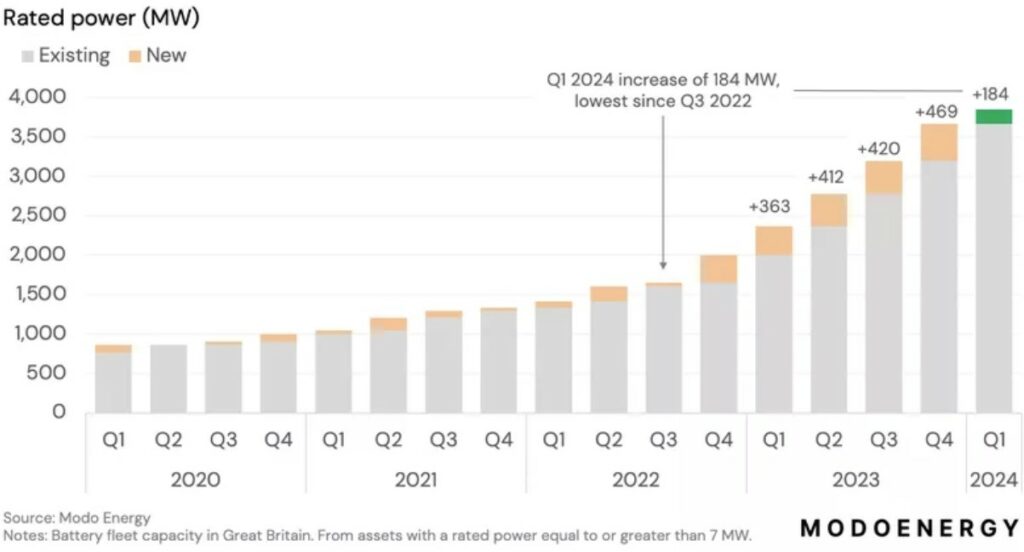

Market analytics platform Modo Energy has indicated that Q1 2024 saw the lowest battery energy storage capacity installed since 2022.

According to Modo’s latest statistics, six new battery energy storage systems (BESS) with a total capacity of 184MW, each ranging from 19MW to 50MW, have commenced commercial operation.

As a result, the overall battery energy storage capacity in Great Britain has reached 3.9GW with an energy capacity of 4.9GWh at the end of the quarter.

In Q1, 184MW was added, the lowest capacity installed in the GB market since Q3 2022.

It is worth noting that the battery energy storage market has been plagued with numerous issues in 2024, most notably impacting revenue for various asset management firms such as Gresham House Energy Storage Fund and Harmony Energy Income Trust.

One of the biggest drivers of low revenue was the implementation issues of National Grid ESO’s Open Balancing Platform, an issue that Modo Energy had previously referenced in contributing to December having the lowest BESS revenues since 2020.

2023 saw record-breaking new capacity begin commercial operation – 1.7GW came online at an average of 416 MW per quarter, meaning the 184MW that started operations in Q1 2024 was less than half of this. This highlights the stagnation witnessed in the British BESS market.

You can find a breakdown of the average quarterly installed BESS capacity below.

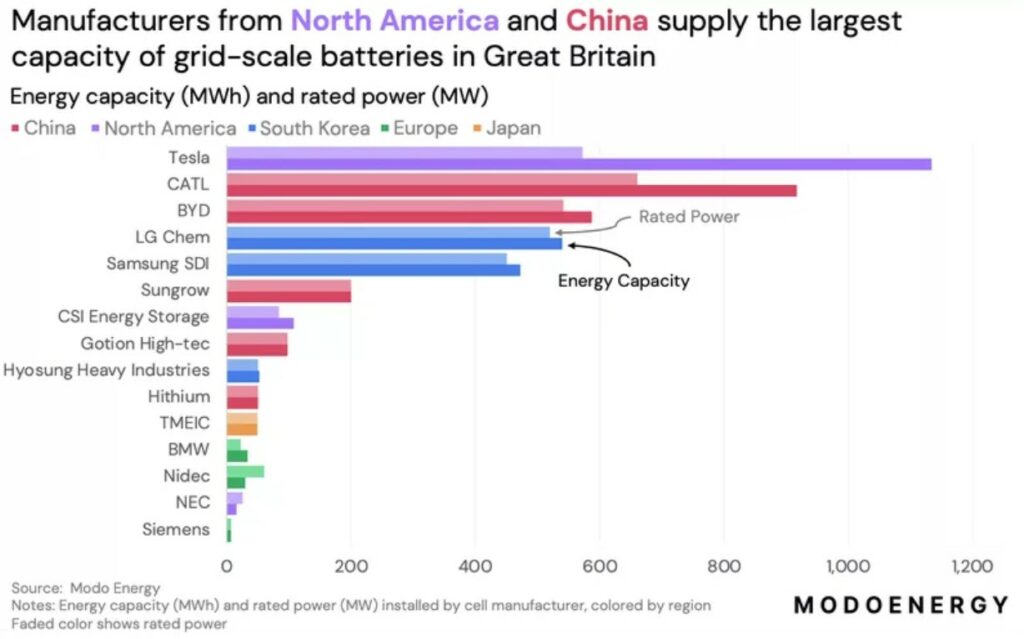

Tesla dominates GB battery cell manufacturing market

Modo also revealed that technology giant Tesla has provided the largest proportion of total energy capacity installed in GB at 1.1GWh.

Chinese manufacturers BYD, CATL, and Sungrow have also provided an additional 1.7GWh.

Tesla and CATL have supplied cells for the most battery units (32) and the largest capacity (2GWh) since 2022, twice as much as all other manufacturers combined. The two companies have also manufactured over 90% of two-hour batteries installed in Great Britain.

Tesla, CATL, and BYD are the three largest manufacturers of battery cells installed in systems in GB. Tesla (1150MWh) accounts for 90% of the market share from companies based in North America.

Meanwhile, CATL (920MWh) is the primary manufacturer of battery cells in China, comprising 55% of the region’s battery capacity. BYD (590MWh) supplies the most individual battery units.

South Korean manufacturers LG Chem and Samsung SDI were among the first to enter the British market, supplying 500MWh of installed capacity each.