Cornwall Insight’s latest Default Tariif Cap predictions are at their lowest in over two years, but principal consultant Dr Craig Lowrey warns the UK energy system remains on a “tightrope.”

According to the market researcher’s latest predictions, the next price (April to June 2023) will be set at £1,635 per year for a typical dual fuel household, a 15% (£293) decrease from the current cap set at £1,928.

This is a £15 increase from Cornwall Insight’s January prediction but does also include the one-off £16 bad debt allowance suggested by energy regulator Ofgem to tackle record energy debt.

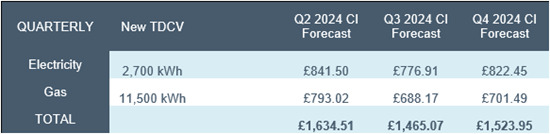

Cornwall Insight’s Default Tariff Cap forecasts using new Typical Domestic Consumption Values (dual fuel, direct debit customer)

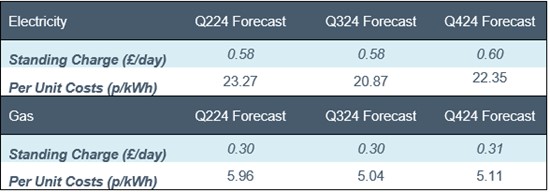

Default Tariff Cap forecasts, Per Unit Costs and Standing Charge (dual fuel, direct debit customer)

These predictions suggested that the UK has “weathered the storm” of Red Sea shipping tensions, said Cornwall Insight, lowering prices by securing a steady supply of liquified natural gas (LNG) from the Atlantic, good availability of cargoes in Europe and Asia, as well as mild weather.

Although Cornwall Insight forecasts that the cap will continue to decrease into July, with only a slight increase in October, the market researcher noted that due to several ongoing consultations – including Ofgem’s review into standing charges – additional charges may still be included in the cap.

UK remains on a ‘tightrope’

Despite calling the two-year low in predictions a “much-needed respite” for UK households, Lowrey warned that the nation “mustn’t get too complacent.”

“Our energy system is still walking a tightrope, and we cannot be sure another political or economic crisis won’t send bills straight back up.

“Even with the drop, prices will remain a struggle for many. We need to remember, bills remain hundreds of pounds above pre-pandemic levels, and if we don’t speed up the switch to sustainable energy and cut down on volatile imports, they are likely to stay that way.”

Jess Ralston, energy analyst at the Energy and Climate Intelligence Unit (ECIU) echoed Lowrey’s warning stating that the nation “may not be out of the woods yet.”

“Bills are still hundreds of pounds higher than pre-crisis, and we’re just as vulnerable to future gas price shocks because we haven’t made much progress in switching away from gas to get our energy independence,” continued Ralston.

“The OBR has said that future crises every 10 years could add the equivalent of 13% of GDP to our level of debt, so it might be an idea to fix the roof – in this case insulating homes and building out renewables – while the sun is shining, but the government failed to get any offshore wind bids in the last renewables auction, and energy efficiency schemes are flatlining.”