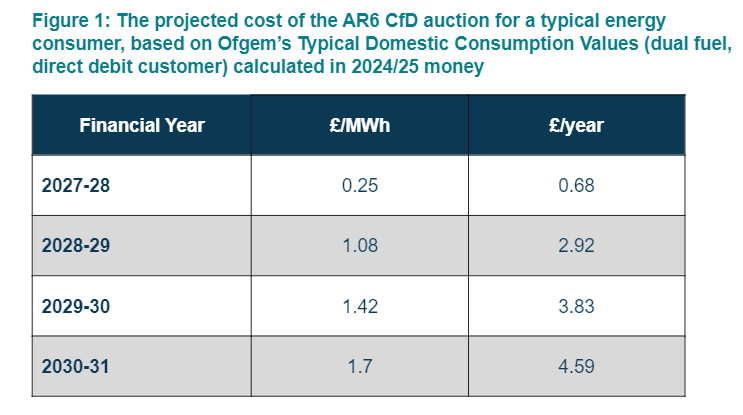

Forecasting by Cornwall Insight shows that this year’s Contracts for Difference (CfD) auction will add around just £4.59 to a typical household’s energy bill by 2030-31.

The sixth auction round of the scheme (AR6) meant strike prices were set below the maximum allowed—offshore wind came in 19% under the cap. Strike prices were still higher than the record lows of AR4.

CfD guarantees generators a set income through the strike price. If a generators’ earnings exceed the strike price they repay the excess; if they earn less the government compensates them. Earnings are based on the relevant wholesale electricity market price, so a high market price means generators charge consumers more. In theory, if market prices are low consumer bills will decrease, offsetting any compensation made to generators.

Despite the small added cost projected by Cornwall Insight, the shift towards domestic energy generation is expected to reduce the UK’s reliance on volatile international energy markets. This, along with the lower cost of energy from renewable sources, is what has informed the government’s promise to reduce household bills in the transition to net zero.

Cornwall Insights Third Party Charges Forecast was calculated by projecting the energy market up to the end of the decade, incorporating the new CfD strike prices to forecast costs beginning 2027-2028. That is when the first significant costs from AR6 are anticipated according to the awarded developers’ target commissioning dates.

Cost impacts are expected to rise in later years as more of the larger offshore wind projects are scheduled to come online. The Third Party Charges Forecast based its wholesale price forecasts on Cornwall Insight’s in-house forecasts.

According to Lee Drummee, a senior analyst at Cornwall Insight, “there is always a cost to these transitions” but that it remains clear that investing in renewables is “essential for the security of our energy, the stability of our bills and the health of our nation”.

He continued: “The scheme does carry a small cost, but if the past three years have shown us anything, it is the risks of relying heavily on the international energy market, which has had a significantly adverse impact on energy bills. Without investing in renewable energy, we remain vulnerable to price spikes driven by global events. Increasing our own energy generation reduces our exposure to such volatility.”

When the results of the CfD scheme AR6 were announced, a senior consultant at Cornwall Insight, Tim Dixon, pointed out a “significant gap” between contracted capacity and the amount needed to achieve the government’s 2030 targets.

Public support of climate policy remains

A recent YouGov poll commissioned by the Energy and Climate Intelligence Unit (ECIU) showed general public support for the Labour government’s clean energy ‘blitz’, in spite of the fact that 61% of respondents do not expect the government’s policies to lower bills.

The poll closely followed the revelation that Ofgem’s price cap would rise by 10%. Dr Craig Lowrey, principal consultant at Cornwall Insight, blamed the increase on the lingering impact of the energy crisis and advised the government to take a “two-pronged approach”.

He said: “This means a fundamental overhaul of our energy system, with a strong emphasis on increasing domestic energy production. Simply waiting for prices to drop on their own isn’t an option, we need a proactive and forward-thinking approach to ensure long lasting energy affordability and security.”