The latest Default Tariff Cap prediction for April has fallen by £40 since December, with energy costs in 2024 estimated to hit their lowest since the Russia-Ukraine war began.

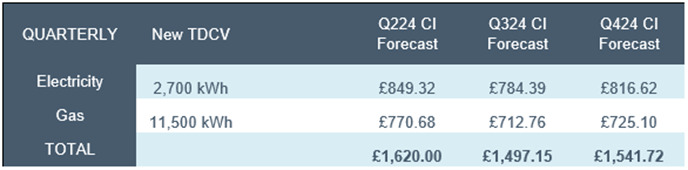

According to Cornwall Insight’s latest price cap predictions, the Q2 2024 cap – which will come into force in April – will sit at £1,620 per year for an average dual fuel household paying with direct debit.

Figure 1: Default Tariff Cap forecasts using data from market close 17 January 2024 (dual fuel, direct debit customer)

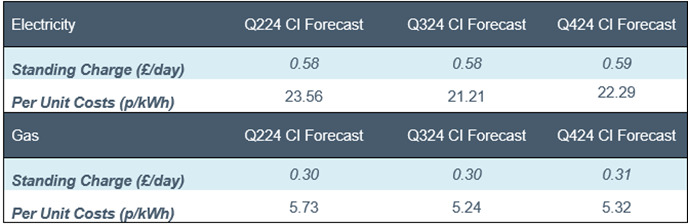

Figure 2: Default Tariff Cap forecasts, Per Unit Costs and Standing Charge 17 January 2024 (dual fuel, direct debit customer)

The latest prediction represents a £40 decrease from Cornwall Insight’s December prediction, which stood at £1,660 and a 16% quarter-on-quarter increase from the current cap set at £1,928. The market researcher attributed this decrease to higher-than-expected European gas stocks, owing to a relatively mild winter and “fairly healthy supply conditions”, causing wholesale prices to fall from November.

Additionally, Dr Craig Lowrey, principal consultant at Cornwall Insight, noted that fears over the impact of Red Sea Liquified Natural Gas (LNG) shipping disruptions impacting whole prices have “so far proved premature,” with predictions continuing to drop throughout 2024 to a low of £1,497.

Commenting on the latest predictions, Lowrey said that these decreasing prices will allow households to “breathe a sigh of relief” with the potential for energy costs to hit “their lowest since the Russian invasion of Ukraine.”

Nonetheless, Lowrey added that despite recent trends hinting at a market stabilisation, returning to pre-crisis energy costs “isn’t on the horizon”, with current levels looking to become “the new normal.”

“Though recent trends hint at possible stabilisation, a full return to pre-crisis energy bills isn’t on the horizon. Shifts in where and how Europe sources its gas and power, alongside continued market jitters over geopolitical events, mean we are likely still facing costs hundreds of pounds above historical averages for a while, potentially the new normal for household energy budgets,” said Lowrey.

“Whether we can achieve long-term reductions in the UK’s energy costs will hinge on breaking free from the volatility of imported energy prices. To make a real and lasting impact, we need to commit to a sustained transition to homegrown renewable energy sources, reducing our reliance on the volatile international energy market.”

Current± recently published a market spotlight on the UK energy price cap, exploring the impact of its coupling with wholesale gas prices throughout the energy crisis. Read more here.

Additionally, Ofgem launched a review into standing charges in November 2023 as well as proposed a one-off price cap adjustment to tackle record energy debt, each of which will impact future price cap levels.