The prowess of the UK’s offshore wind sector and how it has helped shape global developments, particularly with the international acclaim the nation’s work in the North Sea continues to gain, cannot be understated.

Although many may look to the East coast of the UK to observe the renewable powerhouse being developed in the North Sea, another market is beginning to mature to the West in the Celtic Sea. This market is gaining increasing interest from multiple parties.

Current± has reported on several developments in the past year showcasing the growing interest in the region. One of which was a report released by centre of energy expertise Regen.

The conveniently named Go West! report was released in October 2022 in partnership with Magnora Offshore Wind, Morwind, Northland Power and Simply Blue Group. Inside, the organisation outlined how the development of West Coast wind farms would reduce the volatility of energy generation, providing additional benefits for system operation.

Developing offshore wind in the Celtic Sea could also level up infrastructure and communities adjacent to the Celtic Sea and North and West Scotland. This is a crucial aspect to consider, given that it could help scale clean energy jobs in areas such as the South West of England and Wales.

Touching on this topic, the University of Plymouth, which is home to the UK Floating Offshore Wind Turbine Test facility and other specialist laboratories, indicates that the development of floating offshore wind in the Celtic Sea could be a 4.5GW opportunity by 2035. This will bring social, economic and environmental opportunities to local regions.

The Crown Estate continues to incentivise development in the Celtic Sea

When discussing offshore wind development in the Celtic Sea, the Crown Estate must also be considered. The Crown Estate, a collection of lands and holdings in the UK belonging to the British monarch as a corporation sole, has been vocal about the potential the Celtic Sea holds for renewable energy generation.

In October 2023, the organisation revealed its intention to raise the overall available capacity for its Offshore Wind Leasing Round 5 to 4.5GW, with this round being used to support the first developments in the Celtic Sea. It is worth noting that this originally had a capacity of 4GW but was increased in a welcome announcement by the group.

More recently, the organisation concluded its Habitats Regulations Assessment (HRA) ahead of the leasing round, meaning that the projects will not have an adverse effect on a range of environmental areas, such as marine life and birds. As such, the scene is set for the auction round to begin at the end of this month.

It is worth noting that this is the first time that the Crown Estate has undertaken the HRA ahead of an offshore wind leasing process, with it designed to give bidders early visibility of the steps they will need to take to ensure conformity with the HRA, reducing uncertainty and helping reduce the risk of future delays.

The HRA includes mitigation measures such as limits on the sweep of wind turbine blades below 80 metres, enhanced and strategic management of noise that can disturb or harm marine species, the requirement to develop measures to ensure fish are not accidentally caught during seawater extraction should hydrogen be pursued, and requirements to guide developers in their route selection for electricity cables or hydrogen pipelines.

Developer interest in the offshore wind market continues to grow

With the Crown Estate having made various announcements around offshore wind development in the Celtic Area, it has alerted multiple companies to the region. One such company is the Norwegian state-owned oil and gas giant Equinor, which has greatly influenced the UK wind sector.

In November 2022, the firm expressed interest in developing a gigawatt-scale floating offshore wind farm in the Celtic Sea to increase its renewable energy generation portfolio.

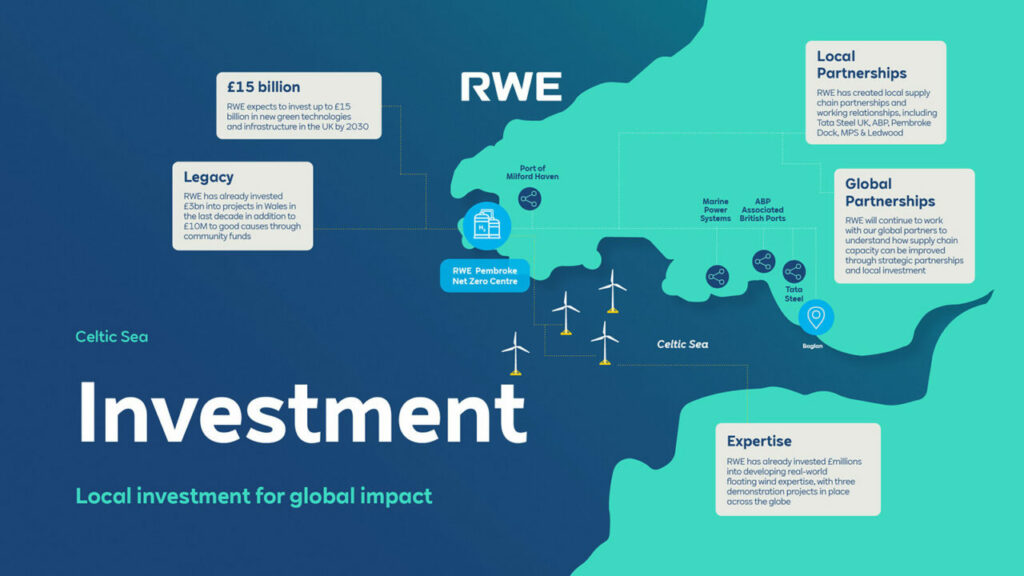

Alongside Equinor, RWE has also expressed interest in developing commercial-scale floating wind projects in the Celtic Sea, with the company calling the UK a “core market”, something that could see developments on the West Coast sooner rather than later.

One of the primary aspects of RWE’s vision for the Celtic Sea is the development and upscaling of local industries, granting an opportunity for areas of the UK, in particular Wales, the opportunity to bolster its net zero economy and specialisations – something that could be critical in achieving various renewable targets in the 2030s.

However, developers will be expected to see further progress in the Celtic Sea in the coming months, especially with the auction results set to be published in due course. But according to RenewableUK Cymru’s director Jess Hooper in October 2023, developers will “need to understand how The Crown Estate intends to support development, be that through engagement with infrastructure or through direct risk sharing mechanisms.”

“What is clear is that The Crown Estate is seeking solutions to the constraints posed by the fact that these developments are with a new technology deploying in a new geographical area, and they are working to understand what tools they have at their disposal to support developers given those increased constraints,” Hooper added.

A boost to local economies

Developers are not only looking to seize the opportunities lying in wait in the Celtic Sea. In the southwest of England, Cornwall Council-funded Celtic Sea Power is working for the region to unlock the potential of offshore floating wind in the sea.

To showcase its potential, recent research by the Crown Estate indicated that up to 5,300 new jobs and as much as £1.4 billion could be generated for the UK economy by galvanising the supply chain and infrastructure opportunities arising from the development of new floating wind farms off the coast of South Wales and the South West England.

As mentioned, developers and research institutes such as Celtic Sea Power could become critical in upskilling local workers. Cornwall, which is often recognised as one of the poorest regions in Britain, could find that transitioning workers towards renewable developments and maintenance could boost the local economy and attract an influx of specialised workers to the region.

The same can be said for Wales. In November 2022, Gwynt Glas Offshore Wind Farm signed a memorandum of understanding (MoU) with Associated British Ports and the Port of Milford Haven to prepare the region for floating wind farms in the Celtic Sea.

Via the MoU, information and industry knowledge will be shared to investigate potential opportunities for the manufacturing, assembly, load-out and servicing of the project. This will be across the key South Wales ports of Port Talbot and Milford Haven.

Preparing these ports for the influx of offshore wind grants the local population an opportunity to become specially trained in the renewable sector, and, as in Cornwall, could attract experienced developers to Wales, granting a boost to the economy.

To quantify offshore floating wind in the Celtic Sea, Blue Gem Wind believes that, by 2030, the first GW of floating wind could deliver over 3,000 jobs and £682 million in local supply chain opportunities. If you consider that the Celtic Sea has the potential to reach 50GW in the future, it is easy to see how lucrative this region could be.

A case for offshore green hydrogen production

Floating offshore wind farms are not the only renewable technology that has been considered for the Celtic Sea. Working in tangent with the wind farms, green hydrogen could be produced instead of direct electricity, enabling the region to contribute to the UK’s green hydrogen aspirations, which include 10GW of low-carbon hydrogen production with 5GW to be green hydrogen by 2030.

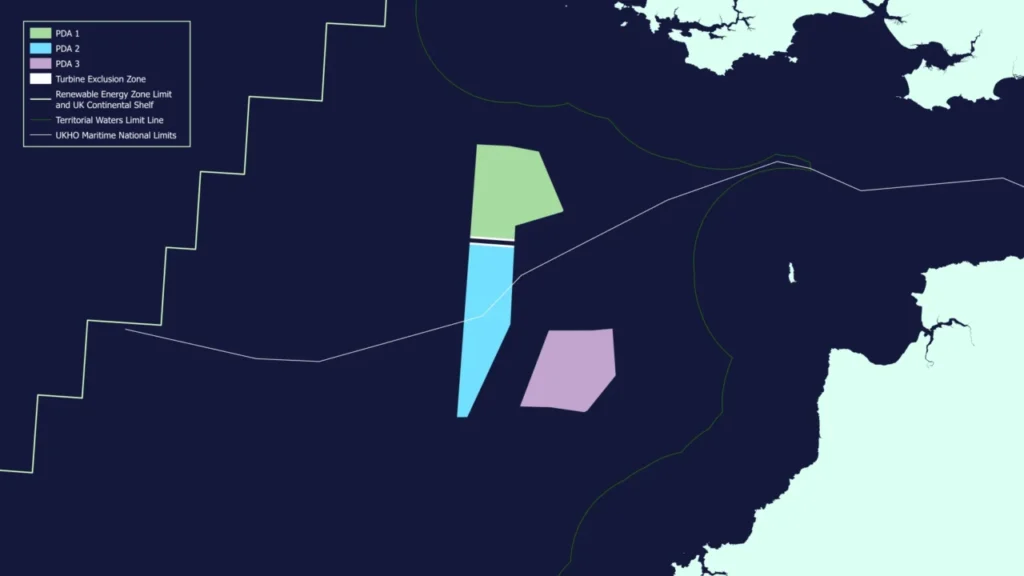

In 2022, Irish renewable firm Source Energie and offshore hydrogen producer ERM Dolphyn partnered to develop floating offshore wind sites that produce green hydrogen, with the first, “Dylan”, set to be completed in 2027/28. The project will be located 60km off the Pembrokeshire coast, west of Milford Haven and was identified based on a phased site selection process, including regional resource and constraints analysis and a high-level shipping and navigation review.

It is worth noting that ERM Dolphyn’s technology combines electrolysis, desalination and hydrogen production on a floating wind platform. It has been developed by ERM, a sustainability consultancy, with active support from the UK government, the Scottish government and the Welsh government.

In a statement, the two companies said that the location is ideal, as it offers good energy generating conditions (>10m/s average wind speeds), strong expansion potential, and has a number of viable low-impact pipeline routes to areas of existing and growing hydrogen demand. Further expansion of the site could provide more than 2GW in energy.

The idea of developing sites like this in the Celtic Sea has garnered praise from across the energy industry.

Renewable energy powers an electrolyser to produce hydrogen, which converts water into green hydrogen. A big topic in the hydrogen industry is producing hydrogen in water-scarce regions of the globe, but using seawater can mitigate this.

Scaling the hydrogen economy in the Celtic Sea, with infrastructure and jobs surrounding the region, could prove vital in ensuring the UK can compete as a world leader in the hydrogen industry. But this does come with challenges.

If there is one takeaway from offshore wind development in the Celtic Sea, it is that it could grant the UK two rich veins of renewable energy production if coupled with the North Sea. Although it could not compete with the sheer size and scale of its Eastern counterpart, the introduction of green hydrogen production could become a vital cog in the UK’s net zero machine.