Ofgem’s ninth report on the operation of the capacity market (CM), covering the period between 1 October 2023 and 30 September 2024, shows the 2023/24 T-4 auction received 810 prequalification applications.

There were two auctions scheduled during the 2023-24 period, with the T-4 auction set for delivery in 2027/28 and the T-1 auction, to be delivered over 2024/25.

Ofgem provides the secretary of state for department for energy security and net zero with the annual report, covering the auction outcomes and prequalification process. The CM was introduced in 2014 to maintain sufficient capacity to ensure security of electricity supply.

It provides revenue in the form of capacity payments to potential capacity providers. in return, capacity providers must commit to delivering electricity at times of system stress. Participation in the CM also means providers are liable to pay a penalty if they fail to provide the support needed.

Of the 810 applications for T-4, totalling 44.2GW of de-rated capacity, a total of 616 prequalified capacity market units (CMUs) participated in the auction process, accounting for a total 44.2GW of de-rated capacity.

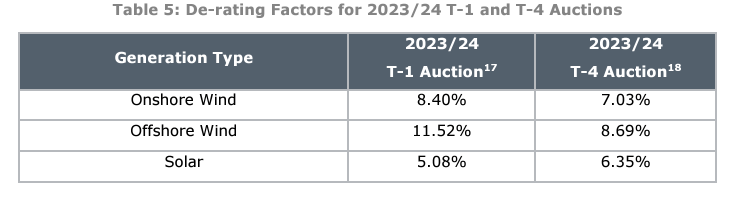

Battery storage CMUs accounted for a significant share of derated capacity that was unsuccessful in prequalification, totalling 52% (1.6GW). De-rating factors are applied to applied to different technology classes to represent how their ability to meet the reliability standard is limited by intermittency and non-dispatchability.

The 2023/24 T-1 auction saw a total of 370 prequalification applications submitted by CMUs totalling 10.0GW of de-rated capacity. The final number of prequalified CMUs for the T-1 Auction was 335, totalling 9.8GW of de-rated capacity.

The T-4 auction cleared at a price of £65.00/kW/year and approximately 42.8GW of de-rated capacity were awarded capacity agreements. Gas CMUs gained the most de-rated capacity in the auction at approximately 28.7GW—over half (67%) of the total de-rated capacity procured in the auction.

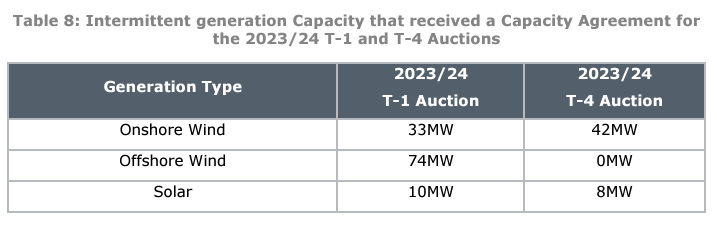

About 50MW of onshore wind and solar de-rated capacity secured a capacity agreement (0.12%) in T-4. No offshore wind bid into the CM for the 2027/28 period. The T-1 Auctions cleared at £35.79/kW/year, at £35.79/kW/year—40% less than the £60/kW/year cleared in the 2023/24 auction.

A total of approximately 7.6GW of de-rated capacity was awarded capacity agreements. Gas CMUs were most awarded in the auction, although the proportion of the total was lower than in T-4, with gas accounting for approximately 2.9GW (39%).

This was closely followed by nuclear CMUs with approximately 2.7GW (36%) of de-rated capacity. T-1 saw a total of 118MW renewables secure capacity agreements, accounting for 2% of the total.

All of the onshore wind applicants received a capacity agreement, just over half of offshore wind did and all but 2MW of bids for solar capacity were successful.

At the end of July, the UK government concluded consultation on CM reform aiming to improve security of supply, align the scheme with net zero goals and improve its functioning.

To support battery participation in the CM, the government will introduce a definition of ‘permitted battery augmentation’ for battery storage CMUs within the CM rules. Permitted battery augmentation will allow CMUs in a “storage generating technology class that is duration limited” to replace and/or add batteries at an existing CMU site, to enable batteries to maintain the level of capacity required to meet extended performance test (EPT) requirements.