Used electric vehicle (EV) batteries could soon be on the market at a significantly reduced cost that competes with brand new energy storage systems, according to a Bloomberg New Energy Finance (BNEF) report.

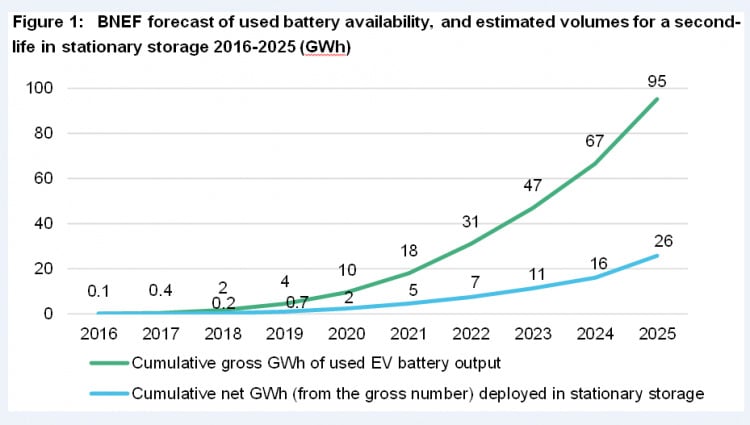

The research note forecasts that a total of 95GWh of batteries will come out of cars between now and 2025, taking into account the age of vehicles, how many will come off the road, the expected number of car crashes and battery failures.

Claire Curry, senior associate, advanced transportation, BNEF, who compiled the report, told Energy Storage News that this capacity is “massive”, although not all of it will be warrantied for second life or have the right quality and packaging.

In 2025 alone, 29GWh of batteries will come out of cars and a third of this (10GWh) will be repurposed as stationery storage. Curry said this translates to 26GWh suitable for storage over the next nine years.

The stationery storage application is particularly important for EV companies as lithium-ion batteries cannot be landfilled, said Curry. There are three current applications for used batteries: recycling, reuse for stationery storage or re-manufacturing for vehicles.

Recycling

The first option of recycling is expensive because commodity prices are fairly low at present. Furthermore, recycling a huge EV battery is expensive and it is also difficult to find companies that offer this service.

Curry said: “There’s probably a handful of recycling facilities in the whole world that would accept an EV battery.

“In the next couple of years before 2020 there will be a real problem because you are going to have a lot of EVs coming in off the [road]. The dealership or the car company or scrap yards need to be doing something with them.”

Curry expects the recycling industry to pick up, however, at present consumers have to pay companies to recycle the battery becasue it is deemed as waste. The recycler would gain some value from the cobalt, but it would not be enough to cover the cost of recycling.

Curry added: “If commodity prices go back to where they were five years ago, suddenly recycling is super profitable and that’s great, but we don’t know if that will happen.”

Second life

Repurposing EV batteries for a second life as stationery storage requires very little work and today costs around US$100, said Curry. This will drop to about half that cost in the next couple of years to as little as $49/kWh in 2018, once economies of scale take effect.

This means used batteries can be on the market for around half the price of new, first-life batteries on the market today, Curry said.

However, right now there are less than ten demonstration projects ongoing, run by Nissan in Japan, BMW in California, Daimler in Germany, Renault in the UK, Mitsubishi in France, but they span the whole range of scales from utility to residential and commercial and industrial.

While all three markets are viable, Curry said: “Residential makes sense because it is a product that competes with Tesla.”

This is also a reason why Tesla is not getting involved in the second life market, preferring to focus on recycling their batteries in-house to recover the precious metals to be used in brand new Tesla batteries, added Curry. Nissan on the other hand is looking at creating value for the used battery, which could become worth US$8,000 on its own and help to push up the overall value of the company’s second-hand electric vehicles.

Curry also said that utility-scale customers tend to want a very reliable warrantied long-life battery and they do not mind paying a large capex upfront, so it is not entirely clear how big that segement will be for second hand batteries.