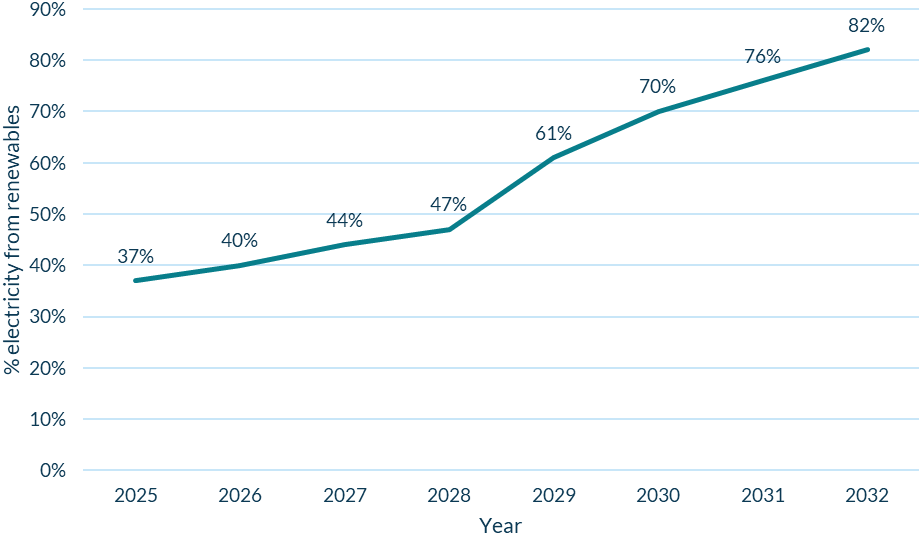

Forecasting by energy market consultancy Cornwall Insight suggests that Ireland and Northern Ireland will miss their goals of generating 80% of their electricity from renewable sources by 2030.

With the 80% target looking to be achieved in 2032, data from Cornwall Insight’s single electricity market (SEM) benchmark power curve shows that by 2030, 70% of Irish and Northern Irish electricity will be generated from renewable sources. The majority of the remaining electricity will be generated by gas plants.

There are several barriers to meeting the 2030 target, which has been included in all of Ireland’s Climate Action Plans since 2021. Namely, planning delays and grid connection shortages have been significant barriers for generators submitting bids in the Renewable Energy Support Scheme (RESS), Ireland’s answer to the UK government’s Contracts for Difference (CfD) scheme.

Concerns have been raised ahead of the RESS4 auction—the last round to procure generation that will come onto the grid ahead of 2030—that the auction price cap for onshore wind will be lower, which is likely to deter bidders.

Representative body Wind Energy Ireland has also highlighted that if planning permission timelines are not extended, “dozens” of wind developments in Ireland will have to shut down before the end of the decade.

That being said, progress has been made in both nations, as the SEM currently has the highest contribution of wind generation of any power system in the world. Forecasts also predict that the percentage of electricity from renewables will see a substantial increase, from just over 40% in 2023 to 82% in 2032.

According to data from grid operator EirGrid’s annual report, Ireland had 42% of electricity generated from renewables in 2023 and Northern Ireland had 45.8%.

Further, there have been positive steps for the RESS scheme, with changes including allowing generators to delay their required operational date by up to two years if systems operator grid connection issues or judicial reviews of planning permissions arise.

Northern Ireland is currently designing its own renewable support scheme; the first auction is anticipated for 2025/26, but much of the procured capacity would not come online until after 2030.

Kitty Nolan, energy modeller at Cornwall Insight said: “Without addressing the systemic challenges in Ireland’s renewables development process, including critical infrastructure and planning concerns, the country’s renewable energy goals will remain out of reach.

“While some may argue that the delay won’t have a significant impact, Ireland’s continued reliance on insecure imports exposes us to global market disruptions, which could drive up prices, while our dependence on fossil fuel generated power is delaying our progress toward achieving net zero.

“It’s crucial that we streamline these planning processes and invest in grid infrastructure to meet our climate commitments. Achieving the 80% renewable target is possible, but it requires decisive and immediate action from all stakeholders involved.”

High electricity demand in Ireland

A report by the International Energy Agency (IEA) found that Ireland is forecast to have the highest growth rate in Europe for electricity demand and consumption, with an average annual rise of almost 7%. Data centres are expected to contribute hugely, with the nation braced to see a rapid expansion in this sector.

Indeed, figures from the Central Statistics Office for Ireland showed that 21% of Ireland’s metered electricity consumption in 2023 was used by data centres, more than the total amount for urban dwellings (18%) and for rural dwellings (10%).

According to a post by Irish construction consultancy Mitchell Mcdermott, Ireland has risen to the top of Europe’s data centre hotspots, beating rival markets of the FLAPD group (Frankfurt, London, Amsterdam, Paris and Dublin). A recent Current± blog post explored the implications of this for Ireland.