Although many across the energy industry previously forecast that energy prices could be on the mend, recent geopolitical developments have placed recovery on a tightrope.

As I am sure many of our readers will be aware, developments in the Middle East, specifically in the Red Sea and the Gulf of Aden, have placed recovery in jeopardy due to the rising tensions in the region. Attacks by the Houthi movement, a Shia Islamist political and military organisation that emerged from Yemen in the 1990s, on international shipping freight have led to increased inflation and rising oil prices, as is being reported by the BBC.

The US and UK escalated the conflict by launching air and naval attacks on 11 January 2024 in retaliation. An international maritime coalition, Operation Prosperity Guardian, was set up to protect vessels in the area but the use of military strikes has posed the question as to whether it will be enough to protect the key shipping lane and how long this instability and tension could last.

The BBC has also reported that the Treasury has “modelled outcomes including crude oil prices rising by more than $10 a barrel and a 25% increase in natural gas”. The extent of this issue has led some to believe that a second energy crisis is looming over an already stretched Western economy.

How has the conflict in the Red Sea impacted energy prices?

According to the UK parliament, Houthis have been launching attacks against ships it says are linked to Israel, causing shipping to be diverted away from the Red Sea, threatening key trading lines and freedom of navigation.

The Suez Canal, one of the most integral shipping lanes in the globe, saw 22,032 ships pass through its waters in 2022. The conflict in the Red Sea has very much deterred many ships from passing through the Canal, instead opting to sail around the southern tip of South Africa to reach European waters.

According to Reuters, from main Asian ports, the Suez Canal route is around 8,500 nautical miles long, which equates to a 26-day trip. The South African route, also known as the Cape Sea Route, is about 11,800 nautical miles, taking as much as 36 days to navigate. With many UK oil imports from Australia, Asia and the Middle East coming via the Suez Canal, this has strained what is already a stretched energy system still on the road to recovery from the previous energy crisis.

Consultancy Advantage Utilities CEO Andrew Grover cautioned that further price increases may still occur in the current bearish energy market. Grover said: “Should the ongoing conflict escalate further, the negative bearing on world energy prices could be significant. Disruption lasting for two more weeks could increase prices further.

“This is at the forefront of our outlook as we head into 2024. Businesses should consider how they would react if further disruption does occur, and exploring the benefit of securing longer term or flexible traded contracts should be considered as a means of mitigating further volatility in the future.”

Now, according to Cornwall Insight’s forecasts, although the energy crisis has partially ended due to a surge in renewable assets being delivered onto the grid and greater energy security, energy prices are still set to remain well above the level seen before the Ukraine-Russian conflict.

This stabilisation, however, has now been thrown into jeopardy. The escalation of the conflict has seen commodity prices surge for various products, particularly oil which has already been referenced in this article. With imported oil still a key aspect of the grid, a drastic rise in pricing, as has already been observed, could mean energy prices spike yet again – much like they did when imported Russian oil and gas was embargoed.

The fact that the UK is still reliant on oil and gas has caused some within the industry to criticise the government for not scaling renewable technologies up enough and thus being subject to geopolitics.

Speaking to Current±, Peter Chalkley, director of the Energy and Climate Intelligence Unit (ECIU) said: “Two years on from the Russian invasion of Ukraine, this is a reminder if one were needed that over-reliance on oil and gas carries heavy economic risks.

“The North Sea is in ongoing decline and new licences won’t make a dent in that. Any oil and gas will be sold at market prices largely dictated by international events.

“When you realise that you also recognise that building out UK renewables for the long-term, deploying EVs that run on British electricity and cutting our gas demand by insulating homes and switching to heat pumps a matter of not just energy security but national security. Investment in these technologies now will build UK energy independence.”

Critical minerals from China for the energy transition

An interesting discussion point regarding the Red Sea is the implications it could have on the UK’s energy transition – especially when considering the impact imports from China could have on this.

As Current± has previously reported, the Royal United Services Institute (RUSI) has argued that the UK risks becoming “too reliant” on China for its renewable transition. Detailed in the defence and security think tank’s report, amply named New Energy Supply Chains: Is the UK at Risk from Chinese Dominance, China’s early move in the processing of many of the minerals used in net zero technologies has meant that it has taken a huge share of the global market and many countries risk becoming too reliant as a result.

According to the report, China has a “near monopoly” in the mineral processing supply chain taking up a staggering 80-100% market share. Another supply chain is rare earths, which are often used to manufacture permanent magnets used in wind turbines and electric vehicles (EVs).

Batteries, wind turbines and solar are also cited as technologies that the UK relies heavily on China to develop, prompting concerns, particularly in the wake of the Russian invasion of Ukraine which saw energy prices skyrocket across the globe primarily due to a reduction in the supply of gas and oil from Russia.

For the solar industry, China also has a “near monopoly” on the production of polysilicon, silicon wafers and silicon cells, RUSI said. There are also very high concentrations of up to a 60-80% market share in many other elements of these supply chains.

The implications of this near monopoly have had a big impact on the pricing of renewable projects in the UK due to the rising inflation amid tensions in the Red Sea. For example, Ace Battery states that the alternative African route nearly triples the container transport costs from China to Rotterdam. It is worth noting that the firm has said that, despite increased costs, solar module prices are yet to skyrocket mainly due to the current moderate demand in Europe.

But with the import of materials being vital for the UK energy transition, question marks must be raised as to how this tension will impact its cost.

A case to be optimistic

Although this article has spoken at length about the possible negative outcome the tension in the Red Sea could cause for energy prices, there is a case to be optimistic in minimising the effect it could have on both energy prices and the energy transition.

For instance, Cornwall Insight’s latest Default Tariff Cap prediction for April fell by £40 since December, with energy costs in 2024 estimated to hit their lowest since the Russia-Ukraine war began. This is despite the ongoing tension in the Red Sea.

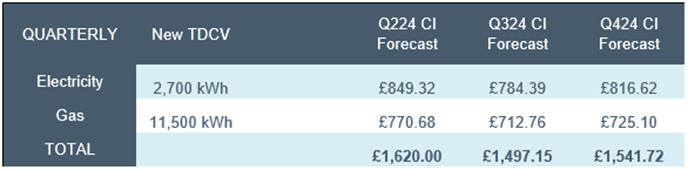

Figure 1: Default Tariff Cap forecasts using data from market close 17 January 2024 (dual fuel, direct debit customer)

According to Cornwall Insight’s latest price cap predictions, the Q2 2024 cap – which will come into force in April – will sit at £1,620 per year for an average dual fuel household paying with direct debit.

On the topic of the Red Sea, Dr Craig Lowrey, principal consultant at Cornwall Insight, noted that fears over the impact of Red Sea Liquified Natural Gas (LNG) shipping disruptions impacting whole prices have “so far proved premature”, with predictions continuing to drop throughout 2024 to a low of £1,497.

Despite this analysis, many across the energy industry will be observing the events unfolding in the Middle East with a watchful eye and be prepared to respond accordingly to protect UK consumers.

It is also worth mentioning that the Treasury’s prediction that the tension could lead to a second energy crisis is very much a “worst-case scenario” with other situations also being monitored and strategically analysed.