Swedish state energy company Vattenfall has announced in its quarterly report that it is stopping work on its Norfolk Boreas offshore wind farm due to rising costs.

The windfarm was due to output 1.4GW, but after a 40% rise in the costs of production, Vattenfall decided to suspend construction on the site. The company said that the increase in costs was putting “significant pressure on all new offshore wind projects.”

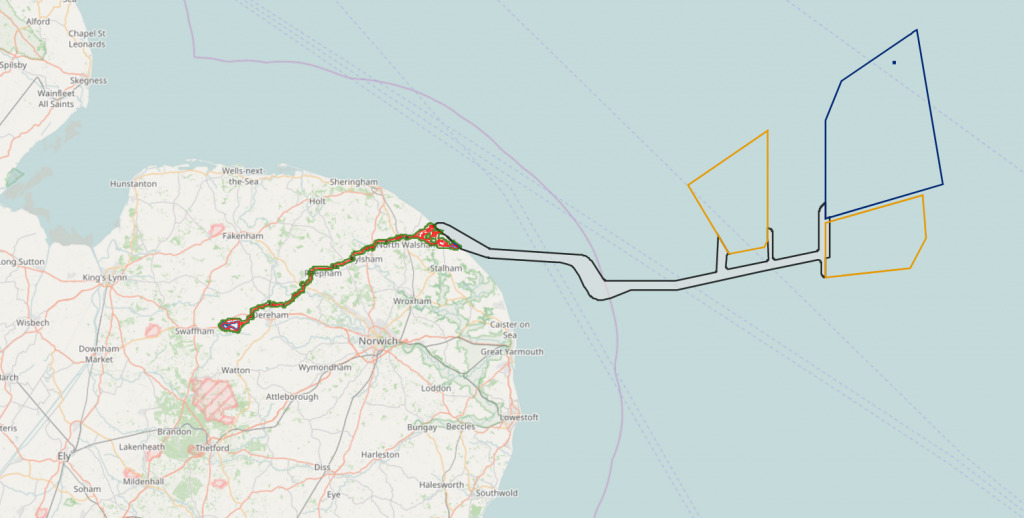

The company said it would not be taking an investment decision on the project now. The project is one of three wind farms planned by Vattenfall in the North Sea.

Companies like Vattenfall and Ørsted have been seeking tax breaks or subsidies on projects which were agreed when energy prices were lower, and which are now looking uneconomical.

Vattenfall agreed a contract to build Norfolk Boreas last year at a record low strike price of £37.35/MWh. The government is currently negotiating the next round of Contracts for Difference (CfDs) for renewable projects, with a maximum price of £44/MWh, which is considered too low by many developers.

Other projects understood to be at risk from spiralling supply chain costs include Inch Cape off the coast of Scotland.

CfDs are designed to ensure companies fixed prices to sell the electricity they generate. If the market price falls below the ‘strike price’, the government pays the difference to the company.

Companies that agreed to a record low strike price of £37.35 last year now think this is too low to ensure long term profitability for their projects.

The announcement yesterday that the UK government will heavily subsidise Tata Group’s electric battery gigafactory will also embolden companies like Vattenfall to demand more help from the government.

In June, the Telegraph reported that Catrin Juny, Vattenfall’s head of offshore wind, said that “Market conditions are extremely challenging currently, with rising costs and a supply chain crunch as well as increasing costs of capital. We are looking at the best way forward for all three projects which make up the 4.2GW Norfolk Offshore Zone and how we can work with the supply chain, including what opportunities there are for UK businesses.”

Responding to the news, wind energy trade body RenewableUK urged the government to set out new policies to enable the UK’s offshore wind pipeline.

RenewableUK’s chief executive Dan McGrail said: “Going forward, Ministers are going to have to take account of these globally inflationary pressures, which have significantly changed the economic landscape.”

“We need a stronger industrial strategy for the sector, which the Chancellor should support with new measures in the Autumn Statement as a matter of urgency. Growing the UK’s supply chain won’t only bring new jobs to Britain – it will also help to ensure we can get on with the job of building new projects to provide cheap power for consumers, strengthening our energy security and tackling climate change.”

Earlier in July, RenewableUK, Energy UK and Scottish Renewables wrote to the Secretary of State for Energy Security and Net Zero, Grant Shapps, urging the government to urgently reform the CfD scheme.

The letter said that “The current emphasis on securing renewable capacity at the lowest possible strike price – minimising expenditure rather than maximising benefit – risks creating a less attractive investment environment in the UK. The race to the bottom on strike prices incentivised by the current auction process is at odds with the reality of project costs and investment needs, jeopardising deployment targets.”