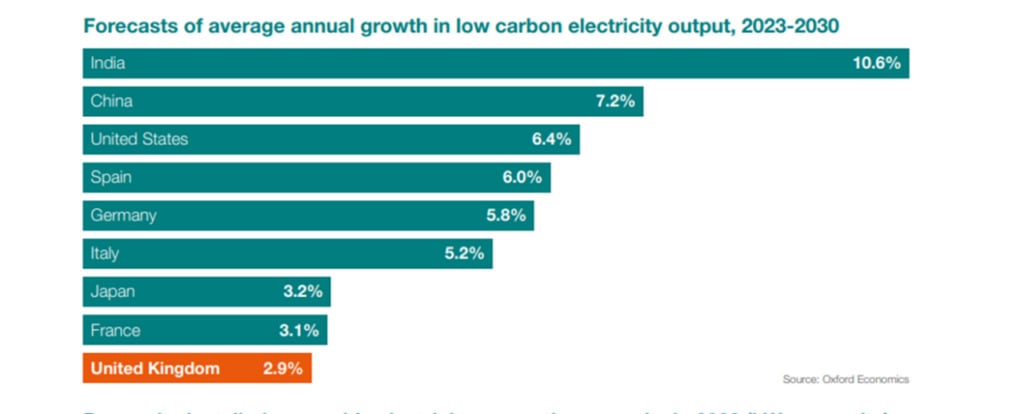

Energy UK has revealed that the UK is forecast to have the slowest growth in low-carbon electricity generation of the world’s eight largest economies between now and 2030.

In a new programme analysing how to remedy the UK’s “weakened investment [renewables] climate”, the trade association highlighted the pressing need for renewable investment incentives.

The UK also has one of the lowest renewable capacity per capita – lower than both the EU and US – at 0.9kW per capita, compared to Germany and France with the highest of 1.8kW per capita.

The Clean Growth Gap – supported by Oxford Economics – attributes low levels of expected investment in UK renewables as one of the leading factors to this “downbeat” forecast.

The unquestionable necessity of private sector investment

According to the Office for Budget Responsibility (OBR) the estimated cumulative investment cost of the UK achieving its net zero by 2050 goal is £1.4 trillion in 2019 prices. This is more than ten times over the government’s estimated capital investment spending in 2023-24.

This means that private sector investment is doubtless necessary to achieving net zero goals as the OBR estimates that over 70% of the UK renewable energy investment must be drawn from the private sector.

The “changing face of global competition”

Recent developments in the international clean energy market mean the UK is at serious risk of losing green energy investment, the report warned.

International incentives such as the US’ Inflation Reduction Act (IRA) or the EU’s Recovery and Resilience Fund or the RePower EU scheme currently offermore attractive incentives for investors than the UK.

In contrast, Energy UK has warned that the UK is removing existing investment incentives through reducing the Contracts for Difference (CfD) scheme budget from £285 million to £205 million in the latest funding round.

Energy UK warned that this leaves a “risk that investment in green energy infrastructure will be pulled from the UK to countries with more attractive regimes”.

Re-routing back to net zero

Despite current regulatory flaws, Energy UK maintained that the UK still has the potential to establish itself as a global leader in green technologies.

The Clean Growth Gap will publish a series of reports and new analysis as the organisation begins to unpack the case for the UK, establishing what options are available for the government.

“At the heart of a successful energy transition is the need to attract investment. The scale of the transition and increasingly constrained public finances mean the vast majority of this investment must come from the private sector,” wrote Emma Pinchbeck, CEO of Energy UK during the first reports Foreword.

“This investment has the capacity to transform our economy and bring jobs, skills, and growth to the areas that need them most. Whether its well-established technologies like renewables and network infrastructure, the strategic export opportunities of the future such as EVs and batteries, or more nascent technologies like CCUS, hydrogen and electrified heating, clean energy investments have the potential to profoundly improve our lives.

“Beyond the obvious environmental benefits, clean energy projects provide countless opportunities for British workers and businesses, reduce our energy bills, and ensure our energy supplies are never again endangered by turbulent geopolitics.”

The report echoes sentiments from National Grid ESO, as covered by Current±, who in a recent webinar called for investment reform to achieve the “unprecedented” levels of investment in terms of scale and pace required for the UK to reach net zero.

Current± publisher Solar Media is hosting the third edition of its Wind Power Finance & Investment Summit Europe in London this 19-20 September. The conference will focus on investment strategies, alleviating bottlenecks, and which countries and technologies are the most exciting ahead as the industry sets to expand to help reach 2030 targets. Packed with industry leaders representing financiers, investors, developers, government departments and more this is the leading conference for decision makers in the European wind industry. More information, including how to attend, can be read here.