The International Energy Agency (IEA) has detailed in two new reports that a rise in the deployment of solar, wind and electric vehicles (EV) has helped soften the increase of carbon (CO2) emissions across 2023.

In its newly published Clean Energy Market Monitor and CO2 Emissions Report studies, the reports showcase how the rise in both renewable and electrification across the globe has culminated in a slower increase of CO2 emissions compared to 2022.

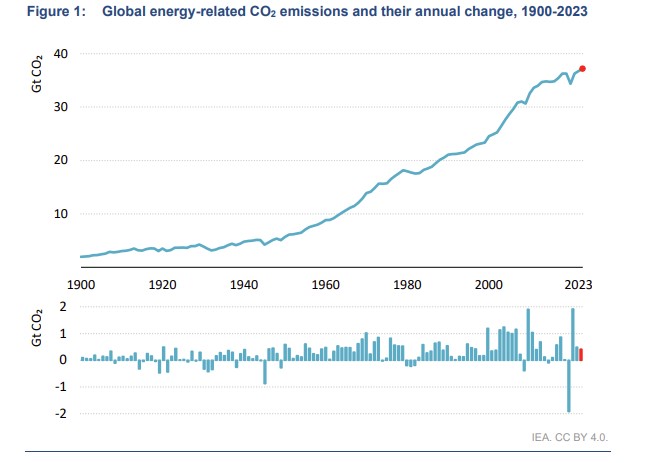

The IEA declared that emissions increased by 410 million tonnes, or 1.1%, in 2023, compared with a rise of 490 million tonnes the year before. Despite a significant rise in renewable generation having entered the market across 2023, rather alarmingly, CO2 emissions have reached a record level of 37.4 billion. You can see how emissions have changed over the years in the graph below.

It is worth noting that the IEA’s analysis indicated that an “exceptional shortfall in hydropower due to extreme droughts in China, the US and several other countries resulted in over 40% of the rise in emissions in 2023”. As a result, many countries turned their attention to fossil fuel alternatives to plug the gap, perhaps highlighting why energy storage is such a pivotal aspect of the global energy transition. Without this shortfall, it is likely that global emissions would have fallen in 2023.

The IEA noted that solar and wind generation have been crucial in curbing CO2 emissions throughout 2023. The deployment of wind and solar PV in electricity systems worldwide since 2019 has been “sufficient enough to avoid an amount of annual coal consumption equivalent to that of India and Indonesia’s electricity sectors combined – and to dent annual natural gas demand by an amount equivalent to Russia’s pre-war natural gas exports to the European Union”.

As previously mentioned, solar PV, wind, nuclear, heat pumps and EVs have all been instrumental in reducing the rise in CO2 emissions, but how has each technology performed?

Solar PV deployment sees 85% rise

Perhaps the most striking statistic from the IEA’s report comes from the solar PV market. According to the organisation, solar PV deployments saw a year-on-year (YoY) rise in 2023 to 85%.

The clean energy generation technology saw its added capacity rise from 228GW in 2022 to 420GW in 2023 – a new record. Countries leading the deployment of the technology include China, which saw its added capacity grow 2.5-fold YoY to 261GW, and the European Union, which increased its deployment from 12GW in 2022 to 53GW.

The US, a nation often regarded as a leader in the deployment of solar PV, also saw an increase to 32GW – a 50% increase YoY. The IEA noted that this was due to an “easing of supply chain issues that caused a decline in annual capacity additions in 2022”. Federal tax incentives and state-level support also supported the deployment of utility-scale and rooftop solar PV installations.

To learn more about solar, read our sister publication PV-Tech’s analysis of the IEA’s reports.

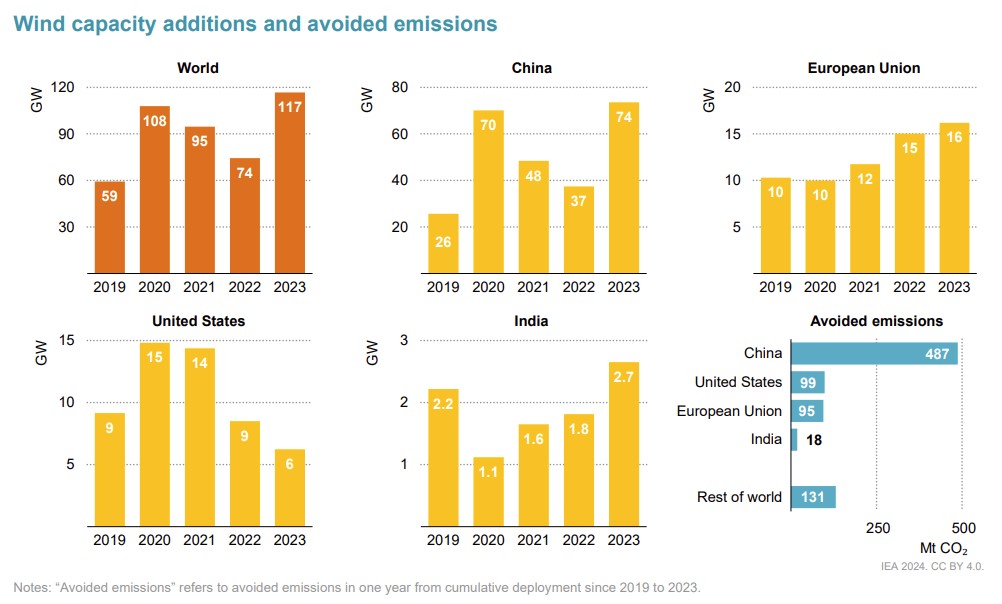

Global wind additions jump by almost 60%, but challenges remain

Global additions in wind surged from 74GW in 2022 to 117GW, representing an increase of nearly 60%. Like solar, China’s additions accounted for more than 60% of the global wind expansion.

As shown in the graph above, China installed the same amount of wind capacity in 2023 as the rest of the world in 2022, showcasing the pace of the Chinese renewables sector.

In the European Union, wind additions increased slightly less than 10% in 2023, with onshore wind deployment slowing down. Developers have faced various challenges in the region, the IEA said, including rising equipment costs, inflation and supply chain constraints, all of which have made developers less interested in participating in competitive auctions such as the UK Contracts for Difference (CfD) scheme.

Across the pond, the US witnessed a decrease in deployment YoY by more than a quarter. The IEA stated that this was mainly due to uncertainty over the tax credit extension before adopting the Inflation Reduction Act (IRA), resulting in an empty project pipeline and supply chain issues.

The organisation did note that wind capacity additions are expected to “increase significantly” in the coming years, driven by “long-term policy visibility provided by the IRA”.

In India, a more significant number of projects awarded in previous years led to a year-on-year deployment increase of almost 50%.

The biggest issue impacting the offshore wind industry is investment costs, which have increased by more than 20% compared to a few years ago, the IEA said. As such, across 2023, developers have cancelled or postponed 15GW of offshore wind projects in the US and the UK because pricing for previously awarded capacity does not reflect the increased costs facing project development today.

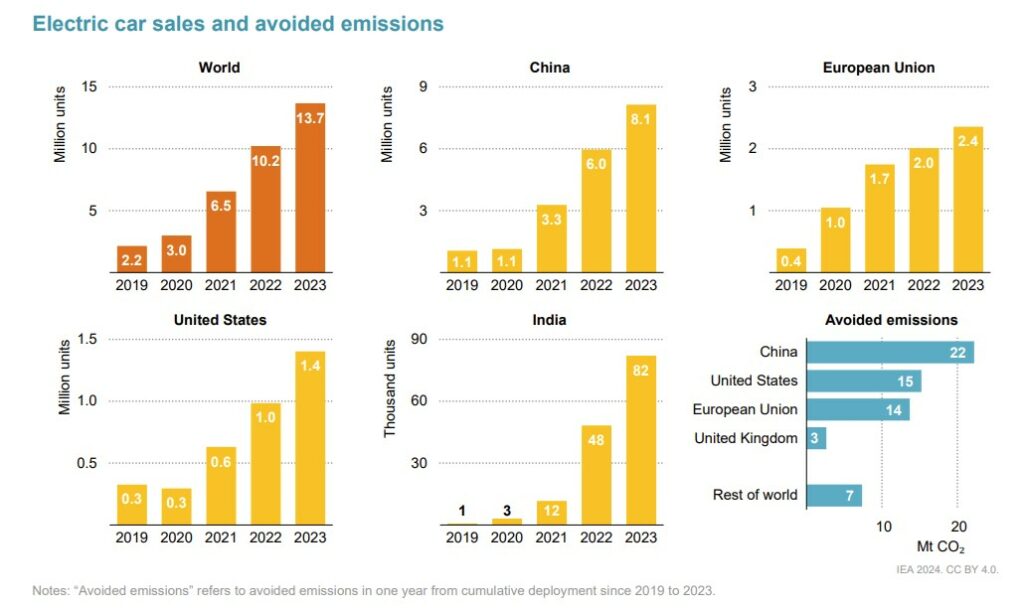

EV sales rise by 35% in 2023

Turning attention away from renewable energy generation, EV sales and increased adoption rates also contributed to reducing CO2 emissions. According to the IEA’s reports, 2023 saw 13.7 million sales meaning that one-in-five cars sold globally were electric.

This figure means that EV sales were 35% higher than in 2022 and more than six times the level witnessed in 2019. Between 2019 and 2023, EV sales have seen an average annual growth rate of 60%.

Much like solar and wind, China remains the largest market for EVs, with over eight million sold in 2023 – almost 60% of global sales. This means that more than one in three cars sold in China are electric.

Following China, the European Union remains the second largest EV market, with around 2.4 million units sold in 2023. In comparison to 2022, EV sales increased by around 20%. Although not mentioned by the IEA, the UK’s EV sales continue to rise, with the UK hitting its millionth EV in January 2024.

In the US, the third largest market for EVs, around 1.4 million were sold in 2023, representing an increase of more than 40% compared to sales in 2022. Around one in ten cars sold in the US last year were electric.

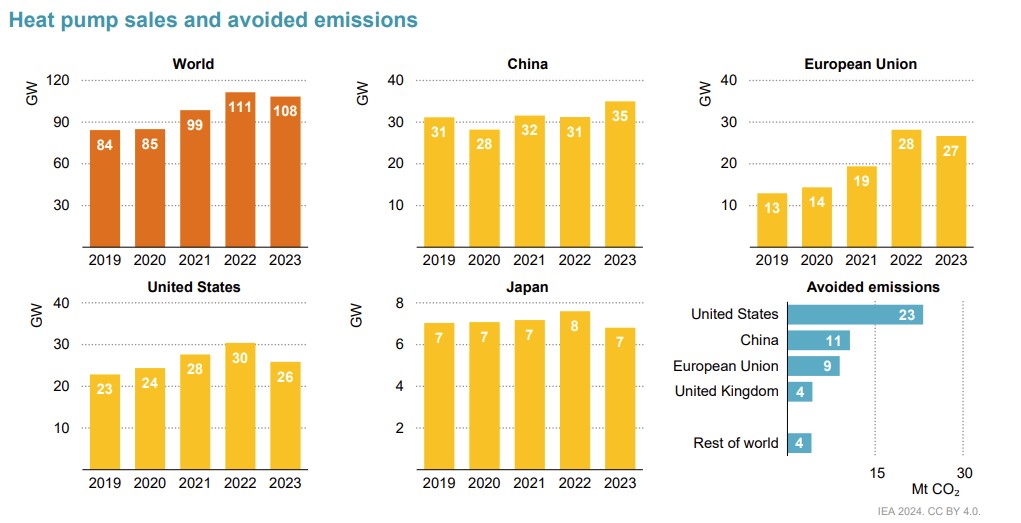

Heat pump sales stagnate following two years of growth

Despite the positives witnessed in the solar PV, wind generation and EV markets, heat pumps saw a 3% decrease in global sales following two consecutive years of growth fuelled by the energy crisis.

The IEA stated that the decrease in heat pump sales is due to a culmination of different aspects. Firstly, the slowdown reflects a broader aversion to large-ticket purchases among consumers amid higher interest rates and inflation. Secondly, natural gas prices have mostly declined from their peaks in 2022, and people are more inclined to save money than spend on heat pumps.

In the UK, the government has worked hard to maintain adoption rates for heat pumps. For example, in October 2023, the government increased the Boiler Upgrade Scheme grant from £5,000 to £7,500, making the technology cheaper than a gas boiler, tackling a huge deterrent for the technology.

China was the only “major market” where heat pump sales grew, with a rate of 12% for the year. The US saw its heat pump sales decrease YoY by 15%, partly due to postponed purchases, and Japan, another mature market, also saw its sales decline by 10%.

Heat pump sales in the European Union decreased by 5%, as seen in the graph above. This was attributed to a steadying of interest following the energy crisis. The IEA also stated that the construction of new buildings, where many new heat pump units are installed, slowed. Germany, however, saw a significant increase in sales YoY in the region of 50%.

Installed electrolyser capacity sees ‘remarkable surge’

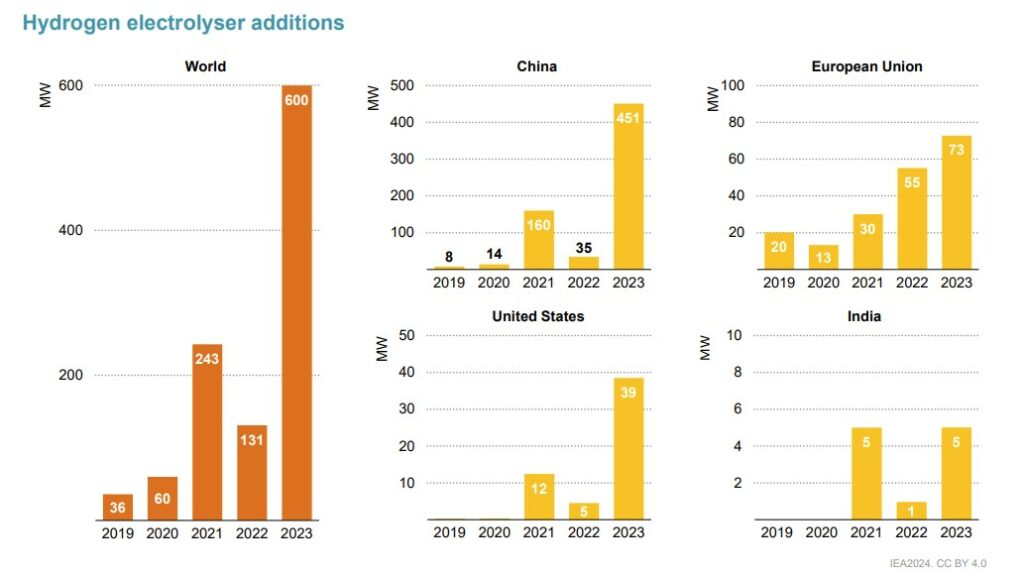

Another noteworthy technology highlighted in the IEA’s reports is hydrogen, specifically the technology used to produce the energy carrier, electrolysers. In 2023, global installed capacity exceeded 1GW to reach 1.3GW, marking what the IEA dubbed a “historic milestone in the energy landscape”.

Notably, the capacity added in 2023 nearly matched the cumulative global installed capacity up to 2022. However, the IEA said it is still far from the annual multi-gigawatt additions required to keep climate goals within reach.

In what is still a market in its infancy, China has emerged as a dominant force, reaching an installed capacity of more than 650MW by the end of 2023. This is close to half the global installed capacity.

According to the IEA, this transformation has been fuelled by Chinese developers’ scaling up of project sizes, with several projects now exceeding 100MW in capacity. This includes six of the world’s “largest operational electrolysis projects”.

Elsewhere, the European Union saw its added installed capacity exceeding 70GW in 2023, making it the second-largest market for hydrogen. The US emerged as the third-largest market, with additions exceeding 30MW.

Current±’s publisher Solar Media will host the Green Hydrogen Summit on 17-18 April 2024 in Lisbon. The event will explore green hydrogen’s role in shipping, its production, supply chains, financing and renewable hydrogen derivatives and their applications. For more information, go to the website.