Current± – along with its sister site Energy-Storage.news – is at Solar Media’s Energy Storage Summit 2023, finding out about the investment opportunities for storage, the growing flexibility markets, how storage can help tackle grid connection constraints and much more.

Follow the biggest news and best comments from the summit, in our rolling coverage here.

‘Energy storage is fundamental to a high renewables power system’

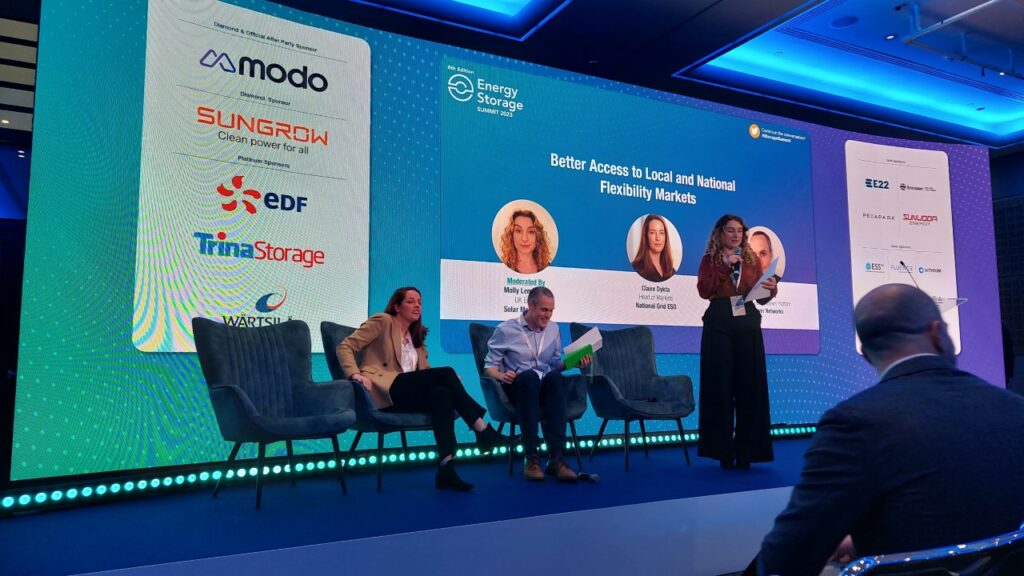

“There is a clear signal being put out that storage is fundamental to a high renewables power system,” said head of markets at National Grid ESO, Claire Dykta, speaking on the Local and National Flexibility Markets panel at this year’s at Solar Media’s Energy Storage Summit 2023.

Dykta pointed out that the energy market has shifted massively compared to when ESO released its Enhanced Frequency Response (EFR) scheme in 2018.

“If you look at the flexibility that is being provided by storage in the balancing and wholesale markets and what you can infer is happening via distribution or behind the meter, you’re probably equal to a combined cycle gas turbine plant, so there is enough there to be equivalent to a flexible fossil fuel plant,” said Dykta.

Although that the UK’s energy market is much more sophisticated in terms of optimisation across different revenue streams, market structure reforms will still be required to ensure a smooth transition to a wholly renewable system.

Fellow panellist, Alex Howard, manager – DSO market platform at UK Power Networks (UKPN) highlighted long-term clarity for system operators alongside standardisation as two major consideration for the a flexible market.

“Storage investors are making decisions at various points so I think that long term clarity across system operators, so that UKPN is speaking the same language as ESO, so it’s clear what the rules are and how these things combine,” said Howard.

“Linked to that, I think one of the big challenges will be around standardisation, trying to innovate and solve new problems quickly and sometimes it’s difficult to reconcile that with what we want to develop in a situation where everyone is using the same solutions and platforms. So that is going to be one of our big challenges, which will hopefully make it easier for storage to continue growing.”

Dykta added the additional consideration of longer duration storage is likely to have a different feel to the system at a transmission level.

“For longer duration storage, our studies have shown that as you get into a system with consistently high renewable generation, we’re likely to have a very different feel to the system. A stress event is likely to be less frequent but more prolonged and that’s where long duration storage will really come into play,” she said.

Despite these transitional issues, the panel was in agreement that storage will play a significant role in the future of flexibility in the UK’s energy market.

Dykta concluded: “We published just before Christmas a report of power system adequacy in the 2030s and the high level conclusion of that is that it is perfectly possible to run a zero carbon power system and still meet demand and secure supplier obligations”

UK battery energy storage market is ahead of most EU countries

“The UK battery energy storage market is ahead of most European markets in terms of what has already been installed, but it is running into challenges such as grid connectivity,” said Julian Jansen, senior director of Fluence, at Solar Media’s Energy Storage Summit.

Grid connectivity has become a crucial discussion point within the energy storage sector, with many in the industry seeing delays into the 2030s for a connection, presenting a significant challenge.

Despite this, the UK still retains a strong market potential for investors and developers. The market potential amongst Europe is spread across the continent, but Daniel Connor, head of flexibility and storage, power markets EMEA, Lightsource bp, believes one country could become a hotspot for battery energy storage.

“I think Europe is the market of the future – there are opportunities everywhere. But everyone’s talking about the Spanish market because of a subsidy which grants up to 40% of your capex for a co-located storage project,” he said.

A key aspect of this market is the country’s high solar potential. Pablo Otin, CEO and co-founder of Powertis said: “Spain has 45GW of solar approved by the government. In the middle of summer there is a lot of solar generation and as a result, a lot of curtailment. Battery energy storage and long-duration storage could capture this and save it for the future.”

For this, co-location could be a suitable technology and could support the energy transition in the nation. This grants an opportunity for developers and investors to seize this market opportunity.

Taking place now in Stream 1 ‘UK Market: Building Flexibility to Improve Connections’ with @MollyLempriere, Marek Kubik @fluenceenergy, Alex Howard @UKPowerNetworks, Dr. Avinash Aithal @energynetworks, Nicola Waters #Electron, Dr. Andrew Crossland #RenewcoPower #StorageSummit pic.twitter.com/eyo1QJspft

— Solar Energy Events (@_SolarEnergy) February 22, 2023

Installed UK battery energy storage capacity to double to around 4GW in 2023

“The UK’s installed battery energy storage capacity is set to double in 2023 to around 4GW,” Quentin Draper-Scrimshire, CEO of Modo, told Energy Storage Summit 2023.

The UK’s battery energy storage industry is continuing to grow, with the same amount of capacity set to be installed in 2023 as was in the previous eight years according to Draper-Scrimshire.

He continued to point to the record high number of storage projects, which were awarded contracts within the T-4 Capacity Market auction this week too, with 1.29GW winning contracts. This was up from just over 1GW last year, itself a 800MW jump from the previous year.

Companies that had already anticipated the growth of the battery storage market had witnessed significant growth in revenue as a result. “The Modo Benchmark shows that in 2022, the average revenue stood at £155,000/MW. This took us by surprise with 2020 having stood at £65,000/MW,” Draper-Scrimshire said.

Despite this, Draper-Scrimshire highlighted what is expected to be one of the key developments for battery energy storage in 2023: grid connectivity.

Grid connections are an obstacle for the overarching energy grid in the UK with many renewable projects attempting to connect. However, delays have had a severe impact on the rollout of the renewable projects and battery projects could be affected.

Quentin Draper-Scrimshire

— Solar Energy Events (@_SolarEnergy) February 22, 2023

Co-Founder & CEO @ModoEnergy now takes the stage to discuss ‘The State of GB BESS’ #storagesummit pic.twitter.com/ODSxfIc3wz

‘Incredibly exciting time’: Alexa Capital’s Reid sets stage for surging storage

“Energy storage is critical to humankind,” said Gerard Reid, co-founder and partner at Alexa Capital in his keynote opening address at the Energy Storage Summit 2023.

From fridges to pumped hydro, “what has differentiated man, is our ability to use energy”, he continued in The Energy Storage Revolution. Going forwards, this is firmly switching from our ability to use fossil fuels – for example, the large amounts of gas storage European countries have – as the future will all be about storing electricity as effectively as possible.

With Germany targeting 215GW of solar by 2030, but only having 80GW of demand, for example, “there’s going to be massive opportunity” in the space for batteries.

Combined with this surging demand for storage to balance demand and intermittent generation, the cost of battery energy storage is continuing to fall. For lithium-ion for example – with Reid noting that “lithium-ion is the king of batteries” currently – we can expect prices for battery packs to hit US$100kWh by 2026, before falling further to just US$62/kWh by 2035.

Those operating battery assets will have to increasingly become traders as the market switches to be dominated by merchant, in response to the flexibility of the system.

Reid ended the keynote, the first session of the two-day conference in London, by reiterating that “it is incredibly exciting for all of us” in the storage space, with growth seemingly guaranteed in the years to come.

UK needs to ‘work hard’ to attract extra capital for long-duration energy storage

“The investment case is currently not there for the UK, it needs to work hard so we can invest extra capital,” said Sonia Quiterio, new business director – development at Conrad Energy.

With additional investment, technologies other than lithium-ion batteries could be explored for both short and long-duration storage. For Quiterio, there is a need to create an investment case to see if they are applicable to certain geographies and markets, and to identify the risks associated with certain technologies.

“We need to study the market and what it will look like and build an investment case. When we know what it will look like, we then fit the technology in. But we as an investor need to see the correct signals in the market to deploy that technology,” she said.

The correct market signals could be on the horizon with the UK Government providing over £32 million to five energy storage projects across the nation to support the development of new technologies such as thermal batteries and liquid flow batteries in November.

By placing focus on the technology, this will increase investor confidence and could lead to additional capital being allocated to the UK market.