Consultancy Cornwall Insight has signalled that the year-on-year growth for publicly accessible chargepoints for battery electric vehicles (BEVs) has “substantially dropped” in Q3 2023.

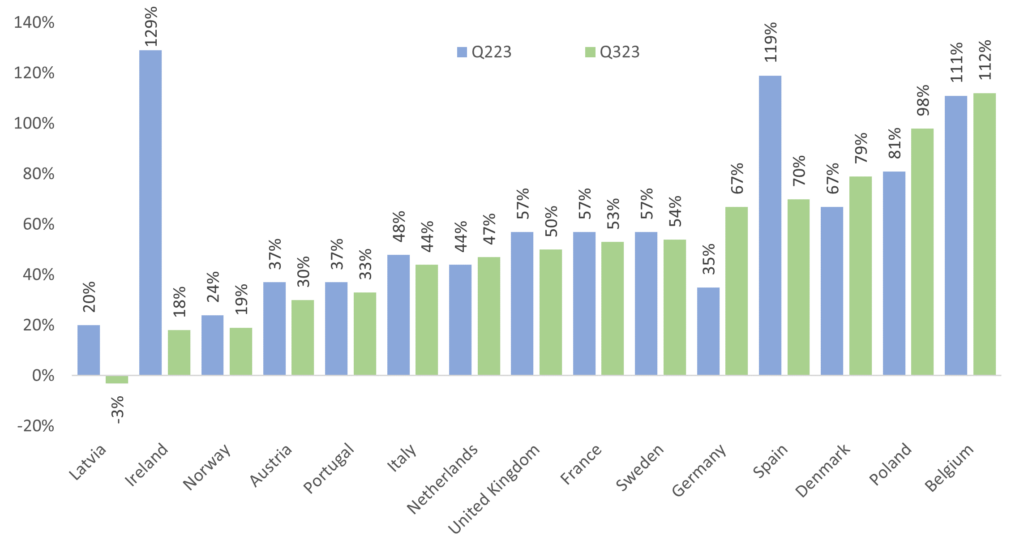

The data that has been analysed for Cornwall Insight and law firm Shoosmiths’ for the Electric Vehicle Country Attractiveness (EVCA) Index has seen Ireland’s growth decrease from the staggeringly high 129% in Q2, to just 18% in Q3.

This could raise eyebrows into the growth of the infrastructure to support EVs.

There are genuine fears with this too. Cornwall Insight explained that although the Irish network needs an estimated 2,540 – 4,850 new chargers by 2025, such a drop off in growth could act to slow the country’s EV transition.

There is, however, cause to be optimistic with Ireland’s Budget 2024 expected to bring clarity and incentives for the industry. This could include an extension to the vehicle registration tax relief and benefit-in-kind tax rates for BEVs until 2025.

Ireland is also in the process of developing a national delivery plan of en-route charging which is expected to be released before the end of 2023. Cornwall Insight believes that this could mean that the nation plans to “reinvigorate” itself for 2024.

Jamie Maule, research analyst at Cornwall Insight said: “Ireland’s recent slowdown in EV charge-point growth is a reminder that we cannot rest on our laurels when it comes to EV adoption. Any dip could derail the transition, and with Ireland’s EV programme at an earlier stage than many major European countries, it is essential they keep up momentum.

“While this decline is certainly not good news, we are hopeful that it is temporary. The Irish government has taken some positive steps to support the EV market moving in to 2024, and we are confident that the country will be able to get back on track.”

UK government urged to step up support for EVs

In other news, Cornwall Insight has stated that setbacks in UK support programmes, such as the Rapid Charging Fund, cuts to EV passenger car purchase incentives for most consumers, and a rollback on petrol and diesel vehicle rollout targets have seen the UK drop behind much of Europe in the race to grow its EVs.

Interestingly, the report outlines that the UK’s BEV fleet has experienced slower growth of 37% in the past year, down from the 42% experienced in the year prior.

Adding further concerns to the UK’s EV growth, new trade tariffs could further discourage investment in the EV sector.

Of these, Cornwall Insight flagged that the impact of the Rules of Origin Tariffs on EVs not manufactured within the EU could add-on approximately £3,400 to EU-made EVs sold in the UK and £3,600 to British-made EVs sold in Europe.

Discussions continue around potential delays to the implementation of the tariffs currently scheduled for January 2024, with the UK proposing a delay until 2027. When these tariffs are implemented, the cost-gap between EVs and fossil-fuel vehicles could widen by a significant amount, as petrol and diesel vehicles will be unaffected.

Commenting on this, Maule added: “The government needs to implement a more consistent and holistic approach to EV support, to avoid casting a shadow over the nation’s EV industry. While EV sales continue to rise at a respectable rate, the government’s wavering commitment has created an unstable environment for investors, potentially jeopardising the development of a robust domestic supply chain and exposing potential buyers to higher costs.

“The Autumn Statement’s pledge of financial and policy support offers some hope. However if the UK is to establish itself as a true leader in EV growth, we will need to see both sustained government funding and the cultivation of a fully supportive regulatory framework.

“The introduction of tariffs for EVs made outside the EU would add another entry into the ‘cons’ column for investors looking at sites in the UK and would push up prices for UK drivers buying EVs from Europe. Question marks remain over whether the EU will agree to the three-year delay being touted by the UK. Without it, the UK’s EV transition faces a tougher road ahead.”