Cornwall Insight has stated that the rising cost of capital threatens to derail the expansion of renewable energy projects such as onshore wind and solar PV.

With the rising costs of capital, the consultancy believes that already commissioned projects are now becoming financially unviable, meaning many potential projects could well be put on hold until financing is acquired. This delay could have severe consequences on the nation’s net zero ambitions.

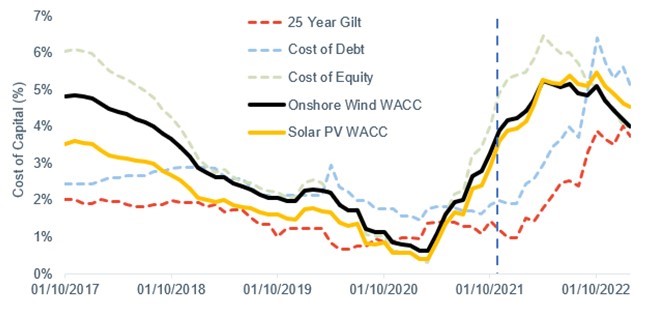

Inflation and interest rates, which have both risen sharply due to cost-of-living crisis, supply chain problems and labour shortages have culminated in the amount of obstacles plaguing the renewable generation sector. Cornwall Insight’s data revealed that the weighted average cost of capital (WACC) for renewable projects by about 4% since early 2021.

This could have a major implication on the successful Contract for Difference (CfD) scheme which will soon launch its fifth allocation round (AR5). As a result of these growing costs, developers are becoming increasingly concerned about bidding for projects in the next CfD auction with fears they may not get a return on any investments they make.

One of the primary concerns is the increase levelized cost of energy (LCOE) with many fearing that it may lead to higher strike prices in the fifth allocation round.

Despite this, the consultancy believes that the inclusion of offshore wind into the same pot as solar PV and onshore wind could facilitate greater competition and reduce submitted prices.

“With all the upwards pressure on strike prices, investors and developers are rightly worried about the government’s cap going into the fifth round of the CfD scheme. After all, if the high cost of capital cannot be compensated for by an increase in the return, the money will simply not be enough for projects to be successful and could act to stifle competition and deter investors and developers from bidding for renewable projects,” said Jamie Maule, research analyst at Cornwall Insight.

“Past projects could also be at risk of failing, with concerns that the strike prices bid may not be sufficient to cover rising costs, jeopardising their profitability and sustainability in the long run.

“Even if AR5 strike prices remain low, as a result of high competition or due to optimistic bidding, rising capital costs may still act as a barrier to the type of large-scale investment needed if the UK is to reach net zero. The added competition from the US and EU for international investors will only add to the challenge.”

Cornwall Insight’s latest data echoes the thoughts of Energy UK, which last month said that due to the Electricity Generator Levy, current inflation levels and supply chain difficulties, costs in developing low carbon generation projects increased by between 20% to 30%, with some quoting 50% for specific projects.