Flexibility marketplace Piclo is targeting further international expansion into new regions across Europe, the US and Asia-Pacific, having raised £8.3 million.

It raised the funds through its now closed Series B funding round, which was co-led by Future Energy Ventures (FEV) and Clean Growth Fund (CGF), followed by existing investor Green Angel Syndicate and new investors Toshiba Energy Systems & Solutions (Toshiba ESS), Sustainable Future Ventures (SFV) and Japan Energy Fund (JEF).

“We are delighted that our investors have chosen to support Piclo and enable our vision of a decarbonised grid by 2050,” said James Johnston, CEO at Piclo.

“We believe that flexibility solutions through our marketplace have a critical role to play in the global journey to net zero and will help deliver increased energy security at lower cost, building on the great progress we’ve already made in the UK. It is an exciting time to be part of a UK cleantech ecosystem that will deliver the solutions we need to achieve net zero. Whilst we had minimal exposure to SVB, we applaud the quick action of the US and UK authorities which has reassured the business community.”

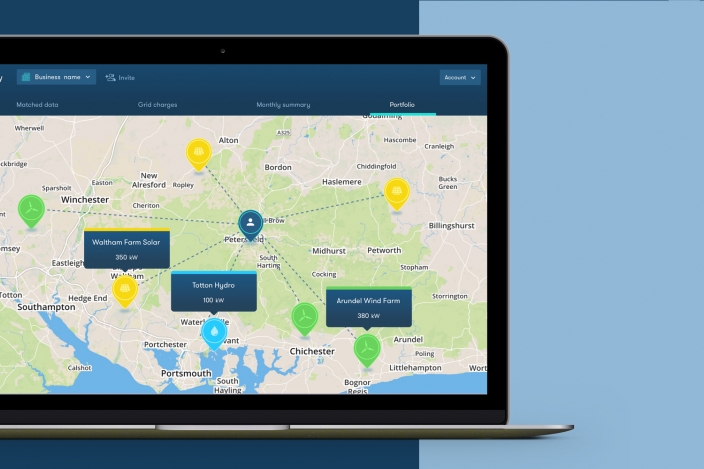

The company’s Piclo Flex platform is already the world’s largest flexibility marketplace, according to the company. There are over 55,000 assets registered on it, representing over 16GW of flexibility.

Since Piclo was launched in 2013 by Johnston along with Andy Kilner and Alice Tyler, the platform has facilitated 1.1GW of flexibility capacity worth over £57 million.

Piclo Flex has already been rolled out in six global markets, including: the UK, where Distribution System Operators UK Power Networks, SP Energy Networks, and Electricity North West use it; and the Transmission System Operator NG ESO uses it; in Ireland where ESBN uses it; in Italy where E-Distribuzion uses it; in Portugal where E-REDES uses it; Lithuania where Energijos Skirstymo Operatorius AB (ESO) uses it; and in the United States in New York State where National Grid uses it.

“We are thrilled to invest in this fast-growing company which has a crucial role to play in the decarbonisation of the energy system and in the transition to a net zero future,” said Jan Lozek, managing partner and co-founder at Future Energy Ventures.

“Given volatile supply and demand patterns and location mismatches between renewable generation sources and major energy consumption centres, flexibility is key to accelerating the energy transition and balancing the energy system. We believe Piclo’s digital marketplace platform is central to that and estimate the company’s long-term cumulative impact potential by 2050 could reach 1.0 GtCO2e, which is c.a. 2.5% of the total global GHG emissions in 2021.”