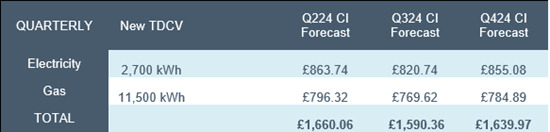

Cornwall Insight’s latest Default Tariff Cap (price cap) predictions see a 14% fall to £1,660 per annum for the period between 1 April and 30 June 2024.

This means that a typical dual fuel household paying by direct debit would pay £268 less than the Q1 price cap which was set by Ofgem at £1,928.

The market researcher cautiously heralded more good news, predicting that this downward trend would continue into 2024, falling to a low of £1,590 in Q3 before a slight increase to £1,639 in the following quarter.

Figure 1: Cornwall Insight’s Default Tariff Cap forecasts (dual fuel, direct debit customer)

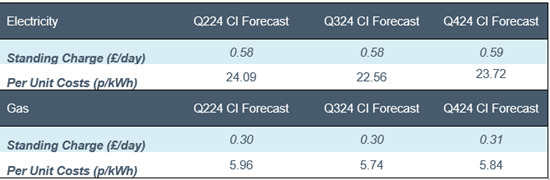

Figure 2: Default Tariff Cap forecasts, Per Unit Costs and Standing Charge (dual fuel, direct debit customer)

Cornwall Insight attributed this decline to a number of factors, including a welcome decline in energy wholesale prices. Initial concerns for the wholesale energy market such as the Israel-Hamas conflict and LNG strikes in Australia, have not yet impacted energy supplies – continued market researcher – meaning that wholesale energy prices are, as yet, unaffected.

A mild winter was another contributor to lower energy prices, leaving gas-in-story levels higher than initially predicted.

Dr Craig Lowrey, principal consultant at Cornwall Insight said that the falling cap predictions “may offer a small light at the end of the tunnel” for UK households, as the stabilisation of international energy markets “trickles down” to 2024 price cap predictions.

However, Lowrey warns that the wholesale energy market can be volatile – as highlighted by the energy crisis experienced over the past year – with Russia’s invasion of Ukraine and the Gaza conflict highlighting the susceptibility of UK energy prices to international events.

Lowrey highlighted that disruption to shipping to the Red Sea is already raising concerns over disruptions to supplies, “whether concerns in the Red Sea become heightened, or another potential disruption to supply occurs, there are no guarantees the price cap will not rise again,” he continued.

“The current scarcity of fixed deals lower than the cap further complicates the situation. With few affordable alternatives, households are left at the mercy of market fluctuations,” Lowrey added.

“Ultimately, waiting and hoping that we will avoid another global incident that sends energy prices climbing is not a sustainable strategy for the government. To achieve substantial reductions below pre-crisis levels, we must focus on long-term strategies which increase domestic renewable energy sources and reduce our reliance on volatile imports.”

Hints at a higher price cap for Q2 have preceded Cornwall Insight’s latest prediction as Ofgem recement proposed a one-off price cap adjustment for Q2 of £16 to protect consumers from the growing risk of procuring debt that they are unlikely to be able to repay.