The government has published the results of Auction Round 5 (AR5) of its flagship Contracts for Difference (CfD) scheme, revealing that just 3.7GW of projects have been awarded funding in Auction Round 5 (AR5).

The previous AR4 had a budget of £285 million compared to AR5’s £227 million funding, £58 million below the 2022 AR4 commitment. The previous round secured almost 11GW of renewable generation, with 7GW of offshore wind being the biggest winner.

AR5 is the first round to be held since the CfD scheme started to be held annually. The UK government has a goal of reaching 50GW of offshore wind by 2030. Labour’s Ed Miliband, the shadow secretary of state for climate change and net zero, announced in June that Labour would target 60GW of offshore wind by 2030.

Despite the fall in capacity awarded, the government said AR5 would award a “record number” of projects, with 95 projects having been successful with their bids, up from 93 in the previous round.

This number included “significant numbers” of solar power and onshore wind projects, and a record number of tidal energy schemes. Geothermal plants have also been successful for the first time, the Department for Energy Security and Net Zero (DESNZ) said.

Energy and Climate Change Minister Graham Stuart said: “We are delighted that our first annual Contracts for Difference auction has seen a record number of successful projects across solar, onshore wind, tidal power and, for the first time, geo-thermal.”

“Offshore wind is central to our ambitions to decarbonise our electricity supply and our ambition to build 50GW of offshore wind capacity by 2030, including up to 5GW of floating wind, remains firm. The UK installed 300 new turbines last year and we will work with industry to make sure we retain our global leadership in this vital technology,” Stuart added.

Solar projects will deliver almost half of this year’s total capacity, while onshore wind accounts for 1.5GW, and tidal projects make up 50MW and geothermal, 12MW.

Trade body Solar Energy UK reacted positively to the news that 56 solar projects were secured in AR5, with a total capacity of 1,928MW, an average 34MW per project. “The smallest is the 7MW Bracon Ash solar farm near Norwich, while the largest is an undisclosed 57MW project from Enso Green Holdings,” Solar Energy UK said, adding that the result was “rather better than had [been] anticipated, illustrating its resilience to economic turbulence compared to offshore wind, for which no bids were made.”

Solar’s strike price came in at £47 per megawatt-hour, with onshore wind at £52. Geothermal and tidal stream technologies secured contracts at strike prices of £119 and £198 respectively.

#Solarenergy demonstrates again that it is the cheapest source of power in the #AR5 #CfD results – though the absence of offshore wind has prompted calls for reform. https://t.co/pmzXOfFCRp

— Gareth Simkins 🇺🇦 (@GarethSimkins) September 8, 2023

“We are pleased that so many solar projects have been successful in AR5, particularly as solar has only recently been able to participate. This shows how resilient solar has become to economic shocks. It remains the cheapest way to generate power in the UK. That said, we need to be roughly doubling the pace of solar installations to meet the government’s capacity target of 70GW by 2035,” said Chris Hewett, chief executive of Solar Energy UK.

Another solar company, Low Carbon, also welcomed the AR5 results, having been offered CfDs for 10 solar projects with a capacity of more than 350MWp.

Steve Mack, Low Carbon chief investment officer, said: “these projects, coupled with more than 300MWp we secured in last year’s auction, will play an important role in supporting the rollout of solar energy across the UK and provide investment certainty in the solar supply chain as we look to make further progress on reaching net zero. They will also make a material contribution to the UK’s energy security and cut bills for consumers, while creating further momentum for our own ambition of delivering 20GW of new renewable energy capacity by 2030.”

But wind energy groups were not so happy about the result. Keith Anderson, ScottishPower chief executive, said: “This is a multi-billion pound lost opportunity to deliver low-cost energy for consumers and a wake-up call for government.”

“The CfD process is recognised globally as a lynchpin of the UK’s offshore success, but it also needs to flex to keep pace with the world around it. We all want the same thing – to get more secure, low-cost green offshore wind built in our waters. ScottishPower is in the business of building windfarms and our track record is second to none in terms of getting projects over the line when others haven’t been able to. But the economics simply did not stand up this time around.”

“We need to get back on track and consider how we unlock the billions of investment in what is still one of the cheapest ways to generate power and meet the UK’s long-term offshore wind ambitions for the future,” Anderson added.

The co-chair of the Offshore Wind Industry Council, Richard Sandford, said: “Although today’s auction results are disappointing, the offshore wind industry’s continued focus is working closely with the Government to reform the auction process so that we can secure far more capacity next year and beyond.”

“It’s clear that this year’s auction represents a missed opportunity to strengthen Britain’s energy security and provide low-cost power for consumers. If all the offshore wind projects eligible to bid into this auction had done so, we could have powered the equivalent of more than five million British homes a year. So, lessons must be learned to ensure that the parameters of the auction are set correctly in the future,” Sandford added.

RenewableUK’s chief executive Dan McGrail said the AR5 results should “set alarm bells ringing”.

“These results should set alarm bells ringing in Government, as the UK’s energy security and net zero goals can only be met if we have offshore wind as the backbone of our future energy system. We need the Government to show that the UK is open for business”

— RenewableUK (@RenewableUK) September 8, 2023

Read our response to… pic.twitter.com/lo6mmlKJ8K

RenewableUK Cymru said they were “incredibly disappointed to learn there are no floating offshore wind winners in this year’s UK government renewable energy auction, including Erebus, Wales’ first planned floating windfarm off Pembrokeshire.”

Sam Richards, founder and campaign director of Britain Remade, said: “The failure to award a single contract for offshore wind in the latest round is the direct result of the government’s complacency and incompetence in the rules they set for the latest auction. This catastrophic outcome will cost hard-pressed billpayers £1 billion a year.”

Richards explained that ministers had decided to ignore warnings that increased materials costs would mean the price of offshore wind would increase, “while still being significantly cheaper than new gas plants”.

“By capping the price the sector could bid at too low, government set it at a level that made it impossible for investors to meet their costs. This will condemn consumers to higher bills than necessary and means Britain loses out on vital jobs and billions in investment,” Richards said.

Jess Ralston, energy analyst at the Energy and Climate Intelligence Unit (ECIU) said: “The renewables that were secured at this auction are still lots cheaper – a third for some technologies – than wholesale power prices which are set by gas. But the elephant in the room is the renewables that weren’t secured. We’ve potentially missed out on bill savings worth over £1 billion from no offshore wind bids, which again would be far cheaper than the alternative gas.”

Phil McNally, a research fellow at UCL’s Institute for Sustainable Resources, said the results “mark the lowest point in UK climate policy in at least a decade.”

Today’s CfD AR5 results mark the lowest point in UK climate policy in at least a decade.

— Phil McNally (@PhillMcNally) September 8, 2023

With no new capacity, and existing projects pulling the plug due to cost pressures, the UK is effectively moving backwards on offshore wind – the supposed backbone of the future system. pic.twitter.com/ZZdE5HYY4i

Alethea Warrington, senior campaigner at climate charity Possible, said: “It is simply mind blowing that the government has failed to attract a single bid for new offshore wind projects, by failing to adjust the power price to reflect the inflation which has been caused by gas prices. This negligence will lock us into reliance on dirty, expensive gas power for even longer. It is incredibly disappointing that, once again, the government has failed to seize the opportunity to sufficiently increase the UK’s supply of clean, cheap renewable energy.”

However, Geothermal Engineering Limited (GEL) and its investors Kerogen Capital and Thrive Renewables, was awarded CfDs for three projects. The company said its “flagship site at United Downs is the first geothermal project in the UK, forecast to deliver electricity by 2025. GEL is targeting 25MWe of baseload electricity and 100 MWh of heat energy across its geothermal portfolio by 2028, enough heat and power for 70,000 homes.”

Ryan Law, managing director of Geothermal Engineering Ltd, said: “We are very pleased for GEL to have been awarded CfDs and achieve another first for the company in the UK. This is a hugely significant milestone in our push to extend the boundaries of what’s possible with geothermal power and heat. Securing these CfDs will also provide the necessary financial foundation to allow more substantial investment in the multiple projects that we have planned in the UK.”

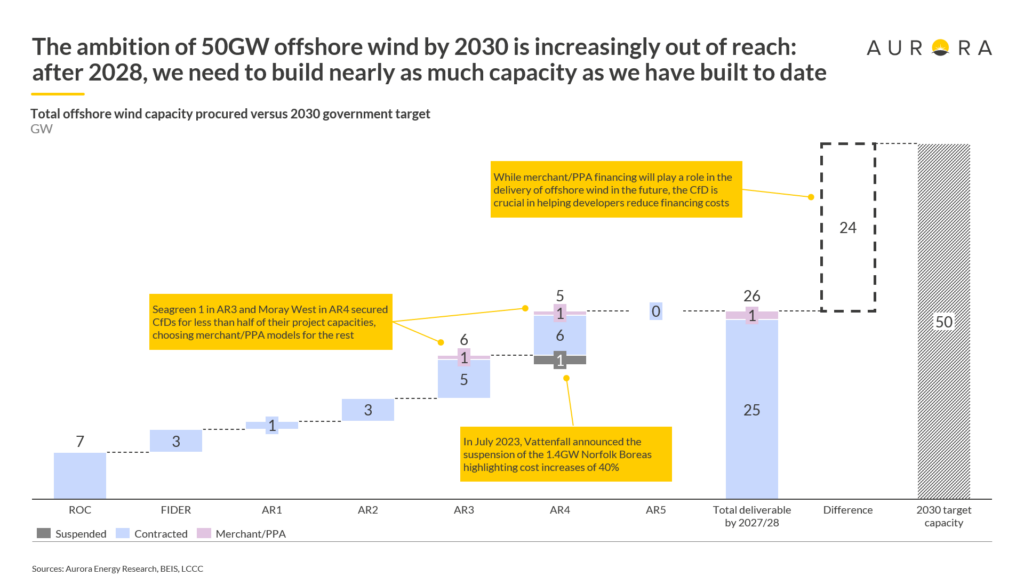

In an analysis of the news, Ashutosh Padelkar, senior research associate for the British power market at Aurora, said it would be “extremely challenging” to reach the government’s 2030 offshore wind target. “To deliver the government’s ambition of 50GW of offshore wind by 2030, we would need to build as much offshore wind capacity between 2028 and 2030 as we are set to build from 2000 to 2027,” Padelkar said.

The results for offshore wind are likely to further dent investor confidence in the UK’s renewables industry. RenewableUK called for the government to “take urgent action to rebuild investor confidence in the UK market”, with incentives in Europe and the US being currently far more attractive than the UK.

Inflation and increased commodity prices resulting from the Ukraine war, supply chain shocks and increased demand are having long term consequences on the speed at which the UK is able to build its renewable energy capacity, and these macroeconomic trends will continue to affect the UK over in the short to medium term.