Across Europe, the electricity transmission grid will not keep up with the energy transition unless grid planning rules and the mandates of TSOs and regulators are updated.

That is according to analysis of 32 electricity transmission system operators (TSOs) carried out by Beyond Fossil Fuels, E3G, Ember and the Institute for Energy Economics and Financial Analysis (IEEFA).

In a report published today, the organisations found that many TSOs are still using outdated scenarios rooted in old government targets and market assumptions, which act as a “systemic handbrake” on building a flexible grid capable of absorbing increasingly high shares of renewables.

The report, called ‘How Europe’s grid operators are preparing for the energy transition’ warns that without change, Europe risks a “self-fulfilling prophecy” whereby fossil gas appears necessary simply because grid planners have never planned for a system without it.

The report’s authors call for more robust governance and oversight from governments and regulators, to ensure that grid planning, operations and investments are fit-for-purpose.

Grid connections and cross-border transmission

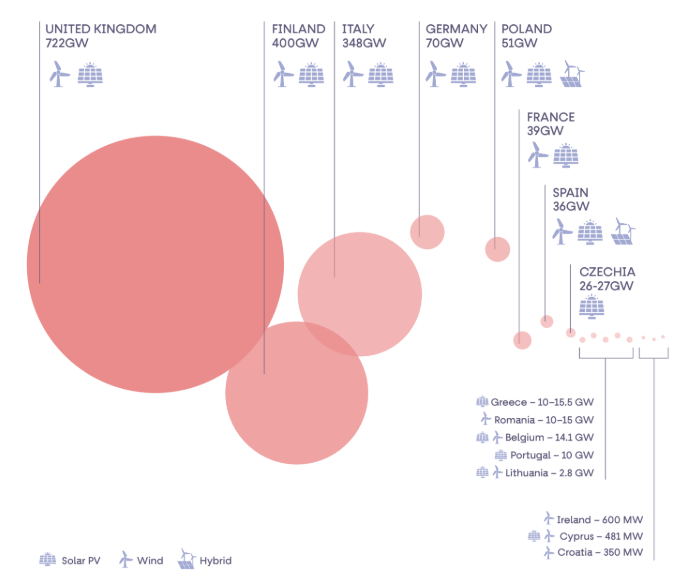

The report calculates that 1,700GW of renewable energy projects across 16 countries are waiting for a grid connection—in a grid connection queue. In the UK, the energy regulator Ofgem estimates that projects face average waiting times of 5.5 years between the requested date and the offer.

Over £200 billion worth of projects are in the UK’s connection queue, which, in some instances, lasts up to 15 years. Unclogging the queue, the report says, “unleashes” renewable energy and supports investment in the energy sector.

In April, Ofgem officially approved plans put forward by the UK National Energy System Operator (NESO) to reduce the queue and change the entry process moving forward. These changes are expected to begin implementation this year.

The report notes that, like the UK, France and the Netherlands are looking to change the connection process, which currently operates under a ‘first come, first served’ approach like most European nations.

High levels of curtailment of renewable energy, the report states, also demonstrates the need for investment in clean flexibility and improved grid balancing, with a need to mainstream demand side response, and rapidly build out energy storage.

The report authors’ key recommendation for reducing curtailment costs accrued due to the grid’s inability to handle renewable energy generation is to build cross-border transmission.

Building more interconnectors across the channel from the UK is a key alternative provided in the argument against establishing a zonal pricing system in the UK’s electricity market.

Unbundling transmission ownership

The report notes that the UK’s establishment of NESO shows good practice in ensuring planning is undertaken separately from the TSO National Grid.

EU regulation requires “unbundling” because if a single company operates a transmission network and generates or sells energy simultaneously, it may have an incentive to obstruct competitors’ access to infrastructure.

The report found that 10 of the 34 TSOs surveyed operate under the minimum form of unbundling, which means the TSO is still part of a portfolio of companies involved in generating or selling electricity.

It states that the UK has shown it is possible to go beyond the EU minimum mandate by forming a public body to undertake whole-system planning.

Recommendations for a renewables-ready transmission network

The report’s authors make three key recommendations for solving these issues. The first suggestion is that governments revise the legal mandates of regulators and TSOs to ensure consistency with climate targets, ensuring that TSOs’ plans support the build-out of a renewables-based power system.

Governments should also increase oversight and governance by establishing fully independent bodies to undertake grid planning, as in the UK.

It also recommends that TSOs employ best practices to support the integration of renewables and energy storage projects, working with governments to improve connection processes and to incentivise and enable demand flexibility.