National Grid ESO (NGESO) has published its Summer Outlook 2024, detailing a season of interconnector reliability and lower balancing costs than the previous year.

The Summer Outlook report breaks down the system operator’s anticipated figures into three categories: demand, supply and operability.

Demand

ESO has signalled that seasonal normal minimum transmission system demand for summer 2024 is expected to be marginally higher than last summer’s weather-corrected outturn, with high summer peak demand falling slightly.

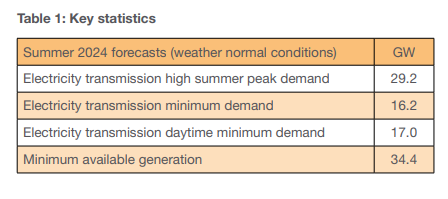

The organisation expects seasonal normal minimum demand to be 16.2GW and to occur overnight and seasonal normal high summer peak demand to be 29.2GW.

It is also worth noting that the observed minimum demand could be as low as 13.5GW under a one in ten-year weather pattern.

As is regularly expected, there will be scheduled outages over the summer, with ESO saying that the period between 1 June and 31 August, or weeks 23 to 35, is when it expects the greatest number of planned generator outages.

Supply

NGESO has indicated that there are no concerns about supply meeting demand for this summer but highlighted that similar to last year, the UK will be relying on importing from continental Europe.

The publication stated that the system operator expects to see net imports into the UK as both baseload and peak forward electricity prices are higher than those on the Continent.

It also said that weather conditions and events on the day may impact the pattern and levels of imports or exports seen over the interconnectors, which will be the avenue for these imports.

Interconnectors with continental Europe saw high levels of imports during summer 2023, with 74% of total summer periods seeing imports. This was significantly different from the summer of 2022, when the UK was a net exporter.

ESO noted that it expects to manage periods where inflexible generation, interconnector imports, and wind output exceed minimum demand.

Therefore, it will need to take action to manage this, including pumping or charging storage, curtailing wind, and trading on the interconnectors to reduce imports.

The outlook report says interconnectors will be “mutually beneficial” during the summer, allowing for the UK and continental Europe to support each other in times of peak demand.

This relationship comes after the “world’s longest” onshore and subsea interconnector was officially switched on in December 2023.

Connecting the UK and Denmark, the £1.7 billion Viking Link will initially operate at a reduced capacity of 800MW due to system constraints put in place by the Danish System Operator, Energinet. This will gradually be increased to 1.4GW over 2024.

The link stretches for 475 miles under land and sea to join the Bicker Fen substation in Lincolnshire with the Revsing substation in southern Jutland, Denmark. It is worth noting that this is National Grid’s sixth interconnector, which started development in 2019.

National Grid launched the UK’s first interconnector (IFA) to France in 1986. Since then, it has built five more, including a second link with France (IFA2) and further connections with The Netherlands (BritNed), Belgium (Nemo Link) and Norway (North Sea Link).

Moreover, just last month, regulation watchdog Ofgem recommended the approval of two 3.2GW high-voltage interconnectors between Britain and Europe.

One of the projects being considered is LionLink, a 1.8GW ‘Offshore Hybrid Asset’ (OHA) that would connect Britain to Dutch wind farms in the North Sea. The second is the 1.4GW Tarchon Energy interconnector, which would connect the British grid with Germany via a 610km power cable.

The regulator has launched two separate consultations on its position to fund the two projects; if approved, they will add a total of 3.2GW to Britain’s 11.7GW of interconnection capacity.

This capacity is set to increase even more upon the completion of Xlinks’ 3.6GW Morocco-UK interconnector. The National Significant Infrastructure Project (NSIP) will connect the UK to a 10.5GW solar, wind, and storage facility in Morocco.

Operability

The operability section of Summer Outlook reported a similar summer to the summer of 2023, and ESO feels assured that it has the right tools in place to maintain the system.

One aspect that was introduced since the last report is the Open Balancing Platform (OBP), which was launched in December 2023.

This, alongside the Balancing Reserves (BR) service, has meant increased flexibility in the UK’s dispatch of batteries and Small Balancing Mechanism Units (BMUs).

Research released last month from Modo Energy revealed that 12% of the UK’s total battery revenues are now coming from the National Grid ESO’s BR.

Launched two weeks prior, the BR service reduces the costs of balancing the system and provides the ESO with better visibility of reserve volume.

Since its launch, 43 batteries have participated in the service, accounting for 12% of total battery revenues. The in-merit dispatch rate for batteries reached 8.5% in the week following the launch, higher than the previous month’s record-high figure.

Prices for the positive service in the first auction were volatile, ranging from £0/MW/h to £29/MW/h, averaging £9.57/MW/h. Since then, prices have stabilised, with 87% of settlement periods seeing prices below £5/MW/h.