This year, National Grid ESO’s Future Energy Scenarios (FES) follows a new framework that no longer represents the widest possible credible outcomes, reflecting the importance of decisive action within the next two years to secure a clean energy system by 2050.

Future Energy Scenarios (FES) 2024: ESO Pathways to Net Zero presents three ‘pathways’ to net zero, an evolution of the previous format that set out ‘scenarios’. The pathways explore narrower ranges and strategic, credible choices on the route to decarbonisation and a fourth ‘Counterfactual’ route that sees net zero targets missed.

The shift reflects the report’s key message: “Decisive action is needed within the next two years to deliver the fundamental change required for a fair, affordable, sustainable and secure net zero energy system by 2050.”

This new framework moves from reactive scenarios to strategic network planning. FES 2024 will inform ESO’s transition to become the National Energy System Operator (NESO) and forms part of a wider industry overhaul of Great Britain’s energy network planning. It underpins the foundations of this network investment by feeding into NESO’s Centralised Strategic Network Plan (CSNP), working alongside the Strategic Spatial Energy Plan (SSEP).

Non-profit energy organisation Regen welcomed the move towards a set of narrower pathways. It said: “Shifting from a world of broad scenarios to aid planning towards a clearer central pathway that we invest for, with sensitivities, is an important step to delivering on our ambitious targets.

“The challenge of adapting industry planning to changing government policy is a useful reminder as we shift to a Strategic Spatial Energy Plan that any energy plan, pathway or scenario will need to evolve and adapt as circumstances change.”

Narrower pathways to net zero

According to LCP Delta’s head of energy economics, policy, and investment, Sam Hollister: “The pathways set out by National Grid ESO this morning leave very little room for error, and an alarming counterfactual scenario highlights where we might end up if we don’t take serious and immediate action to mitigate the potential risks and ensure sustainable and reliable energy for the future.”

The first pathway, requiring the most intensive consumer action, is a Holistic Transition that would see net zero met through a mix of electrification and hydrogen use, the latter mainly around industrial clusters. It requires consumer demand to shift and smart homes and electric vehicles to provide flexibility to the grid.

This pathway has the highest renewable capacity, with unabated gas dropping sharply to zero after 2036, with electricity storage and interconnectors providing high supply side flexibility.

The Electric Engagement pathway would see demand electrified to meet net zero, with consumers “highly engaged” in the energy transition through smart technologies that reduce energy demand, such as heat pumps and electric vehicles.

To achieve this pathway, high nuclear and renewable capacities would be needed, with the utilisation of natural gas plants reduced post-2035. High supply side flexibility would come from electricity storage, interconnectors and low carbon dispatchable power.

A Hydrogen Evolution would meet net zero with massive hydrogen progress in industry and heat. It would see many consumers use hydrogen boilers, but energy efficiency is key to reducing the cost of this. Otherwise, consumer engagement levels are low. Hydrogen will be prevalent for heavy goods vehicles but electric vehicle uptake is strong.

Hydrogen storage would provide most flexibility in this pathway. High levels of hydrogen dispatchable power plants would lower the need for renewable and nuclear capacity and natural gas plants would be used less after 2035.

All three pathways meet net zero by 2050. The comparative, Counterfactual scenario would see heavy reliance on gas continuing across all sectors with “some progress” made for decarbonisation compared to today. EV uptake, while slower than in any of the pathways, still displaces petrol and diesel.

Negative emissions technologies are necessary for all pathways to offset sectors that are difficult to decarbonise, despite the rapid and heavy decarbonisation modelled.

Adam Bell, former head of energy strategy at the government Department for Business, Energy and Industrial Strategy (BEIS) from May 202 until June 2021, and now a director of policy at consultants Stonehaven, wrote on social media site X that questions remained over the ESO’s assumptions on electricity demand and carbon capture and storage (below).

The second is the extent to which all decarbonisation scenarios rely heavily on CCS. We will know by the end of this Parliament whether CCS is really going to be a thing in the UK; the implication of the below is that without it we are going to struggle to decarbonise. /8 pic.twitter.com/K6nYZ4sRMS

— Adam Bell (@Adam_Grant_Bell) July 16, 2024

Carbon capture and storage (CCS) is used in all pathways across the decarbonisation of power (low carbon dispatchable power), industry, hydrogen production (gas reformation) and negative emissions technologies.

Further, all of the potential routes to net zero use varying levels of bioenergy with carbon capture and storage (BECCS) to act as a source of net negative emissions.

Picking up on this, Drax Group CEO, Will Gardiner, said: “National Grid ESO’s Future Energy Scenario’s report makes it clear that deploying BECCS is absolutely critical for the UK to achieve net zero. There is no scenario under which BECCS is not required.

“Power BECCS is such a vital technology because it delivers reliable renewable power whilst permanently removing carbon dioxide from the atmosphere. According to National Grid’s report it is the most viable large scale carbon removal option available.

“Drax is ready to invest billions of pounds delivering BECCS at our power station in Yorkshire, which is already the UK’s biggest renewable power generator by output. With BECCS we could permanently remove millions of tonnes of carbon dioxide from the atmosphere a year, making a significant contribution to the UK’s ability to reach net zero.”

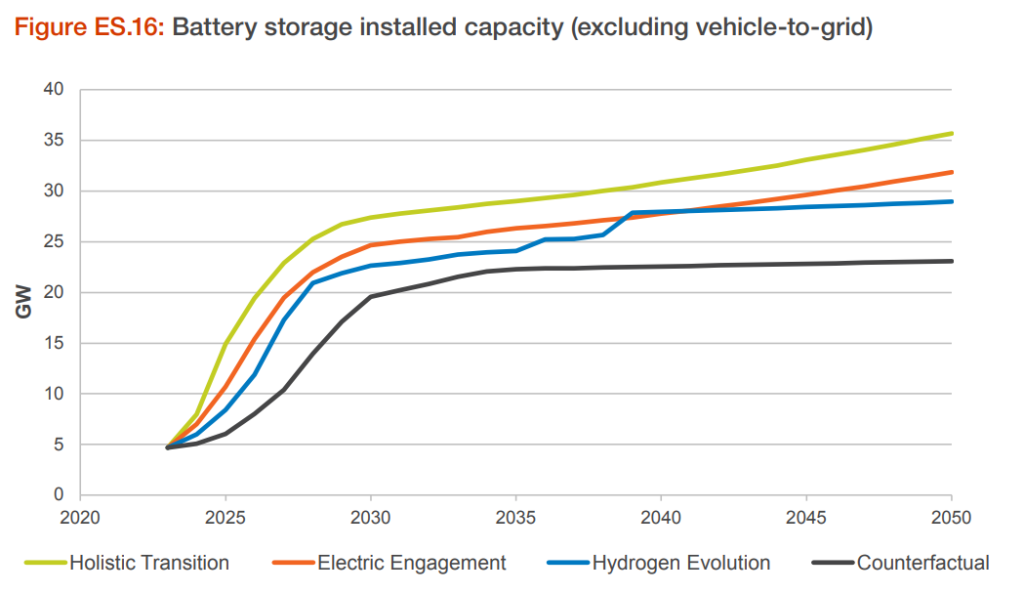

Electricity storage is also necessary across all net zero pathways to help balance the grid and ensure security of supply.

ESO’s modelling considers several types of storage: battery storage, pumped hydro storage (PHS), compressed air energy storage (CAES) and liquid air energy storage (LAES). The pathways all reflect an expected 23-30GW of electricity storage set to connect into the system by 2030.

In May, RenewableUK stated the UK’s battery storage pipeline (including projects that are operational, under construction, consented to, or being planned) had reached 95.6GW, a far greater potential than is projected for 2050 in the ESO report.

Changes since FES 2023

In her foreword to the report, ESO’s director of strategy and policy Claire Dykta acknowledges that “ongoing conflict continues to create international uncertainty in energy markets with the long-term consequences yet to be determined, and the cost-of-living and energy crisis continues to impact households and businesses across Great Britain.”

This year, the modelled pathways assume a high level of consumer interaction to reduce demand and thus net emissions. In 2023, only one scenario, ‘Leading the Way’, called for high consumer engagement with significant energy efficiency home improvements and a steep increase in smart energy services.

Another scenario projected from 2023 would see some dependence on a Demand Flexibility Service, which ESO scrapped this year.

Major changes since last year are noted in FES 2024 and include the publication of the civil nuclear roadmap in January 2024 and the second REMA consultation that concluded in March.

Further, after the December 2023 launch of the Clean Heat Market Mechanism, it was delayed by a year with the stipulation that, beginning in April 2025, heat pump installations must make up 6% of boiler manufacturer sales in the first year.

The grants available under the Boiler Upgrade Scheme (BUS) have increased and the Future Homes and Building Standard consultation closed in March, proposing that new homes built from 2025 are ‘zero carbon ready’ and prohibiting the installation of fossil fuel-powered heating.

It is also noted that all modelling was carried out before the general election on 4 July, reflecting policy and ambition prior to the new government coming into power.