This week’s issue of Current± Price Watch – powered by Enact – explores Cornwall Insight’s latest price cap shifting only £38, wind generating more British electricity than gas for the first time and the demand flexibility service scheme displacing the need for 3.3GWh of electricity.

Day Ahead: Wind outperforms gas in Britain for the first time

Day ahead prices remained stable throughout last week, with a high of £121.2/MWh on Thursday 11 May and a low of £61/MWh on Saturday 13 May.

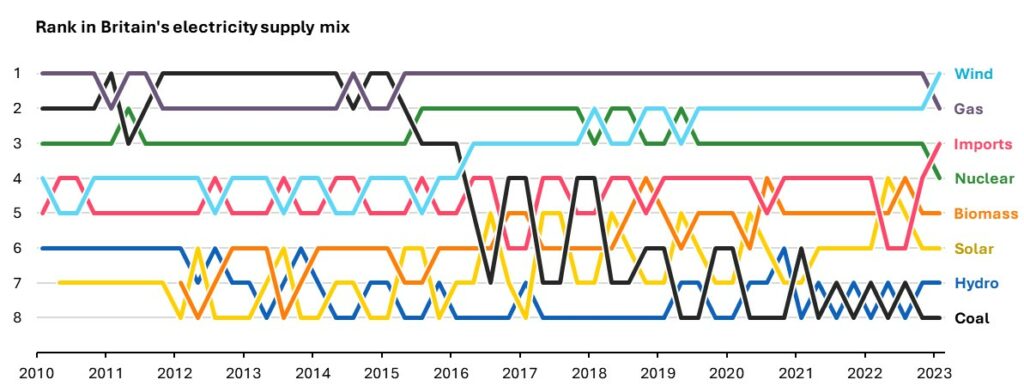

The first three months of 2023 saw wind power generate more electricity than gas for the first time in Britain’s history, according Drax’s quarterly Electric Insights.

The power generation business confirmed that during this period wind produced 24TWh of electricity constituting 32.4% of Britain’s electricity was generated by wind. This was a 3% rise from the same period last year for the renewable generation source and allowed wind to outperform gas which generated 31.7%, falling 5% from the same period last year.

Overall, Drax’s data showed that nearly 42% of Britain’s electricity came from renewable sources from January 2023 to March 2023, with fossil fuels supplying only 33%.

Drax @ElecInsights has found that 32.4% of Britain’s electricity was supplied from wind power during the first quarter of 2023, outpacing gas which delivered 31.7%. 🔌

— Drax (@DraxGroup) May 10, 2023

This is the first time wind has provided the largest share of power in any quarter in the history of the UK’s… pic.twitter.com/fh9ZsSDa6M

“The renewable power revolution has transformed how Britain gets its electricity, making our power grid cleaner and greener,” said Dr Iain Staffell of Imperial College London and lead author of Drax’s Electric Insights reports.

“In the space of a decade the UK has almost completely cut out coal, after relying on the most polluting fossil fuel for over a century to power our country. There are still many hurdles to reaching a completely fossil fuel-free grid, but wind out supplying gas for the first time is a genuine milestone event, and shows what can be achieved when governments create a good environment for investors in clean technology.”

Last week also saw Ireland’s first Offshore Renewable Electricity Support Scheme (ORESS-1) auction, which saw 3GW awarded for offshore wind projects.

The projects are set to deliver more than 12TWh of renewable electricity per year in what the Irish Government has called a “breakthrough moment for Ireland’s offshore wind future.

Two projects that were successful in Irelands first auction are the 450MW Sceirde Rocks Wind farm and the 1.3GW Codling Wind Park.

“This is a great day in the fight against climate change, and for Ireland’s plans to become energy self-sufficient. With Codling Wind Park’s successful bid, Ireland’s largest Phase 1 offshore project of 1,300MW capacity, moves a considerable step closer to reality,” said Codling Wind Park Co-Project Directors Scott Sutherland and Thomas Gellert.

“There is an immense wealth of low-carbon, potential power available in the seas around this country. Today’s successful auction results will increase confidence in Ireland’s ability to realise the opportunities of offshore energy. We look forward to working with the government, state agencies and most of all local communities to ensure that the significant benefits of Irish offshore energy can be delivered to the people of Ireland.”

Intraday: Latest price cap prediction shift by only £38

Intraday prices last week started with a wider spread which consolidated by the end of the week, with maximum prices falling and minimum prices rising. Minimum intraday prices started at a low dip, but stabilised throughout the week, while maximum prices began higher but saw a significant fall from Thursday 11 May to Friday 12 May from £145.4/MWh to £110.27/MWh.

The relatively stable intraday energy prices this week are reflective of larger price trends in energy markets, with Cornwall Insight’s latest price cap prediction for average yearly household energy bills remaining around the £2000 mark.

According to Cornwall Insight, a typical house is now predicted to pay £2,062.91 a year from July (Q3 2023) – up from their April prediction of £2,024.58 for the same quarter – a £38 change.

Wholesale gas and electricity prices are the largest component in Cornwall Insight’s price predictions, and the relative stability of these forecasts reflects a decrease in volatility in the wholesale markets.

In contrast, predictions from January to February 2023 fluctuated by more than £600. A milder than expected winter, reduced demand and higher European energy storage all contributed to the lower price volatility, Cornwall Insight said.

Dr Craig Lowrey, principle consultant at Cornwall Insight, said that the stabilisation of prices could prompt energy companies to reintroduce fixed tariffs, but that uncertainty about prices beyond July meant this was risky.

“We are faced with several uncertainties as we look beyond the July price cap, with ongoing consultations on the cap modelling and other legislative changes that could potentially bring significant changes. This leaves our predictions for the end of this year and beyond potentially vulnerable to change,” Lowrey said.

Household energy prices remain on average £1000 more than pre-2020 levels, and because “unforeseen geopolitical events can easily disrupt the wholesale market again,” Lowrey added, “it is crucial that the UK accelerates its journey towards energy self-sufficiency. “

Imbalance: DFS scheme saves over 3.3GWh of electricity

Imbalance prices remained relatively stable on average throughout the week. Monday 08 May however experienced a major low in imbalance prices with the price standing at £-35.82/MWh.

Wind held the majority share of the UK’s electricity mix on Monday 08 May at 31.7%, followed by gas at 30.9%, as confirmed by the National Grid ESO.

On Monday #wind produced 31.7% of British electricity followed by gas 30.9%, imports 14.4%, nuclear 14.0%, biomass 5.0%, solar 2.9%, hydro 1.0%, coal 0.0%, coal 0.0% *excl. non-renewable distributed generation pic.twitter.com/irw1Qd6rNQ

— National Grid ESO (@NationalGridESO) May 9, 2023

These imbalance prices come at a time when National Grid ESO released its data for the Demand Flexibility Service (DFS) scheme which ran from 1 November 2022 until 31 March 2023. The scheme had 22 service events which included live events to balance Great Britain’s electricity network.

For the entirety of the trial scheme, over 3.3GWh of electricity was saved during peak times with a total of 1.6 million households and businesses having signed up. This could prove a pivotal aspect of the UK energy system and could be implemented as a mainstay service.

This has been highlighted by Octopus Energy which in March 2023, called for the end of the use of coal as a backup energy source due to the successes of the DFS.

“Across this winter the DFS successfully demonstrated the interest of UK consumers and businesses in playing a more active role in balancing our electricity needs. Their work, alongside the providers involved in the Demand Flexibility Service helped to maintain normal service for all GB electricity users,” said Claire Dykta, head of markets at National Grid ESO.

“We are now working with industry and consumers to establish how this world leading service can grow from strength to strength and support the continued evolution of consumer flexibility in the UK.”

Our Demand Flexibility Service delivered electricity to power 10 million households ⚡🏡 Read our article to find out which regions saved the most electricity during peak times across 1.6 million homes and businesses. More 👇

— National Grid ESO (@NationalGridESO) May 10, 2023

Octopus Energy’s results for its DFS scheme “Saving Sessions” saw its customers collectively shift 1.86GWh of electricity throughout the 13 trials. British Gas’ scheme saw customers paid over £1.8 million since December 2022, due to saving a total of 147MWh of energy.

The end of the scheme has also seen various analysis of the DFS. Ne of which includes the Centre for Net Zero, a non-profit research organisation established to provide data on the UK’s net zero prospects.

Centre for Net Zero CEO Lucy Yu commented: “Our own analysis of the DFS scheme clearly demonstrates that UK households are willing and able to support the grid during times of strain, even when provided with short notice or during colder periods.

“Demand flexibility is ready to scale and can play a vital role in emergency response and decarbonising our energy system. In order to unlock its full potential, policy-makers must introduce stronger incentives and regulations around supplier participation, consumer awareness and household compensation.

“Urgently facilitating the rollout of smart consumer energy resources (CERs), such as electric vehicles and heat pumps, is also key to intelligently automating domestic flexibility – which is crucial if we’re to move beyond manual flexibility and deliver system-level impacts.”