The UK onshore wind market has experienced slow growth since its peak in 2017, with an installed capacity of 2.3GW that year. In subsequent years, the highest yearly installed capacity has not exceeded 700MW. However, a recent surge in the pipeline has indicated a rise in installations in the coming years.

The results of the recent Contracts for Difference (CfD) Allocation Round 5 (AR5) suggest that 24 onshore wind farms will be completed by 2028, with a total capacity of 1.5GW. These wind farms were awarded government support contracts at a strike price of £52.29 per MWh. All of these sites are located in Scotland, except for one in Wales – the Foel Trawsnant Wind Farm, which has a capacity of 34.8MW and is being developed by Pennant Walters.

The previous CfD AR4 round awarded contracts to almost 1.5GW across 16 sites, with 690MW slated for completion during 2024. AR3 resulted in just 4 remote island wind farms, totaling 275MW. However, construction delays have occurred in the wait for an interconnector to connect to the mainland.

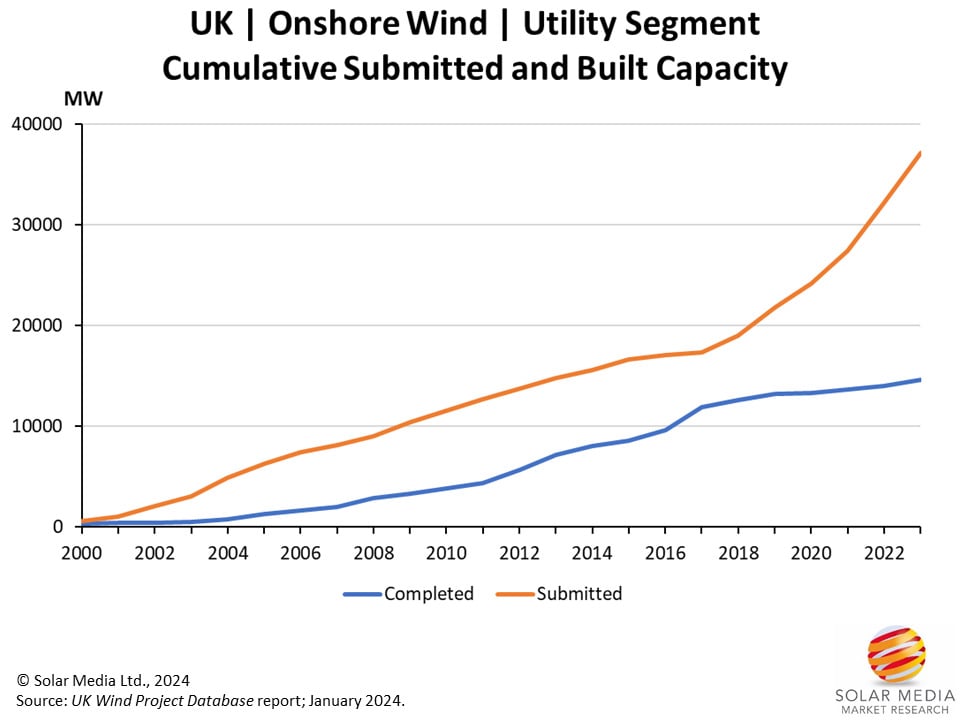

The graphic below displays the submitted and built onshore wind project capacities in the UK on a yearly basis.

In recent years, the growth of onshore wind capacity has slowed down, but it is expected to increase significantly due to the large amount of recently submitted capacity. Prior to 2019, there was a somewhat linear increase in built capacity when compared with submitted capacity. From 2015 to 2017, there was minimal growth in the submitted capacity for onshore wind, and this had an impact on the built capacity from 2017 to 2019.

Currently, the submitted onshore wind capacity stands at 14.6GW, which is spread across 435 sites. However, the total pipeline capacity is much higher, standing at 30.4GW across 594 sites. This is mainly due to several projects that are in the pre-application stage, including large-scale transmission entry projects that are expected to be completed in 2030 and beyond.

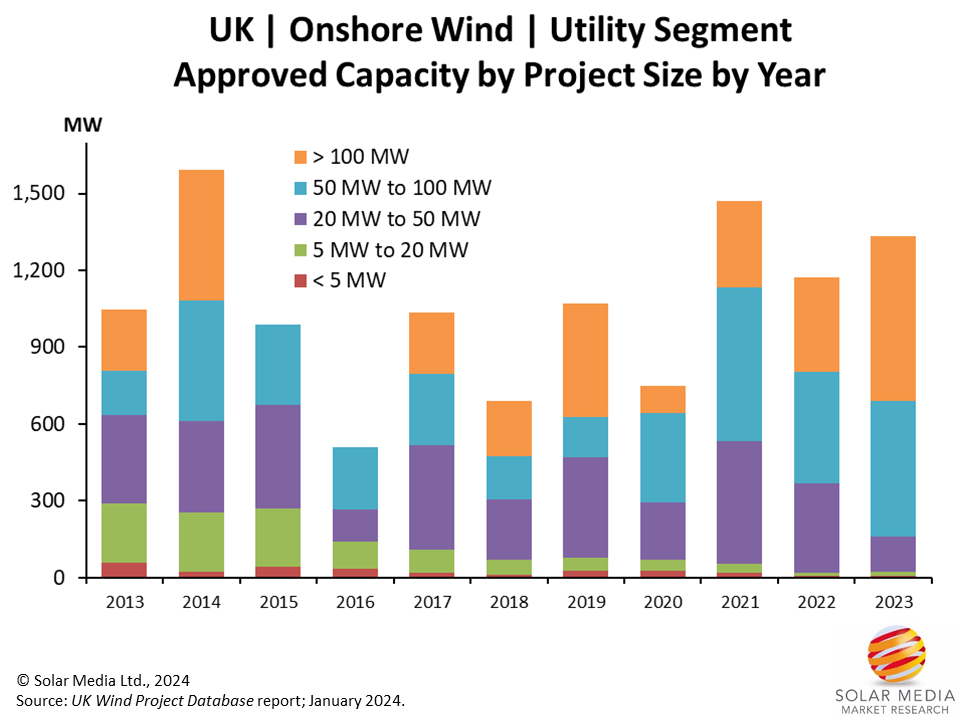

In 2023, a total of 1,334MW was approved in planning, with a large part of this from projects of 50MW capacity and above. The peak year for approved capacity was 2014, when 1,592MW was approved; most of these projects were built in 2017 and 2018.

The graphic below shows the approved capacity of onshore wind projects, by project size, by year.

The approved capacity for onshore wind power has reached 8.1GW across 325 sites. This figure suggests that the number of operational onshore wind farms will increase after a slow build-out in recent years. Currently, there are 23 sites under construction with a total capacity of 1.4GW, with most of them expected to be completed in 2024.

The current operational capacity for onshore wind is 15GW; in coming years, this will increase to at least 23GW due to the already approved capacity.

The advancements in wind turbine technologies have provided developers with the opportunity to construct bigger wind farms. While the average size of submitted projects has not shown much increase since 2018, the above graph presents a slightly different perspective. It clearly illustrates that the average size of the approved projects has increased.

In 2023, a single project with only one turbine was approved in England, and there have been no applications for large-scale wind farms in England since 2013. This was mainly because of strict planning rules that allowed just one complaint to halt a project. However, the government has now declared that it will be easing the restrictions on onshore wind in England.

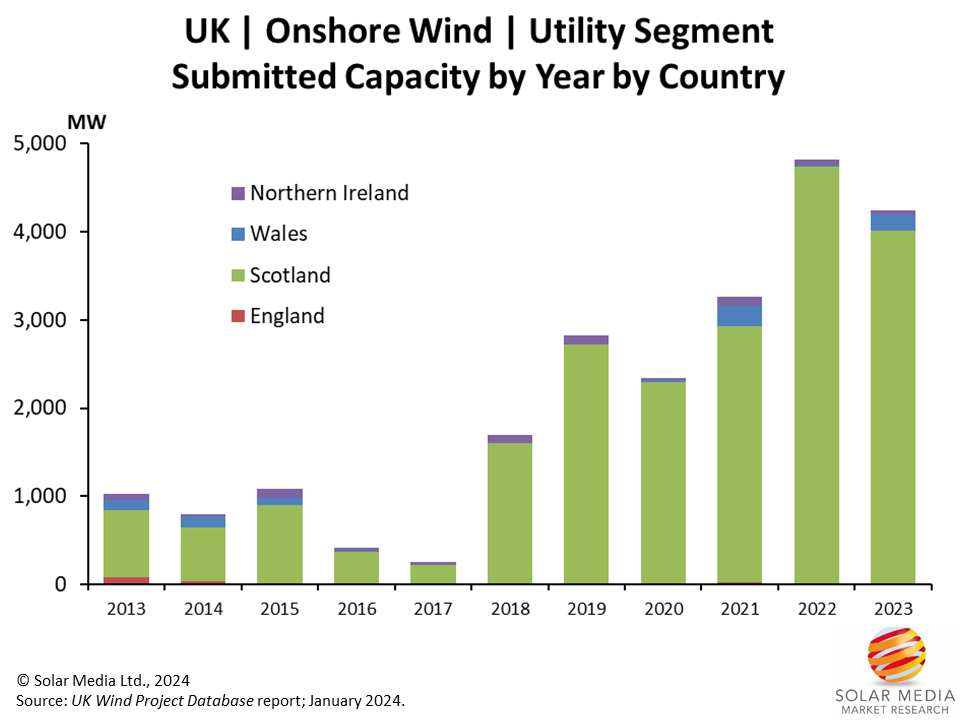

The graphic above shows the capacity submitted by different countries on a yearly basis, with Scotland leading by a considerable margin.

2022 showed the highest yearly submitted capacity of 4.8GW across 84 locations, out of which 4.7GW was submitted in Scotland.

64% of the UK’s operational onshore wind capacity is in Scotland and this is likely to increase until new projects start to be planned in England once again.

It is worth noting that around 15% of the onshore projects listed in the Transmission Entry Capacity (TEC) register is proposed to be situated in England. This suggests that some developers are now choosing to plan their projects there. However, the number of projects planned in England is expected to remain limited due to the scarcity of available sites, lower wind yields, and the current challenging and time-consuming planning process.

In conclusion, the total onshore wind capacity in the UK is expected to surge in the near future, with 8.1GW set to come online in the next few years and a large pipeline to follow.

All data and analysis shown in this article comes from our in-house market research at Solar Media. Full details on how to subscribe to our UK Wind Projects Database can be found here.