Research group Cornwall Insight has updated its 2024 power market forecast to include an 18% drop in prices due to high gas storage levels in the EU.

The volume of gas stored in the EU was higher than expected going into 2024, meaning less gas is required for summer refills, resulting in a reduction in prices.

The reduction serves as a stark contrast to the predictions made in Cornwall Insight’s third quarter (Q3) Power Market Outlook to 2023, which forecasted prices reaching three times the pre-2021 average.

The energy consultant’s report initially predicted an average of €186.62/MWh (£160.51/MWh) in Q3 and then €152.54/MWh (£131.2/MWh) in Q4, showing a drop of more than 34MWh.

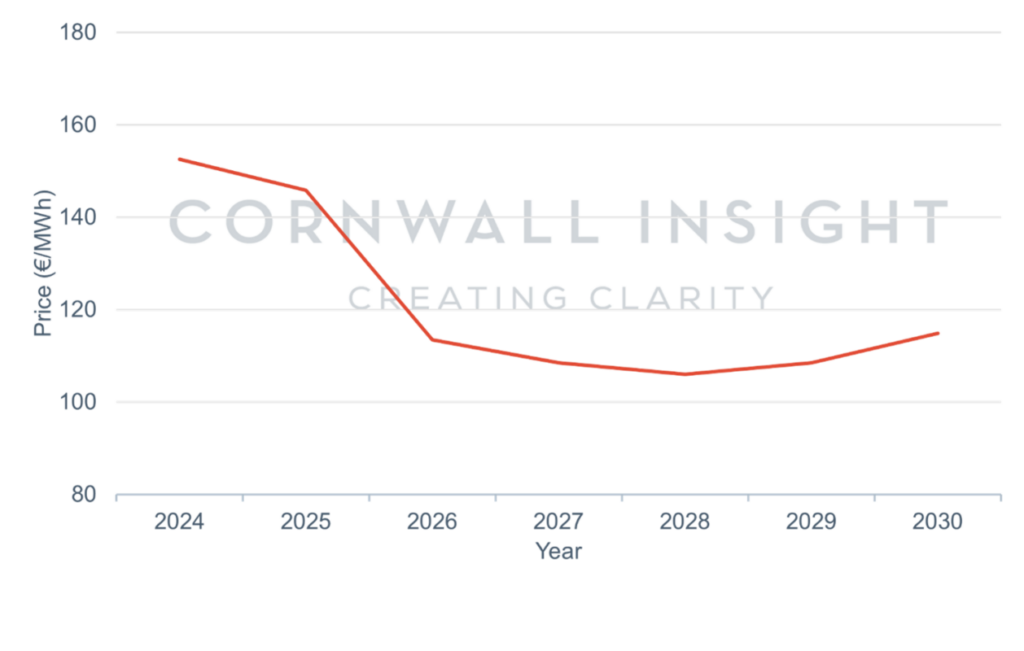

As it stands, Cornwall Insight forecasts a steady annual decline in power prices to the lowest average of €106.09/MWh in 2028, after which point it begins to increase again.

Ireland is currently working its way towards an ambitious target of 80% renewable energy by 2030, the path to which is forecast to include further power price reductions.

Sarah Nolan, senior modeller at Cornwall Insight, said: “While Irish energy prices will likely remain higher than pre-crisis levels for the foreseeable future, Ireland’s renewable ambitions are pushing towards a more stable and sustainable energy future. The energy landscape is changing, and while the road ahead may not be smooth, Ireland is firmly on the right track.”

Ireland’s mission to renewable energy

A large element of Ireland’s journey to 80% renewable energy by 2030 has been the introduction of the Renewable Electricity Support Scheme (RESS), a government subsidy programme which allows renewable projects to bid in auctions for contracts to provide electricity at a guaranteed price.

The first auction (RESS-1) was launched in 2020 and was a booming success, far superseding the 10% of available capacity that was expected to be sold by selling 34% (796MW) of solar instead.

The second auction was another success, however the third auction (RESS-3) faltered in their stead.

Irish grid operator EirGrid reported that the onshore wind and solar volumes provisionally procured in the third auction represented roughly 12% of the renewable capacity; a significant drop from the 34% sold in RESS-1.

There were strict planning restrictions for RESS-3 bids that have since been criticised by members of the industry for penalising developers too harshly.

These criticisms were heard by the Irish government, who then published a new Planning and Development Bill in November 2023, which introduced statutory timelines for decision making to prevent similar issues from arising in the future.

Nevertheless, companies successful in their RESS-3 bids bring great promise to Ireland’s renewable energy industry, especially Ørsted.

The clean energy developer secured planning permissions for a 160MW solar farm in Carlow and a 55MW farm in Cork, and is expecting to begin construction on the 81MW Garrenleen solar farm in Spring 2024.

The government also agreed to a memorandum of understanding (MoU) named ‘Cooperation in the Energy Transition, Offshore Renewables and Electricity Interconnection’ with the UK in September 2023.

The MoU aims to increase cooperation for developing offshore renewable energy, explore further electricity interconnection opportunities and enhance security of gas supplies.

Moreover, the North Seas Energy Cooperation (NSEC) published its offshore wind roadmap for the country, detailing an indicative construction schedule for several projects up until 2038.

The NSEC has said that the results from these projects will ensure Ireland meets its target of installing 20GW of offshore wind capacity by 2040.