New research from Cornwall Insight has revealed that Ireland’s power prices are expected to drop by 14% over the next 12 months.

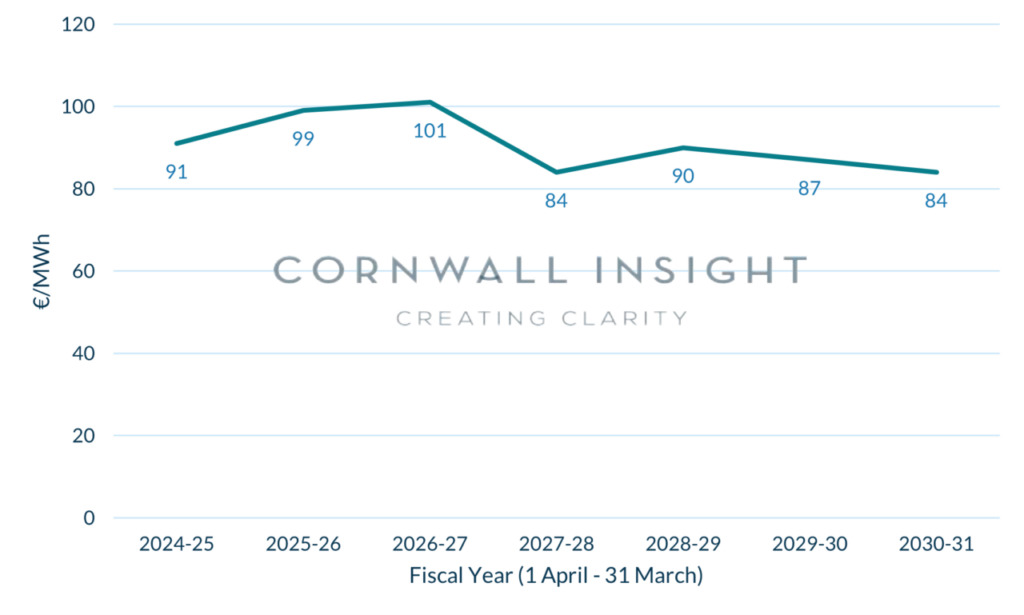

Prices are expected to reduce from an average of €106 (£90) per MWh during the previous 2023-24 fiscal year to €91 (£77) per MWh over the 2024-2025 fiscal year.

According to Cornwall Insight, the mild winter, coupled with ample gas stocks in Europe, have reduced the need for a gas injection over the summer to meet targets, meaning gas prices continue to fall.

Despite the significant reduction, the impact of Europe’s increased reliance on Liquefied Natural Gas (LNG) shipments following the sanctions on imports from Russia is expected to keep Irish prices above historical averages.

For the foreseeable future, prices are expected to remain between €90/MWh (£70/MWh) and €100/MWh (£85/MWh). As more renewables are built to meet the 80% renewable generation target by 2030, they will continue to decrease.

While the growth in renewables will lead to a slight price reduction from 2028-2029, the fall in prices will be tapered by increasing demand and the completion of the Celtic and MaresConnect interconnectors.

Tom Musker, Modelling Manager at Cornwall Insight: “Our forecasts continue to paint a brighter picture for power prices, with this year’s average power price now expected to be lower than 2023-24. This can only be good news for Irish consumers, who, despite recent energy price falls, are still grappling with high energy bills during a cost-of-living crisis.

“Of course, it’s crucial to stay realistic; Ireland’s dependence on imported energy leaves the country, and much of Europe, at the mercy of global energy price fluctuations.

“While the energy market remains relatively stable at the moment, unforeseen events could once again shake up the system and lead to spikes in prices.”

Ireland’s outlook

Ireland’s energy system future looks expansive, with higher electricity demands expected and a growing domestic renewable energy industry.

In January 2024, the International Energy Agency (IEA) reported that Ireland’s electricity demand had risen by 2%, making it one of the few countries in Europe to record an increase in 2023.

Across the year, coal generation fell 17% year-on-year (YoY), alongside a modest decline in gas-fired output of 1.2%.

Renewable generation remained stable, as a decline in wind was buoyed by increases in solar, hydro, and biomass generation. However, it is also worth mentioning that wind generation made up about 33% of total power generation in 2023.

According to the IEA, Ireland is forecast to have the highest demand growth rate in Europe for electricity demand and consumption, where it is expected to rise by, on average, almost 7% per year.

Data centres are expected to contribute hugely to this, with Irish data centres estimated to have consumed around 5.3TWh of electricity in 2022, up by 31% in 2021. This is around 17% of the country’s electricity demand and almost equal to the consumption in all urban dwellings, the IEA said.

The ramp-up of renewable projects in Ireland has also been noted. In March 2024, SSE Renewables and Bord na Móna announced a 50:50 joint venture that aims to deliver an 800MW onshore wind portfolio to Ireland.

The two low-carbon energy companies plan to invest upwards of £850 million in the portfolio over the next decade, focusing on the Irish Midlands.

The portfolio will include onshore wind farm projects, namely Lemanaghan Wind Farm in northwest Offaly, Littleton Wind Farm in Tipperary, and Garryhinch Wind Farm on the Laois-Offaly border.

These three projects have the potential to collectively deliver approximately 250MW of new renewable energy generation for the country. The companies will also invest in a portfolio of “future development prospects to add the remaining 550MW of onshore wind capacity.