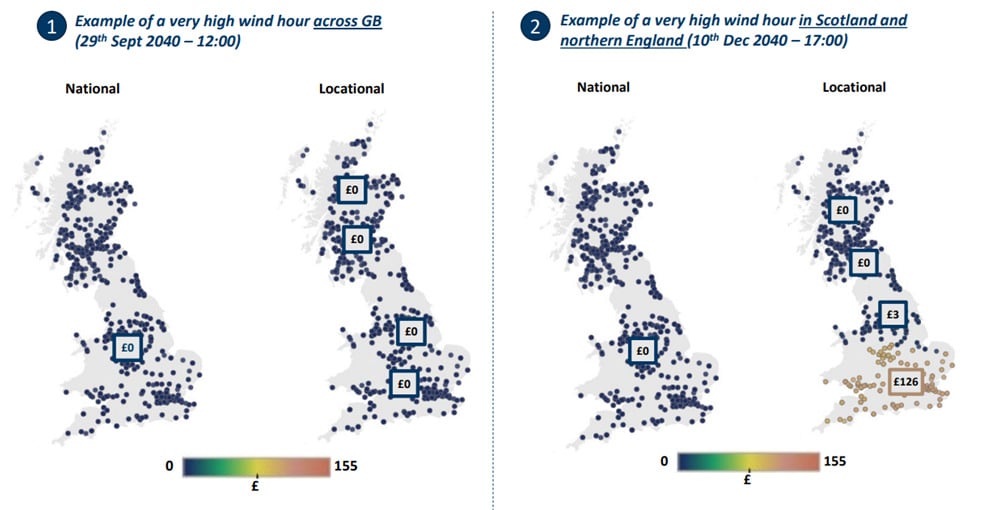

Regional pricing disparities

Despite the benefits of lower average prices in Britain, the disparity of renewable energy generation sites throughout the nation would see some customers paying more for their energy due to where they live as shown below:

In the above scenario, customers in Scotland enjoy low energy prices due to a high concentration of wind generation in their area whilst customers living in the South of Scotland incur much higher costs – presenting a major disparity in energy prices throughout the nation.

The justness of this system is something that has been called to question by a number of industry players.

An independent review based on research by the University of Strathclyde warned of the potential for a “postcode lottery” caused by locational pricing and urged caution before rushing into major wholesale market reform.

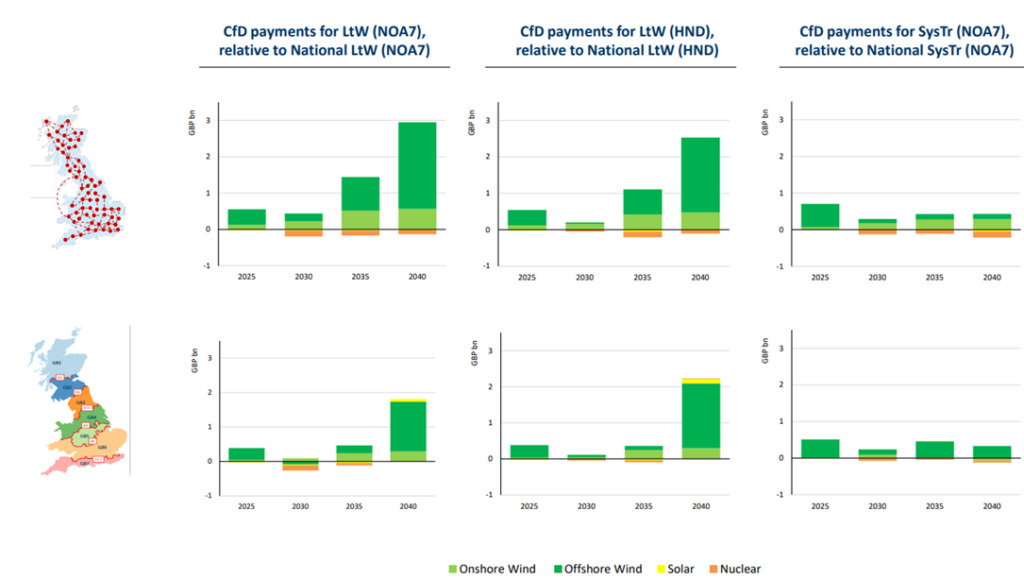

The impact on CfDs

The study went on to asses the effect that locational pricing would have on the UK’s Contracts for Difference (CfD) scheme.

One of the most significant concerns of a locational pricing system in the UK is its effect on low carbon support mechanisms such as the CfD scheme, with worries that the current CfD framework – which doesn’t grant generators top-ups if the reference price is negative – combined with a locational pricing system could “erode the revenue-security that CfDs provide” according to a briefing note co-published by Scottish Futures Trust.

Undertaking some assumption regarding evolution of CfD capacity and future CfD regime design, the assessment found that under a nodal market total CfD support payments would increase relative to a national market across 2025-2040.

The largest increase was found under a zonal market in a LtW NOA7 scenario.

The price of implementation

By examining locational pricing implementation costs through international case studies, the assessment also revealed a price estimation for Britain.

In total, the report estimated that implementation a locational pricing market would incur costs of around £500 million across National Grid ESO and other market participants.

“A final point to note, is that, contrary to perceptions of some, both zonal and nodal pricing electricity markets are commonplace across the globe. We estimate that in 2020, c.60% generation capacity in the liberalised electricity markets of the OECD operated in either a zonal or nodal pricing market (see our annex in the attached presentation),” said Jason Mann, senior managing director at FTI Consulting in a LinkedIn post.

“We understand that views on this issue are inevitably polarised. Nonetheless, we hope we have been transparent and respectful of stakeholder views as we have undertaken the assessment and that there is clarity in the results we have presented.”