The UK will need to address nuclear’s cost-competitiveness with alternative low-carbon technologies to spur growth, a report has indicated.

This is according to a new Wood Mackenzie report, The nuclear option: Making new nuclear power viable in the energy transition. The research company said that the “biggest economic hurdle to the uptake of the latest nuclear and small modular reactors (SMRs) is cost”.

This could be problematic for the UK’s ambitions within the nuclear industry having set a target of 24GW of nuclear energy generation by 2050. Current± reported in late March that the UK Government’s Spring Budget 2023 package included the creation of Great British Nuclear (GBN) to help address constraints in the market, supporting new nuclear builds to aid net zero.

The government confirmed GBN would launch a staged competition for SMRs, designed to attract the best designs from both domestic and international vendors. The government will then look to select the leading technologies to bring forwards into demonstration stages by the end of the year.

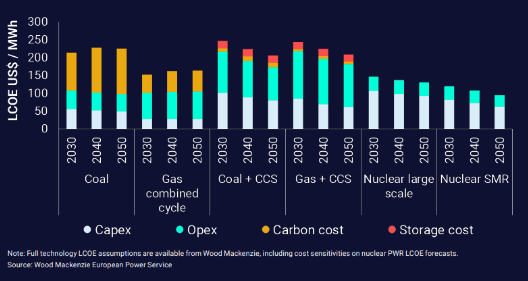

According to Wood Mackenzie’s research, scaling up the SMR market will depend on how fast costs fall to a level that’s competitive against other forms of low-carbon power generation. Wood Mackenzie estimates that conventional nuclear power currently has a levelised cost of electricity (LCOE) of at least four times that of wind and solar.

The UK has been placing an emphasis on SMR research and development. These are expected to be quicker to market, Wood Mackenzie said, and have a target construction time of between three to five years – significantly lower than large-pressurised water reactors (PWR) which usually take around 10.

Should costs fall to US$120 (£96.65) per MWh by 2030, SMRs will be competitive with nuclear PWRs, gas and coal – both abated and unabated – in some regions of the world, the research highlighted.

“The nuclear industry will have to address the cost challenge with urgency if it is to participate in the huge growth opportunity that low-carbon power presents. At current levels, the cost gap is just too great for nuclear to grow rapidly,” said David Brown, director Energy Transition Service at Wood Mackenzie, and lead author of the report.

“Overall, governments, developers and investors must work collaboratively to establish a new ecosystem for nuclear to flourish.”

Current± recently reported that EDF is to keep two nuclear power stations online for a further two years, providing an additional 29TWh of electricity.

Heysham 1, in Lancashire, and Hartlepool, in Teesside will now run until March 2026. This follows a review by EDF in 2022, and in particular positive inspections of the graphite reactor cores, which have given the company confidence that it generates electricity for longer.

“Supplying zero-carbon and affordable electricity, whatever the weather, has never been more important than right now. Our ongoing investment and careful stewardship of the UK nuclear fleet since 2009 has allowed us to make today’s decision and helps support the UK’s energy security at this challenging time,” said Matt Sykes, managing director of EDF’s Generation at the time.