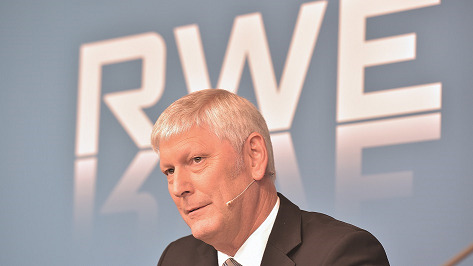

Rolf Martin Schmitz, the chief executive of German energy giant RWE, has said his company is casting at least one eye on the UK energy market for future M&A activity.

Speaking to German newspaper RP last weekend, Martin Schmitz discussed a range of topics including its ownership of clean energy spinoff innogy and its strategy for the coming years.

He said that RWE, which trades as npower in the UK, would be continuing to investigate opportunities for M&A in the UK due at least in part to the certainty offered to power providers through the capacity market.

“We examine opportunities when they offer themselves, opportunistically, in countries where we are active: Germany, Great Britain, Benelux. Basically all regions are interesting in which electricity is particularly scarce,” he said.

RWE has continued to be linked with a number of acquisition targets since disclosing at a capital markets day in March that it was looking at “selective and opportunistic” targets for further M&A activity.

This has included competitor EDF’s nuclear-focused spin-off Uniper, who Martin Schmitz would not be drawn on to discuss by RP.

The UK’s capacity market will be of considerable interest to RWE given how it offers long-term power purchasing contracts via its auctioning process to guarantee security of supply. Germany currently has no equivalent mechanism, piquing RWE’s interest in UK-based acquisition targets.

RWE is no stranger to M&A activity in the UK energy market. Late last year innogy – the clean energy spin-off of which RWE owns nearly 80% – signalled its intent by acquiring Belectric’s solar and battery storage business to plug a gap in its expertise.